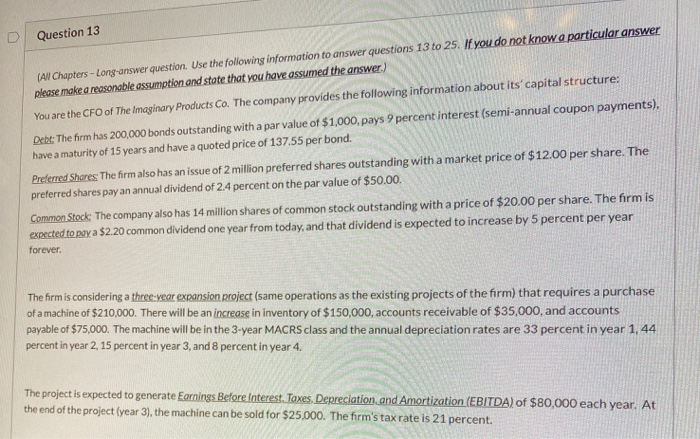

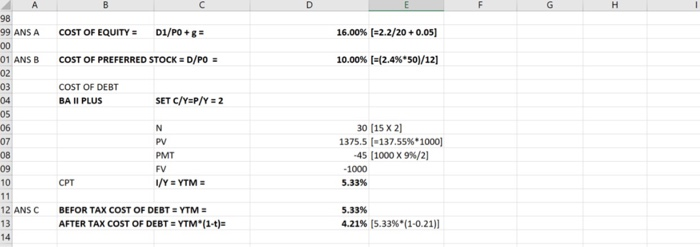

Question 13 (Al Chapters - Long-answer question. Use the following information to answer questions 13 to 25. If you do not know a particular answer please make a reasonable assumption and state that you have assumed the answer.) You are the CFO of The Imaginary Products Co. The company provides the following information about its capital structure: Debt: The firm has 200,000 bonds outstanding with a par value of $1,000, pays 9 percent interest (semi-annual coupon payments). have a maturity of 15 years and have a quoted price of 137.55 per bond. Preferred Shares: The firm also has an issue of 2 million preferred shares outstanding with a market price of $12.00 per share. The preferred shares pay an annual dividend of 2.4 percent on the par value of $50.00 Common Stock The company also has 14 million shares of common stock outstanding with a price of $20.00 per share. The firm is expected to pay a $2.20 common dividend one year from today, and that dividend is expected to increase by 5 percent per year forever The firm is considering a three-year expansion project (same operations as the existing projects of the firm) that requires a purchase of a machine of $210,000. There will be an increase in inventory of $150,000, accounts receivable of $35,000, and accounts payable of $75,000. The machine will be in the 3-year MACRS class and the annual depreciation rates are 33 percent in year 1,44 percent in year 2, 15 percent in year 3, and 8 percent in year 4. The project is expected to generate Earnings Before Interest. Taxes. Depreciation and Amortization (EBITDA) of $80,000 each year. At the end of the project (year 3), the machine can be sold for $25,000. The firm's tax rate is 21 percent. B G H COST OF EQUITY = D1/PO + 16.00% (-2.2/20+ 0.05) COST OF PREFERRED STOCK = D/PO 10.00% (-2.4% 50/12] COST OF DEBT BA II PLUS SET C/Y=P/Y=2 98 99 ANS A 00 01 ANS B 02 03 04 05 06 07 08 09 10 11 12 ANSC 13 14 N PV PMT FV 1/Y = YTM 30 (15 X 21 1375.5 [-137.55%*1000) -45 (1000 X 9%/21 -1000 5.33% CPT 5.33% BEFOR TAX COST OF DEBT = YTM = AFTER TAX COST OF DEBT - YTM* (1-7)= 4.21% (5.33%*(1-0.21)] Calculate the weights of equity, debt, and preferred stock. What is the firm's weighted average cost of capital? What is the net cash flow at time 0