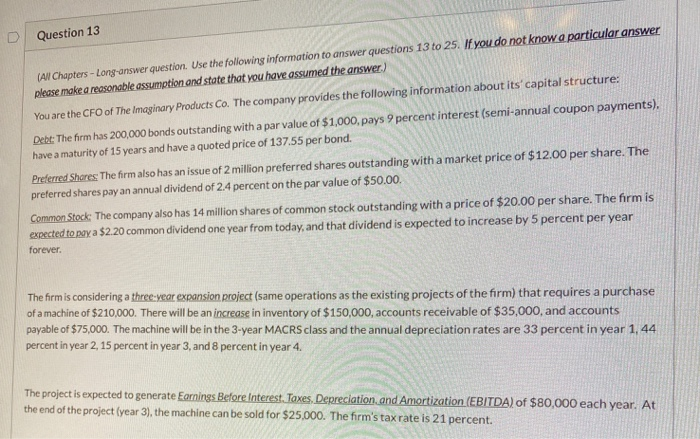

Question 13 (Al Chapters - Long-answer question. Use the following information to answer questions 13 to 25. If you do not know a particular answer please make a reasonable assumption and state that you have assumed the answer.) You are the CFO of The Imaginary Products Co. The company provides the following information about its capital structure: Debt: The firm has 200,000 bonds outstanding with a par value of $1,000, pays 9 percent interest (semi-annual coupon payments). have a maturity of 15 years and have a quoted price of 137.55 per bond. Preferred Shares: The firm also has an issue of 2 million preferred shares outstanding with a market price of $12.00 per share. The preferred shares pay an annual dividend of 2.4 percent on the par value of $50.00 Common Stock: The company also has 14 million shares of common stock outstanding with a price of $20.00 per share. The firm is expected to pay a $2.20 common dividend one year from today, and that dividend is expected to increase by 5 percent per year forever The firm is considering a three-year expansion project (same operations as the existing projects of the firm) that requires a purchase of a machine of $210,000. There will be an increase in inventory of $150,000, accounts receivable of $35,000, and accounts payable of $75,000. The machine will be in the 3-year MACRS class and the annual depreciation rates are 33 percent in year 1,44 percent in year 2, 15 percent in year 3, and 8 percent in year 4. The project is expected to generate Earnings Before Interest. Taxes. Depreciation and Amortization (EBITDA) of $80,000 each year. At the end of the project (year 3), the machine can be sold for $25,000. The firm's tax rate is 21 percent. H828 B D F G 818 819 820 821 DEBT COMMON STOCK PREFERRRED STOCK A 200000 14000000 2000000 B 1375.5 20 12 E AB 275100000 280000000 24000000 579100000 0.4750 0.4835 0.0414 822 823 824 ANS 1 825 WEIGHT OF EQUITY DEBT PREFERRED STOCK 826 48.35% 47.50% 4.14% 827 WACC 828 829 830 831 832 833 834 835 ANS 2 836 837 838 ANS 3 839 840 841 DEBT COMMON STOCK PREFERRRED STOCK WEIGHTS 0.4750 0.4835 0.0414 WACC = COC (%) WEIGHTED COST B AB 4.21% 2.00% 16.00% 7.74% 10.00% 0.41% 10.15% NET CASH FLOW AT TIME = = COST OF MACHINE WORKING CAPITAL NET CASH FLOW -210000 - 110000 150000 +35000 - 75000) -320000 A B D E ANS A COST OF EQUITY = D1/PO+ g = 16.00% (=2.2/20 +0.05] ANS B COST OF PREFERRED STOCK = D/PO = 10.00% (=(2.4%*50)/12] COST OF DEBT BA II PLUS SET C/Y=P/Y = 2 N PV PMT FV 1/Y = YTM = 30 (15 X 2] 1375.5 [=137.55%*1000) -45 (1000 X 9%/2] -1000 5.33% CPT ANS C BEFOR TAX COST OF DEBT = YTM = AFTER TAX COST OF DEBT = YTM*(1-t)= 5.33% 4.21% (5.33%*(1-0.21)] 2 ANS 1 COST MACRS YEAR 3 4 5 33 210000 DEPRECIATION 69300.00 45 94500.00 14 29400.00 8 16800.00 2 3 4 BOOK VALUE 140700.00 46200.00 16800.00 0.00 on 9 1 2 3 -210000 -110000 3 4 5 b YEAR COST OF FIXED ASSETS WORKING CAPITAL EBITDA DEPRECIATION EARNINGS BEFORE TAX TAXES NET INCOME DEPRECIATION OPERATING CASH FLOW 80000 69300.00 10700.00 2247.00 8453.00 69300.00 77753.00 80000 94500.00 -14500.00 -3045.00 -11455.00 94500.00 83045.00 80000 29400.00 50600.00 10626.00 39974.00 29400.00 69374.00 -320000 B 9 1 ANS 2 ANNUAL OCF ... RELEVANT MI-np-ir BETA LEVERED YEAR 1 YEAR 2 YEAR 3 77753.00 83045.00 69374.00 REPLACEMENT BOND OPTION TO WAIT STEIN indiffEPS EBIT OCF 1 NPV . 48 -381 fo AB AC AD AE AF AG AH U YEAR 1 77753.00 YEAR 2 83045.00 YEAR 3 69374.00 1 ANS 2 ANNUAL OCF 3 ANS 3 SALVAGE VALUE = BOOK VALUE AT THE END OF 3 PROFIT ON SALE TAX ON PROFIT AFTER TAX SALVAGE 25000 16800.00 8200.00 1722 23278.00 (25000 - 1722] What is the terminal cash flow in year 3? What are the free cash flows in years 0, 1, 2, and 3? Calculate the NPV, IRR, MIRR (assuming the reinvestment rate is 8 percent), Profitability Index (PI) Ratio, Payback Period, and Discounted Payback period for the projects. Will you accept the project using NPV, IRR, MIRR, Profitability Index (PI) Ratio? Question 13 (Al Chapters - Long-answer question. Use the following information to answer questions 13 to 25. If you do not know a particular answer please make a reasonable assumption and state that you have assumed the answer.) You are the CFO of The Imaginary Products Co. The company provides the following information about its capital structure: Debt: The firm has 200,000 bonds outstanding with a par value of $1,000, pays 9 percent interest (semi-annual coupon payments). have a maturity of 15 years and have a quoted price of 137.55 per bond. Preferred Shares: The firm also has an issue of 2 million preferred shares outstanding with a market price of $12.00 per share. The preferred shares pay an annual dividend of 2.4 percent on the par value of $50.00 Common Stock: The company also has 14 million shares of common stock outstanding with a price of $20.00 per share. The firm is expected to pay a $2.20 common dividend one year from today, and that dividend is expected to increase by 5 percent per year forever The firm is considering a three-year expansion project (same operations as the existing projects of the firm) that requires a purchase of a machine of $210,000. There will be an increase in inventory of $150,000, accounts receivable of $35,000, and accounts payable of $75,000. The machine will be in the 3-year MACRS class and the annual depreciation rates are 33 percent in year 1,44 percent in year 2, 15 percent in year 3, and 8 percent in year 4. The project is expected to generate Earnings Before Interest. Taxes. Depreciation and Amortization (EBITDA) of $80,000 each year. At the end of the project (year 3), the machine can be sold for $25,000. The firm's tax rate is 21 percent. H828 B D F G 818 819 820 821 DEBT COMMON STOCK PREFERRRED STOCK A 200000 14000000 2000000 B 1375.5 20 12 E AB 275100000 280000000 24000000 579100000 0.4750 0.4835 0.0414 822 823 824 ANS 1 825 WEIGHT OF EQUITY DEBT PREFERRED STOCK 826 48.35% 47.50% 4.14% 827 WACC 828 829 830 831 832 833 834 835 ANS 2 836 837 838 ANS 3 839 840 841 DEBT COMMON STOCK PREFERRRED STOCK WEIGHTS 0.4750 0.4835 0.0414 WACC = COC (%) WEIGHTED COST B AB 4.21% 2.00% 16.00% 7.74% 10.00% 0.41% 10.15% NET CASH FLOW AT TIME = = COST OF MACHINE WORKING CAPITAL NET CASH FLOW -210000 - 110000 150000 +35000 - 75000) -320000 A B D E ANS A COST OF EQUITY = D1/PO+ g = 16.00% (=2.2/20 +0.05] ANS B COST OF PREFERRED STOCK = D/PO = 10.00% (=(2.4%*50)/12] COST OF DEBT BA II PLUS SET C/Y=P/Y = 2 N PV PMT FV 1/Y = YTM = 30 (15 X 2] 1375.5 [=137.55%*1000) -45 (1000 X 9%/2] -1000 5.33% CPT ANS C BEFOR TAX COST OF DEBT = YTM = AFTER TAX COST OF DEBT = YTM*(1-t)= 5.33% 4.21% (5.33%*(1-0.21)] 2 ANS 1 COST MACRS YEAR 3 4 5 33 210000 DEPRECIATION 69300.00 45 94500.00 14 29400.00 8 16800.00 2 3 4 BOOK VALUE 140700.00 46200.00 16800.00 0.00 on 9 1 2 3 -210000 -110000 3 4 5 b YEAR COST OF FIXED ASSETS WORKING CAPITAL EBITDA DEPRECIATION EARNINGS BEFORE TAX TAXES NET INCOME DEPRECIATION OPERATING CASH FLOW 80000 69300.00 10700.00 2247.00 8453.00 69300.00 77753.00 80000 94500.00 -14500.00 -3045.00 -11455.00 94500.00 83045.00 80000 29400.00 50600.00 10626.00 39974.00 29400.00 69374.00 -320000 B 9 1 ANS 2 ANNUAL OCF ... RELEVANT MI-np-ir BETA LEVERED YEAR 1 YEAR 2 YEAR 3 77753.00 83045.00 69374.00 REPLACEMENT BOND OPTION TO WAIT STEIN indiffEPS EBIT OCF 1 NPV . 48 -381 fo AB AC AD AE AF AG AH U YEAR 1 77753.00 YEAR 2 83045.00 YEAR 3 69374.00 1 ANS 2 ANNUAL OCF 3 ANS 3 SALVAGE VALUE = BOOK VALUE AT THE END OF 3 PROFIT ON SALE TAX ON PROFIT AFTER TAX SALVAGE 25000 16800.00 8200.00 1722 23278.00 (25000 - 1722] What is the terminal cash flow in year 3? What are the free cash flows in years 0, 1, 2, and 3? Calculate the NPV, IRR, MIRR (assuming the reinvestment rate is 8 percent), Profitability Index (PI) Ratio, Payback Period, and Discounted Payback period for the projects. Will you accept the project using NPV, IRR, MIRR, Profitability Index (PI) Ratio