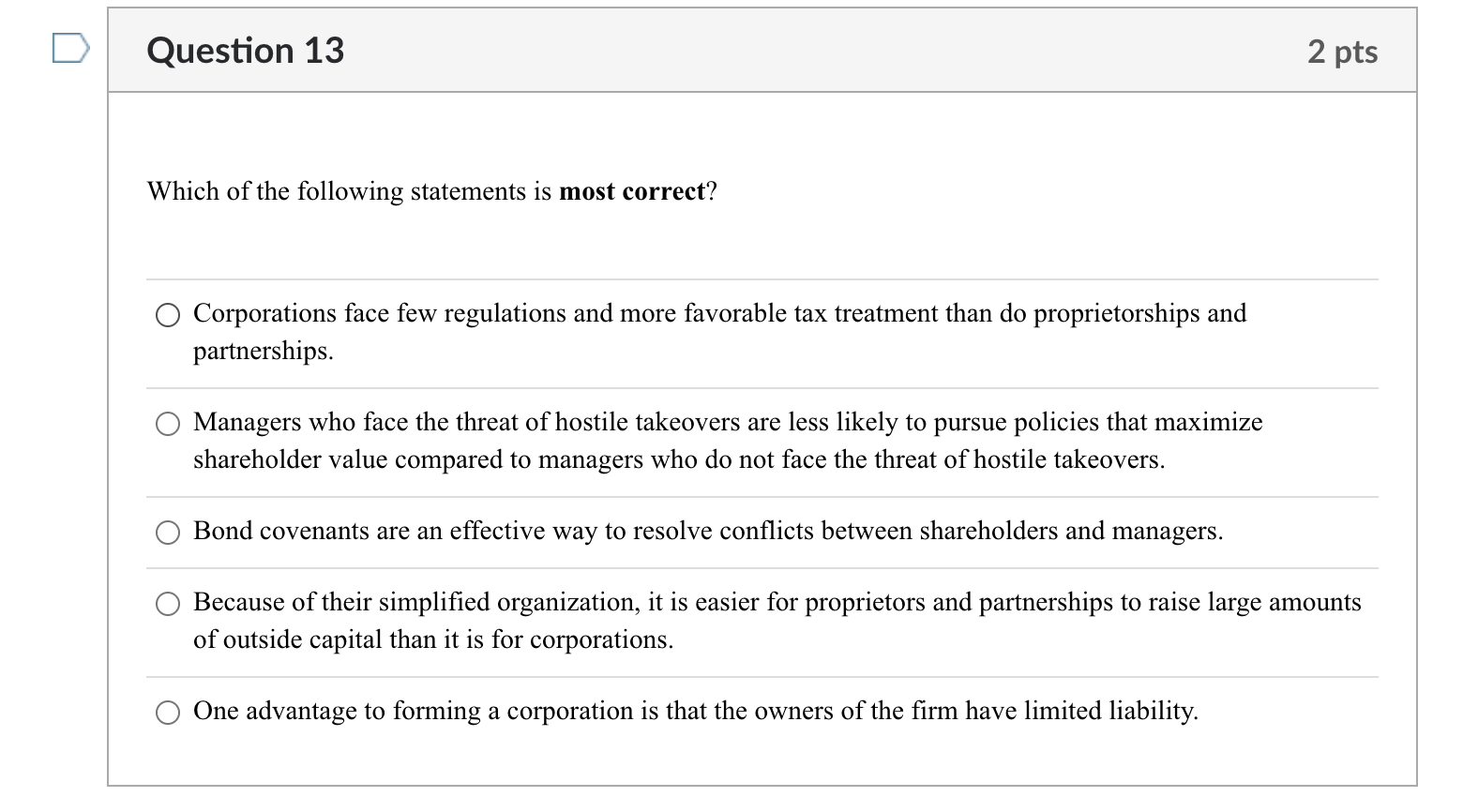

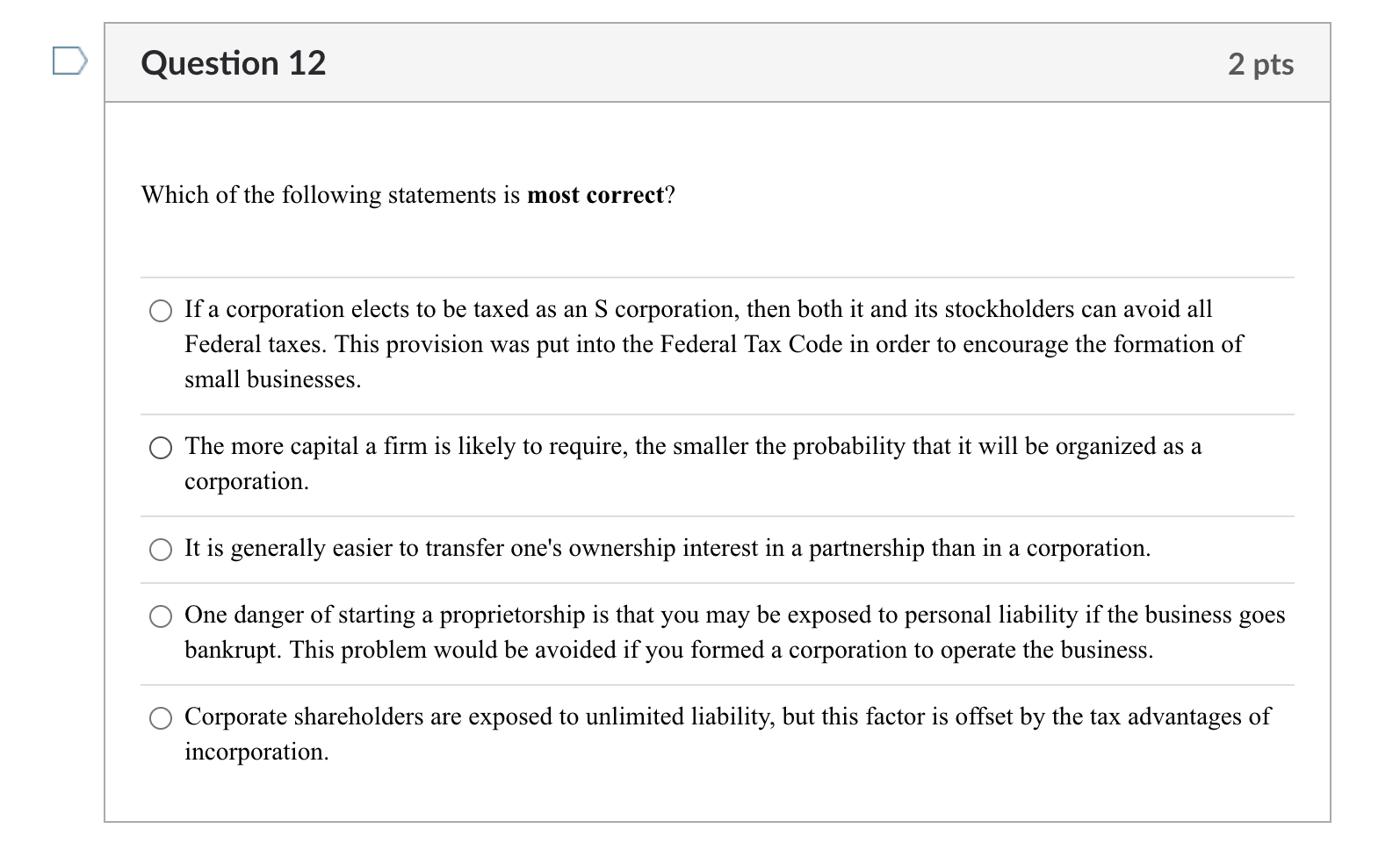

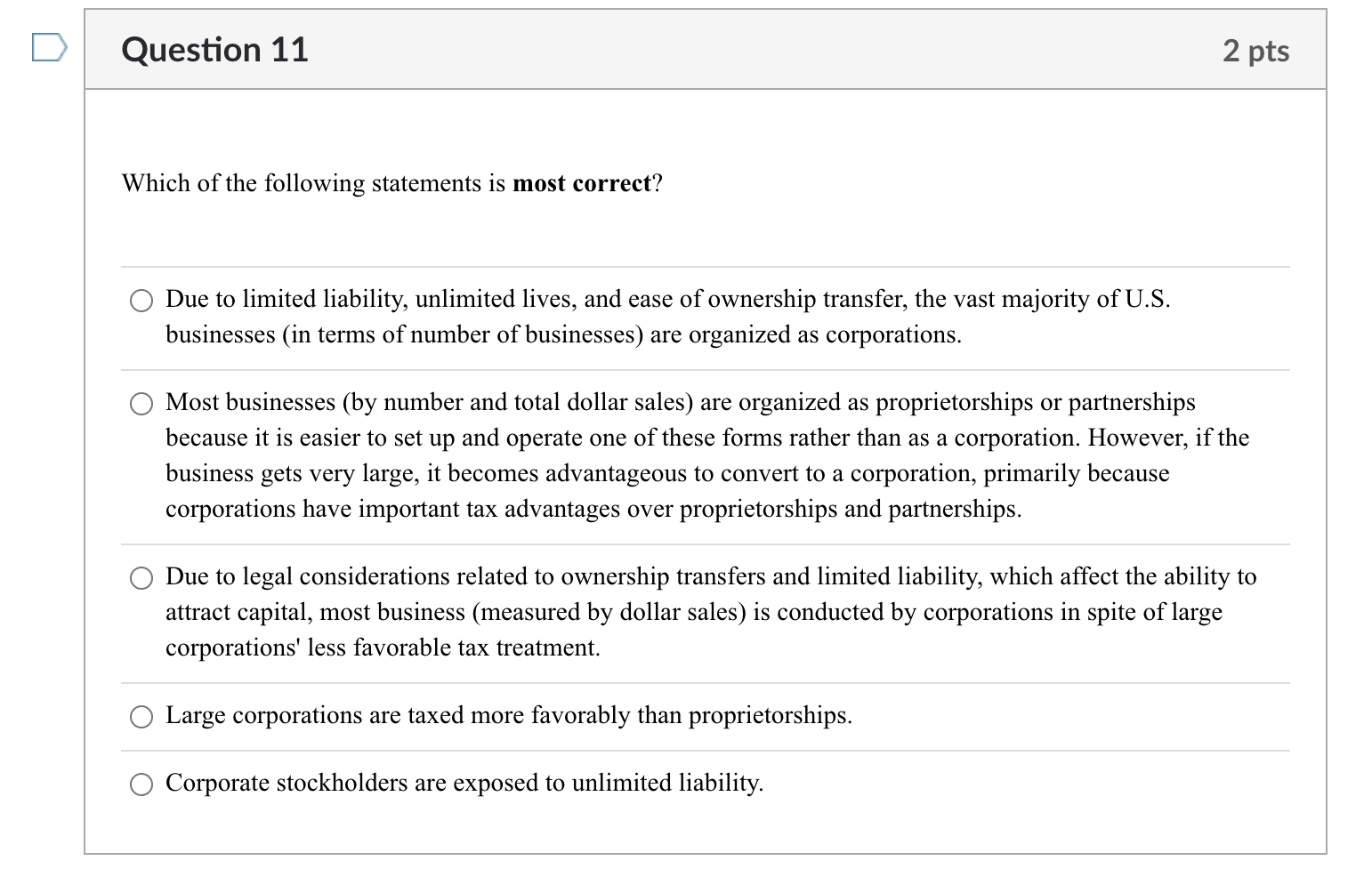

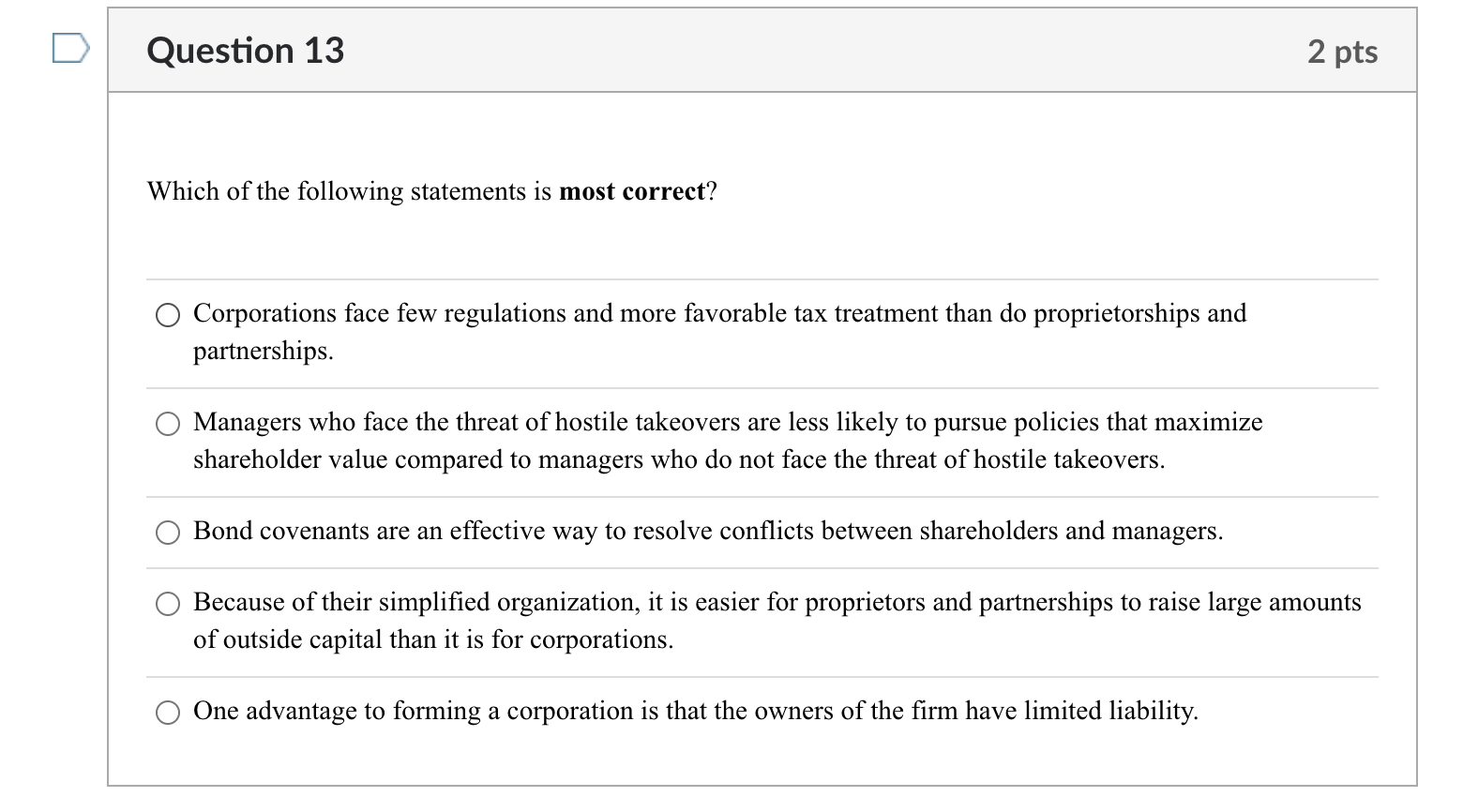

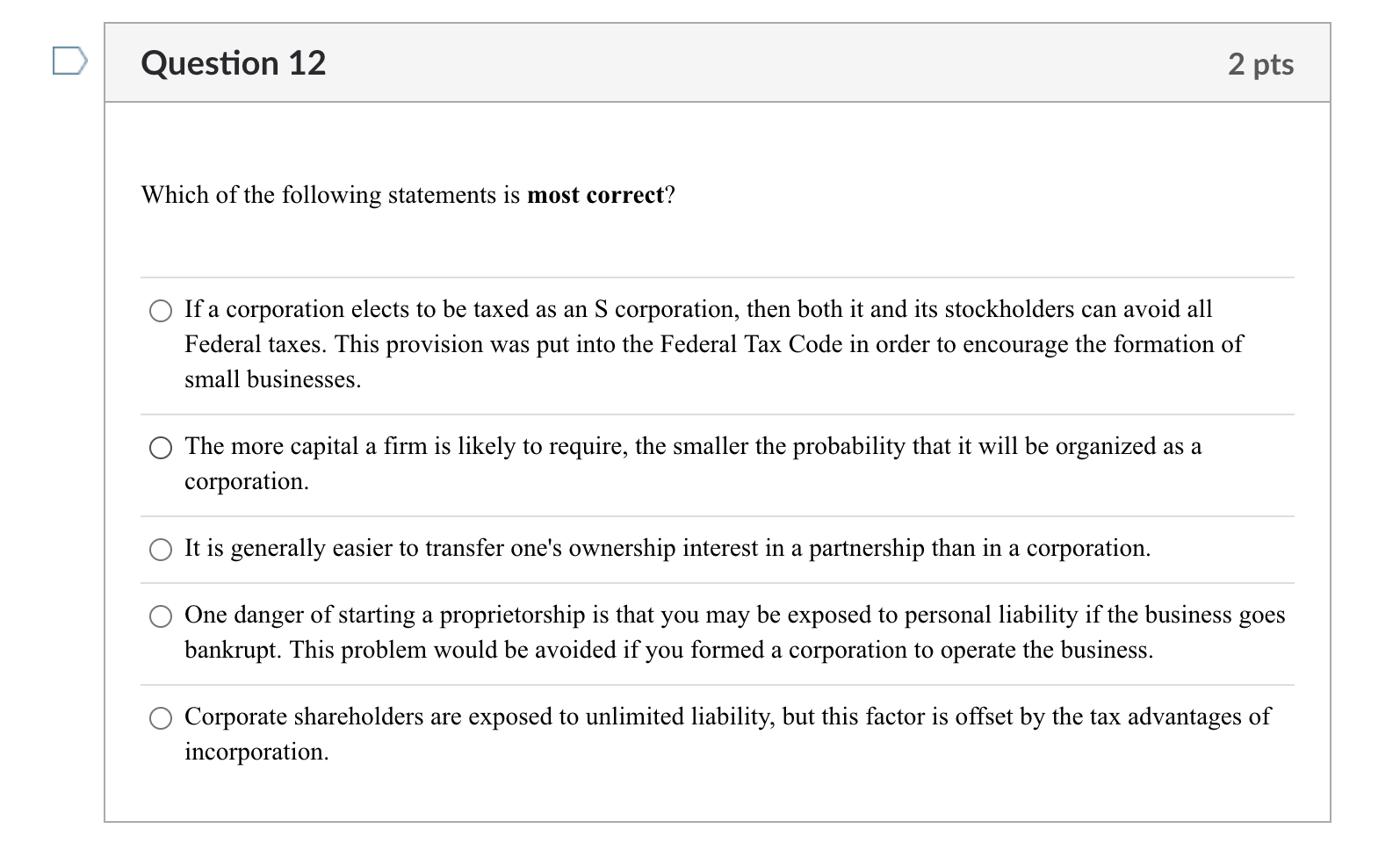

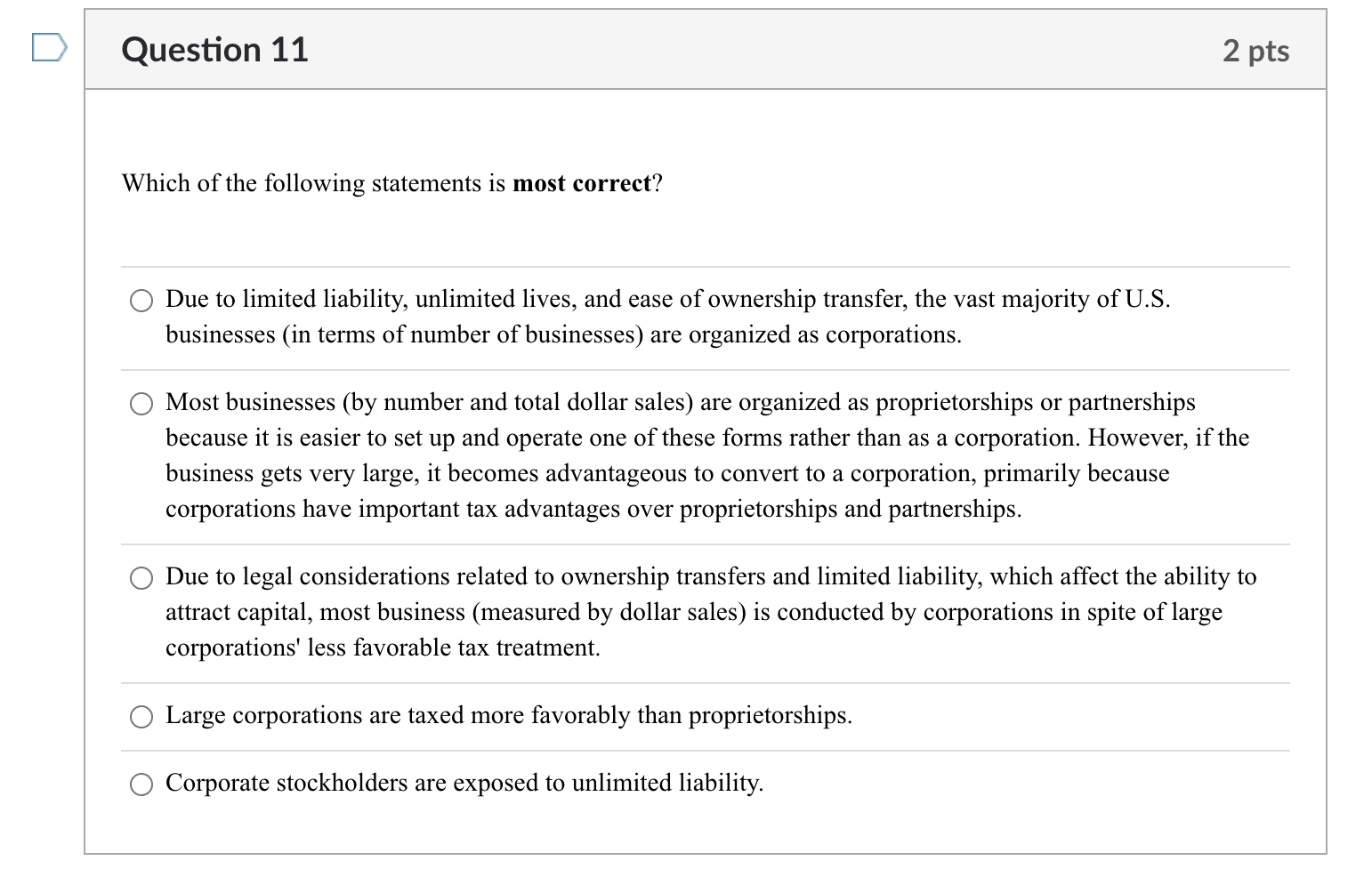

Question 13 2 pts Which of the following statements is most correct? Corporations face few regulations and more favorable tax treatment than do proprietorships and partnerships. Managers who face the threat of hostile takeovers are less likely to pursue policies that maximize shareholder value compared to managers who do not face the threat of hostile takeovers. O Bond covenants are an effective way to resolve conflicts between shareholders and managers. Because of their simplified organization, it is easier for proprietors and partnerships to raise large amounts of outside capital than it is for corporations. One advantage to forming a corporation is that the owners of the firm have limited liability. Question 12 2 pts Which of the following statements is most correct? If a corporation elects to be taxed as an S corporation, then both it and its stockholders can avoid all Federal taxes. This provision was put into the Federal Tax Code in order to encourage the formation of small businesses. O The more capital a firm is likely to require, the smaller the probability that it will be organized as a corporation. It is generally easier to transfer one's ownership interest in a partnership than in a corporation. One danger of starting a proprietorship is that you may be exposed to personal liability if the business goes bankrupt. This problem would be avoided if you formed a corporation to operate the business. Corporate shareholders are exposed to unlimited liability, but this factor is offset by the tax advantages of incorporation. Question 11 2 pts Which of the following statements is most correct? Due to limited liability, unlimited lives, and ease of ownership transfer, the vast majority of U.S. businesses in terms of number of businesses) are organized as corporations. Most businesses (by number and total dollar sales) are organized as proprietorships or partnerships because it is easier to set up and operate one of these forms rather than as a corporation. However, if the business gets very large, it becomes advantageous to convert to a corporation, primarily because corporations have important tax advantages over proprietorships and partnerships. Due to legal considerations related to ownership transfers and limited liability, which affect the ability to attract capital, most business (measured by dollar sales) is conducted by corporations in spite of large corporations' less favorable tax treatment. Large corporations are taxed more favorably than proprietorships. Corporate stockholders are exposed to unlimited liability