Question 12-5B

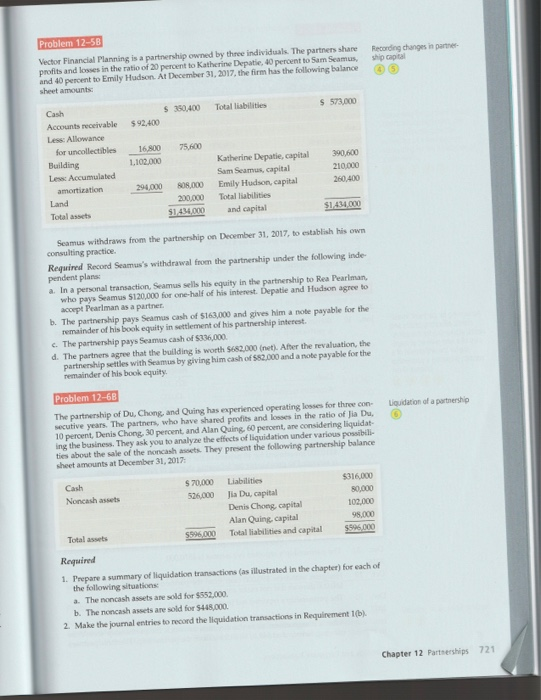

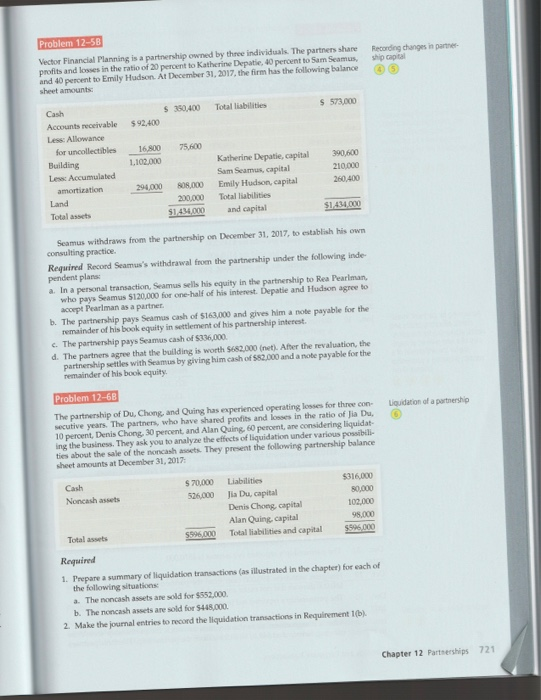

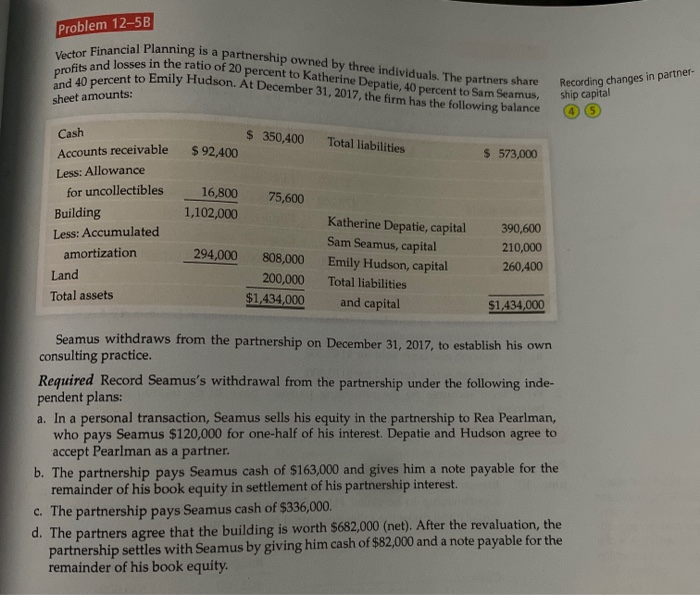

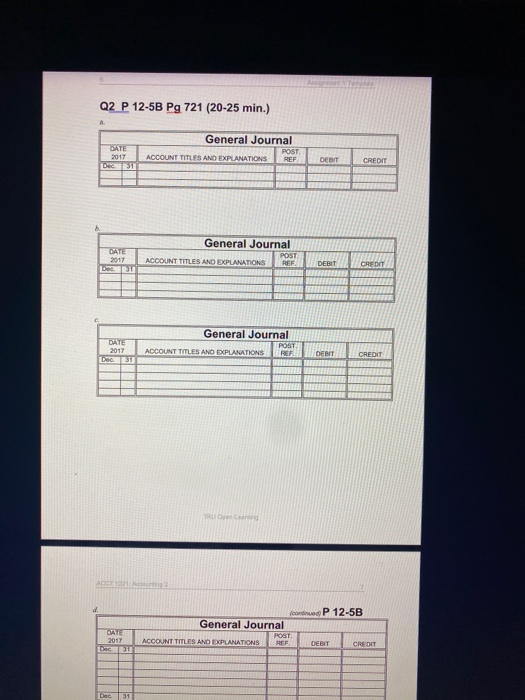

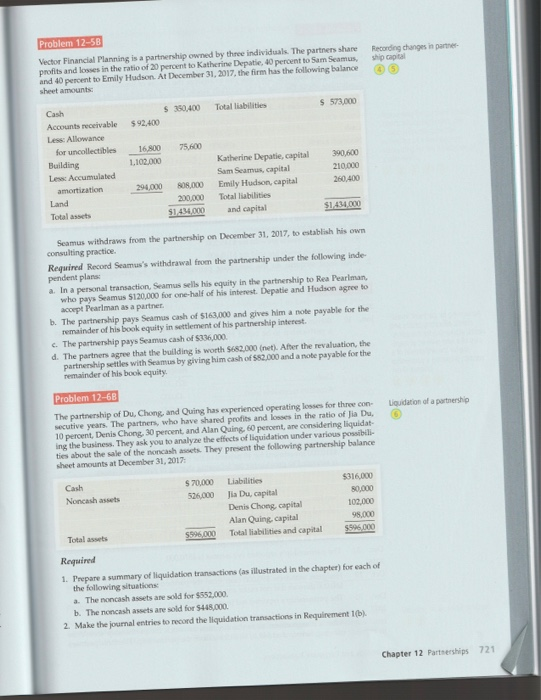

Recording changes in partner sho capital Problem 12-5B Vector Financial Planning is a partnership owned by three individuals. The partners share profits and losses in the ratio of 20 percent to Katherine Depatie, 40 percent to Sam Seamus, and 40 percent to Emily Hudson. At December 31, 2017, the firm has the following balance sheet amounts: $ 350.400 Total liabilities $ 573.000 $ 92.400 75 600 Cash Accounts receivable Less: Allowance for uncollectibles Building Less Accumulated amortization 16.900 1.102.000 390,600 210.000 260,400 294,000 Katherine Depatie, capital Sam Seamus, capital Emily Hudson, capital Total liabilities and capital SO8.000 200.000 $1434.000 Land $1434.000 Total assets Seamus withdraws from the partnership on December 31, 2017, to establish his own consulting practice Required Record Seamus's withdrawal from the partnership under the following inde pendent plans a. In a personal transaction Seamus sells his equity in the partnership to Rea Pearlman, who pays Seamus $120,000 for one-half of his interest. Dupatie and Hudson agree to accept Pearlman as a partner. b. The partnership pays Seamus cash of $163,000 and gives him a note payable for the remainder of his book equity in settlement of his partnership interest The partnership pays Seamus cash of $336,000 d. The partners agree that the building is worth 5682,000 (net). After the revaluation, the partnership settles with Seamus by giving him cash of 582,000 and a note payable for the remainder of his book equity. Liquidation of a partnership Problem 12-6B The partnership of Du, Chong and Quing has experienced operating losses for three con secutive years. The partners, who have shared profits and losses in the ratio of Jia Du. 10 percent, Denis Chong, 30 percent, and Alan Quing, 60 percent, are considering liquidat ing the business. They ask you to analyze the effects of liquidation under various possibili ties about the sale of the noncash awets. They present the following partnership balance sheet amounts at December 31, 2017: Cash Noncash assets $ 70,000 526.000 Liabilities Jia Du, capital Denis Chong, capital Alan Quing capital Total liabilities and capital $316,000 80,000 102,000 95.000 550.000 5596,000 Total assets Required 1. Prepare a summary of liquidation transactions (as illustrated in the chapter) for each of the following situations 2. The noncash assets are sold for $552.000 b. The noncash assets are sold for $448.000 2. Make the journal entries to record the liquidation transactions in Requirement 1(b). Chapter 12 Partnerships 721 Vector Financial Planning is a partnership owned by three individuals. The partners share profits and losses in the ratio of 20 percent to Katherine Depatie, 40 percent to Sam Seamus, and 40 percent to Emily Hudson. At December 31, 2017, the firm has the following balance Problem 12-5B Recording changes in partner- ship capital sheet amounts: $ 350,400 $ 92,400 Total liabilities $ 573,000 Cash Accounts receivable Less: Allowance for uncollectibles Building Less: Accumulated amortization Land Total assets 16,800 1,102,000 75,600 294,000 Katherine Depatie, capital Sam Seamus, capital Emily Hudson, capital Total liabilities and capital 390,600 210,000 260,400 808,000 200,000 $1,434,000 $1,434,000 Seamus withdraws from the partnership on December 31, 2017, to establish his own consulting practice. Required Record Seamus's withdrawal from the partnership under the following inde- pendent plans: a. In a personal transaction, Seamus sells his equity in the partnership to Rea Pearlman, who pays Seamus $120,000 for one-half of his interest. Depatie and Hudson agree to accept Pearlman as a partner. b. The partnership pays Seamus cash of $163,000 and gives him a note payable for the remainder of his book equity in settlement of his partnership interest c. The partnership pays Seamus cash of $336,000. d. The partners agree that the building is worth $682,000 (net). After the revaluation, the partnership settles with Seamus by giving him cash of $82,000 and a note payable for the remainder of his book equity. Q2 P 12-5B Pg 721 (20-25 min.) DATE 2017 General Journal POST ACCOUNT TITLES AND EXPLANATIONS REF. DEBIT CREDIT DAYE 2017 Dec 31 General Journal POST ACCOUNT TITLES AND EXPLANATIONS REF DEBIT CREDIT DATE 2017 DOC General Journal POST ACCOUNT TITLES AND EXPLANATIONS REF DEBIT CREDIT AGEN d con P 12-5B General Journal POST ACCOUNT TITLES AND EXPLANATIONS REF DEBIT CREDIT DATE Dec 311 Dec 31 ACCA feP 12-5B General Journal POST ACCOUNT TITLES AND EXPLANATIONS DEBIT CREDIT nonnn