Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 12 Which of the following alternatives is correct for the creation of an allowance for credit losses of R2500,00 in preparation of the

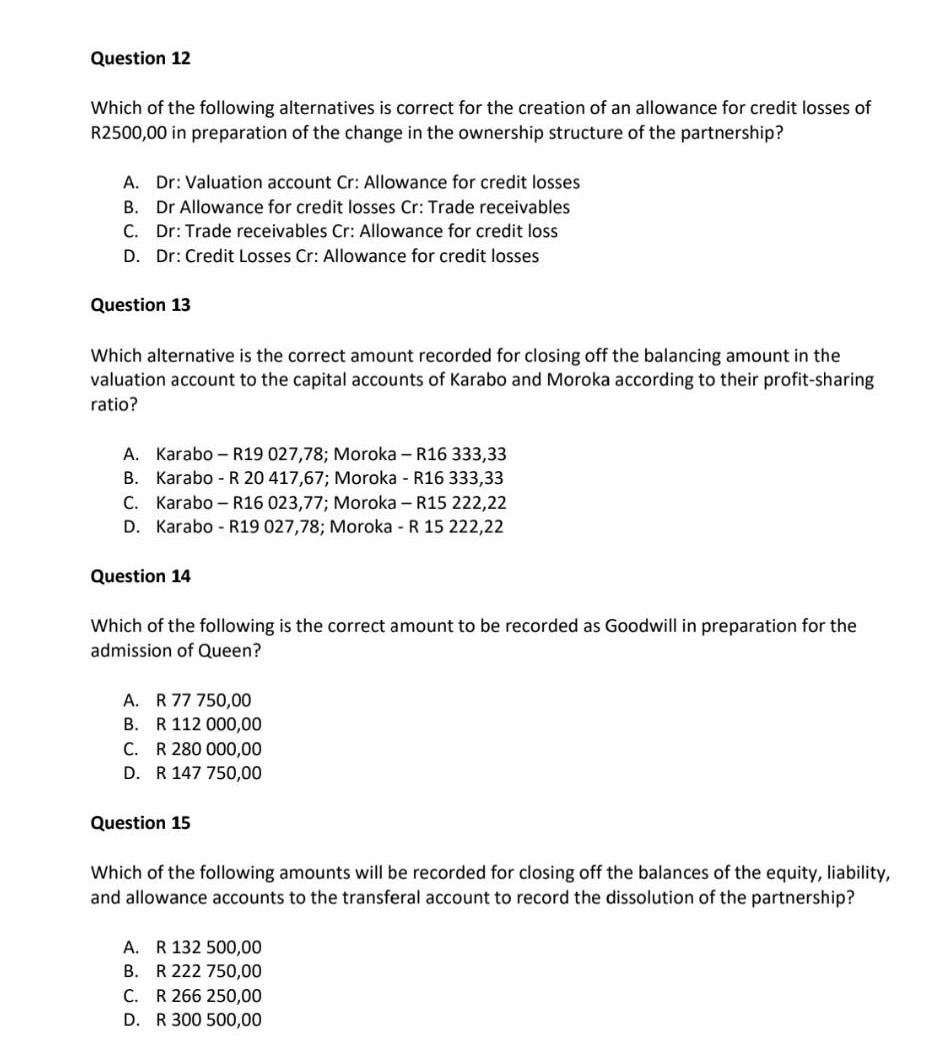

Question 12 Which of the following alternatives is correct for the creation of an allowance for credit losses of R2500,00 in preparation of the change in the ownership structure of the partnership? A. Dr: Valuation account Cr: Allowance for credit losses B. Dr Allowance for credit losses Cr: Trade receivables C. Dr: Trade receivables Cr: Allowance for credit loss D. Dr: Credit Losses Cr: Allowance for credit losses Question 13 Which alternative is the correct amount recorded for closing off the balancing amount in the valuation account to the capital accounts of Karabo and Moroka according to their profit-sharing ratio? A. Karabo-R19 027,78; Moroka - R16 333,33 B. Karabo R 20 417,67; Moroka - R16 333,33 C. Karabo R16 023,77; Moroka - R15 222,22 D. Karabo R19 027,78; Moroka - R 15 222,22 Question 14 Which of the following is the correct amount to be recorded as Goodwill in preparation for the admission of Queen? A. R 77 750,00 B. R 112 000,00 C. R 280 000,00 D. R 147 750,00 Question 15 Which of the following amounts will be recorded for closing off the balances of the equity, liability, and allowance accounts to the transferal account to record the dissolution of the partnership? A. R 132 500,00 B. R 222 750,00 C. R 266 250,00 D. R 300 500,00

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

13 14 15 11 Valuation Account relating Equipment Carrying Amount Fur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started