question 1,2,3 use first pic for reference. will leave good review

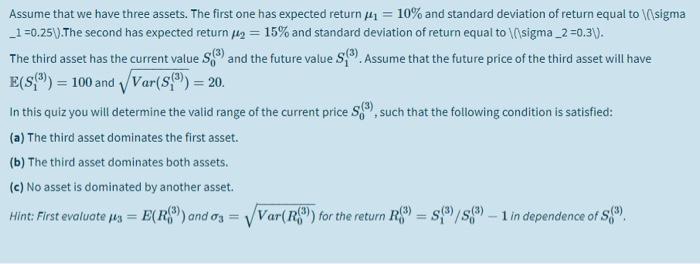

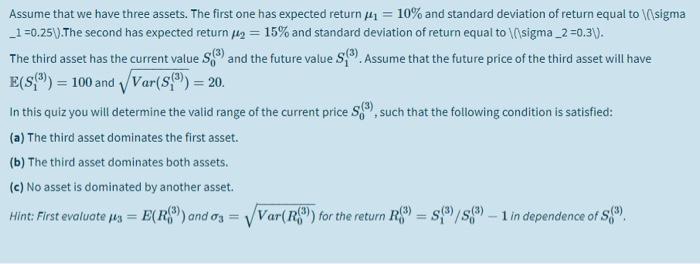

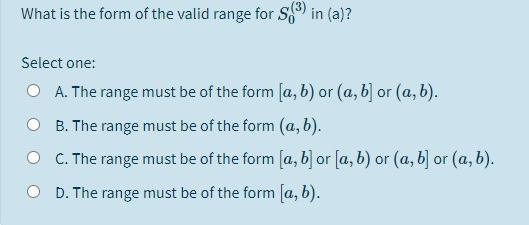

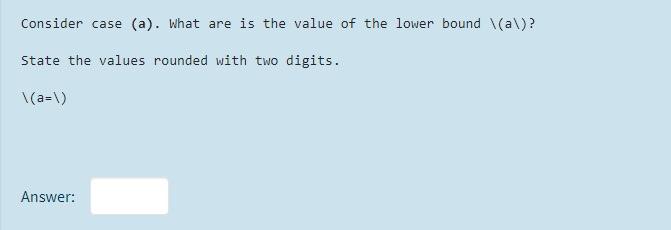

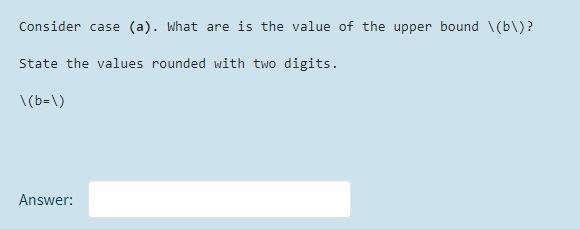

Assume that we have three assets. The first one has expected return 441 = 10% and standard deviation of return equal to sigma1=0.25).Thesecondhasexpectedreturn112=15. The third asset has the current values and the future value $(3) Assume that the future price of the third asset will have E(S) = 100 and Var(${") = 20. In this quiz you will determine the valid range of the current prices such that the following condition is satisfied: (a) The third asset dominates the first asset. (b) The third asset dominates both assets. (c) No asset is dominated by another asset. Hint: First evaluate pus = E(R) and 03 = Var(R"for the return R) = $/S) - 1 in dependence of 5 What is the form of the valid range for p in (a)? Select one: O A. The range must be of the form (a,b) or (a, b) or (a,b). OB. The range must be of the form (a,b). OC. The range must be of the form (a, b) or (a,b) or (a, b) or (a,b). O D. The range must be of the form (a,b). Consider case (a). What are is the value of the lower bound \a\)? State the values rounded with two digits. (a=V) Answer: Consider case (a). What are is the value of the upper bound (b)? State the values rounded with two digits. (b=1) Answer: Assume that we have three assets. The first one has expected return 441 = 10% and standard deviation of return equal to sigma1=0.25).Thesecondhasexpectedreturn112=15. The third asset has the current values and the future value $(3) Assume that the future price of the third asset will have E(S) = 100 and Var(${") = 20. In this quiz you will determine the valid range of the current prices such that the following condition is satisfied: (a) The third asset dominates the first asset. (b) The third asset dominates both assets. (c) No asset is dominated by another asset. Hint: First evaluate pus = E(R) and 03 = Var(R"for the return R) = $/S) - 1 in dependence of 5 What is the form of the valid range for p in (a)? Select one: O A. The range must be of the form (a,b) or (a, b) or (a,b). OB. The range must be of the form (a,b). OC. The range must be of the form (a, b) or (a,b) or (a, b) or (a,b). O D. The range must be of the form (a,b). Consider case (a). What are is the value of the lower bound \a\)? State the values rounded with two digits. (a=V) Answer: Consider case (a). What are is the value of the upper bound (b)? State the values rounded with two digits. (b=1)