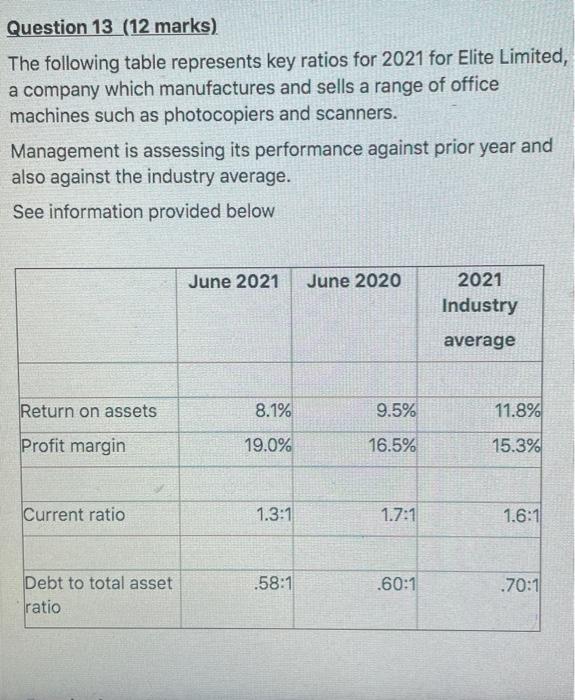

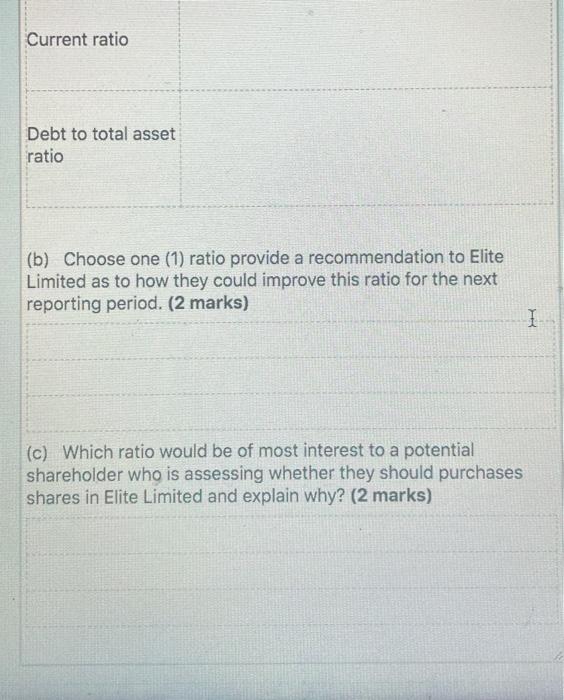

Question 13 (12 marks) The following table represents key ratios for 2021 for Elite Limited, a company which manufactures and sells a range of office machines such as photocopiers and scanners. Management is assessing its performance against prior year and also against the industry average. See information provided below June 2021 June 2020 2021 Industry average Return on assets 8.1% 9.5% 11.8% Profit margin 19.0% 16.5% 15.3% Current ratio 1.3:1 1.7:1 1.6:1 .58:1 .60:1 .70:1 Debt to total asset ratio Required (a) You are working as an assistant accountant for Elite Limited and have been asked to provide some analysis/commentary with respect to the above table of ratios and what implications these ratios may have on the business. Your discussion should include the movement of each of these ratios from the prior year and also comparison to the industry average. (8 marks) (b) Choose one (1) ratio provide a recommendation to Elite Limited as to how they could improve this ratio for the next reporting period. (2 marks) (c) Which ratio would be of most interest to a potential shareholder who is assessing whether they should purchases shares in Elite Limited and explain why? (2 marks) (Total 12 marks) 7 A BU I . II! III 93 (a) You are working as an assistant accountant for Elite Limited and have been asked to provide some analysis/commentary with respect to the above table of ratios and what implications these ratios may have on the business. Your discussion should include the movement of each of these ratios from the prior year and B U I 6 Ff III (a) You are working as an assistant accountant for Elite Limited and have been asked to provide some analysis/commentary with respect to the above table of ratios and what implications these ratios may have on the business. Your discussion should include the movement of each of these ratios from the prior year and also comparison to the industry average. (8 marks) Ratio Analysis / Discussion Return on assets Profit margin Current ratio Debt to total asset ratio Profit margin Current ratio Debt to total asset ratio (b) Choose one (1) ratio provide a recommendation to Elite Limited as to how they could improve this ratio for the next reporting period. (2 marks) (C) Which ratio would be of most interest to a potential shareholder who is assessing whether they should purchases shares in Elite Limited and explain why? (2 marks) Current ratio Debt to total asset ratio (b) Choose one (1) ratio provide a recommendation to Elite Limited as to how they could improve this ratio for the next reporting period. (2 marks) I (c) Which ratio would be of most interest to a potential shareholder who is assessing whether they should purchases shares in Elite Limited and explain why? (2 marks)