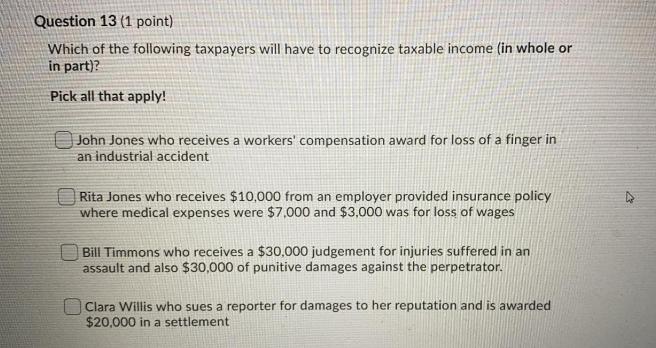

Question 13 (1 point) Which of the following taxpayers will have to recognize taxable income (in whole or in part)? Pick all that apply!

Question 13 (1 point) Which of the following taxpayers will have to recognize taxable income (in whole or in part)? Pick all that apply! John Jones who receives a workers' compensation award for loss of a finger in an industrial accident Rita Jones who receives $10,000 from an employer provided insurance policy where medical expenses were $7,000 and $3,000 was for loss of wages Bill Timmons who receives a $30,000 judgement for injuries suffered in an assault and also $30,000 of punitive damages against the perpetrator. Clara Willis who sues a reporter for damages to her reputation and is awarded $20,000 in a settlement

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Bill Timmons who receives a 30000 judgment for injuries suffered in an assault and also 30000 of pun...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started