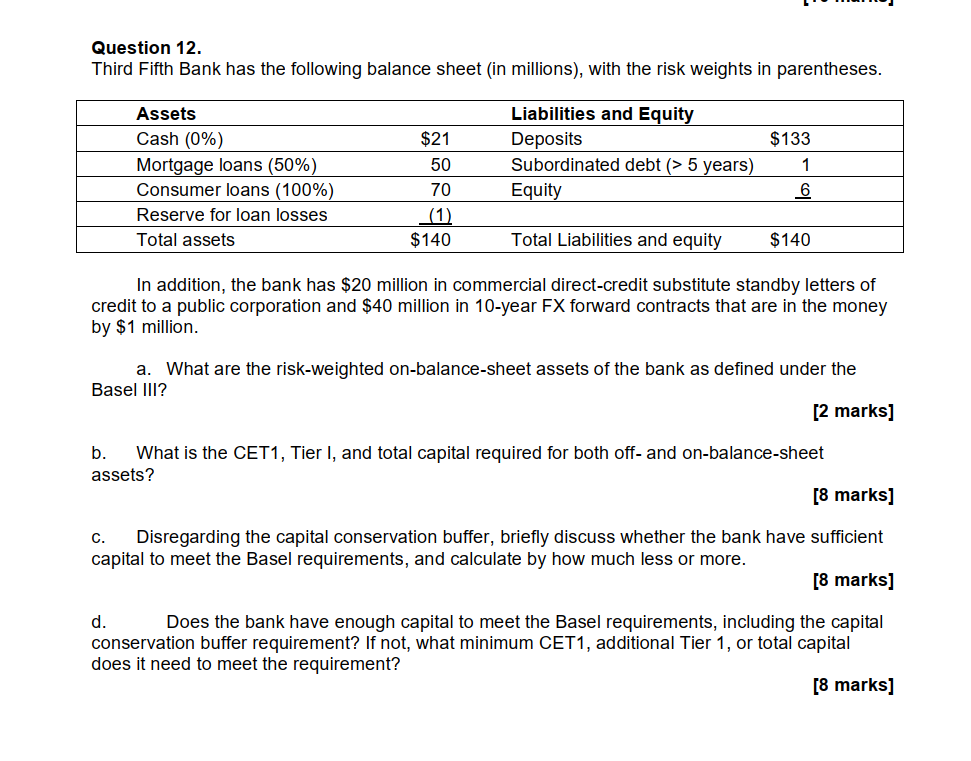

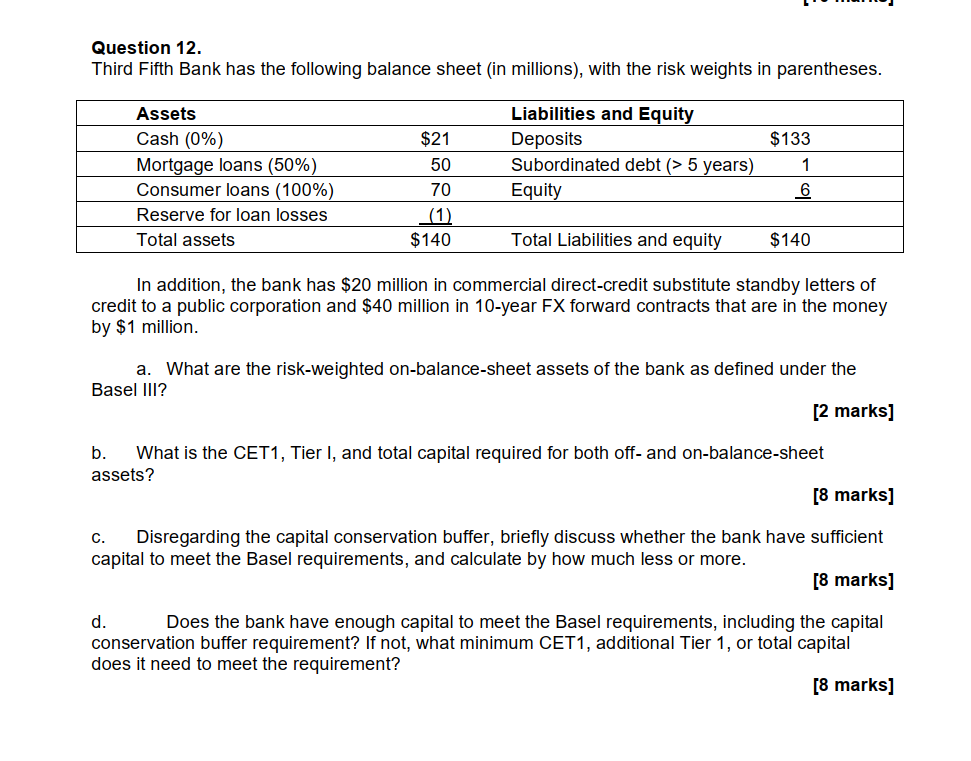

Question 12. Third Fifth Bank has the following balance sheet (in millions), with the risk weights in parentheses. Assets Cash (0%) Mortgage loans (50%) Consumer loans (100%) Reserve for loan losses Total assets $21 50 70 (1) $140 Liabilities and Equity Deposits Subordinated debt (>5 years) Equity $133 1 6 Total Liabilities and equity $140 In addition, the bank has $20 million in commercial direct-credit substitute standby letters of credit to a public corporation and $40 million in 10-year FX forward contracts that are in the money by $1 million. a. What are the risk-weighted on-balance-sheet assets of the bank as defined under the Basel III? [2 marks] b. What is the CET1, Tier I, and total capital required for both off- and on-balance-sheet assets? [8 marks] C. Disregarding the capital conservation buffer, briefly discuss whether the bank have sufficient capital to meet the Basel requirements, and calculate by how much less or more. [8 marks] d. Does the bank have enough capital to meet the Basel requirements, including the capital conservation buffer requirement? If not, what minimum CET1, additional Tier 1, or total capital does it need to meet the requirement? [8 marks] Question 12. Third Fifth Bank has the following balance sheet (in millions), with the risk weights in parentheses. Assets Cash (0%) Mortgage loans (50%) Consumer loans (100%) Reserve for loan losses Total assets $21 50 70 (1) $140 Liabilities and Equity Deposits Subordinated debt (>5 years) Equity $133 1 6 Total Liabilities and equity $140 In addition, the bank has $20 million in commercial direct-credit substitute standby letters of credit to a public corporation and $40 million in 10-year FX forward contracts that are in the money by $1 million. a. What are the risk-weighted on-balance-sheet assets of the bank as defined under the Basel III? [2 marks] b. What is the CET1, Tier I, and total capital required for both off- and on-balance-sheet assets? [8 marks] C. Disregarding the capital conservation buffer, briefly discuss whether the bank have sufficient capital to meet the Basel requirements, and calculate by how much less or more. [8 marks] d. Does the bank have enough capital to meet the Basel requirements, including the capital conservation buffer requirement? If not, what minimum CET1, additional Tier 1, or total capital does it need to meet the requirement? [8 marks]