Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1,2,3 P6-2 Reporting Net Sales and Expenses with Discounts, Returns, and Bad Debts G (AP6-1)L06-2, 6-4 The following data were selected from the records

Question 1,2,3

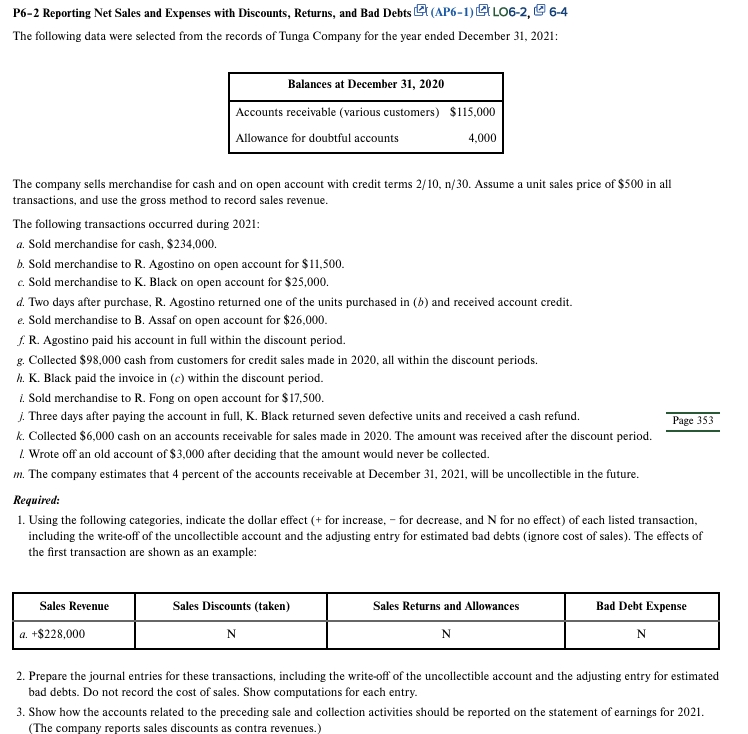

P6-2 Reporting Net Sales and Expenses with Discounts, Returns, and Bad Debts G (AP6-1)L06-2, 6-4 The following data were selected from the records of Tunga Company for the year ended December 31, 2021: Balances at December 31, 2020 Accounts receivable (various customers) $115,000 Allowance for doubtful accounts 4,000 c. The company sells merchandise for cash and on open account with credit terms 2/10, n/30. Assume a unit sales price of $500 in all transactions, and use the gross method to record sales revenue. The following transactions occurred during 2021: a. Sold merchandise for cash, $234.000. b. Sold merchandise to R. Agostino on open account for $11,500. c. Sold merchandise to K. Black on open account for $25,000. d. Two days after purchase, R. Agostino returned one of the units purchased in (b) and received account credit. e. Sold merchandise to B. Assaf on open account for $26,000. 1. R. Agostino paid his account in full within the discount period. g. Collected $98,000 cash from customers for credit sales made in 2020, all within the discount periods. h. K. Black paid the invoice in (c) within the discount period. 1. Sold merchandise to R. Fong on open account for $17.500. 1. Three days after paying the account in full, K. Black returned seven defective units and received a cash refund. Page 353 k. Collected $6,000 cash on an accounts receivable for sales made in 2020. The amount was received after the discount period. 2. Wrote off an old account of $3,000 after deciding that the amount would never be collected. m. The company estimates that 4 percent of the accounts receivable at December 31, 2021, will be uncollectible in the future. Required: 1. Using the following categories, indicate the dollar effect (+ for increase. - for decrease, and N for no effect) of each listed transaction, including the write-off of the uncollectible account and the adjusting entry for estimated bad debts (ignore cost of sales). The effects of the first transaction are shown as an example: Sales Revenue Sales Discounts (taken) Sales Returns and Allowances Bad Debt Expense a. +$228,000 N N N 2. Prepare the journal entries for these transactions, including the write-off of the uncollectible account and the adjusting entry for estimated bad debts. Do not record the cost of sales. Show computations for each entry. 3. Show how the accounts related to the preceding sale and collection activities should be reported on the statement of earnings for 2021. (The company reports sales discounts as contra revenues.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started