Answered step by step

Verified Expert Solution

Question

1 Approved Answer

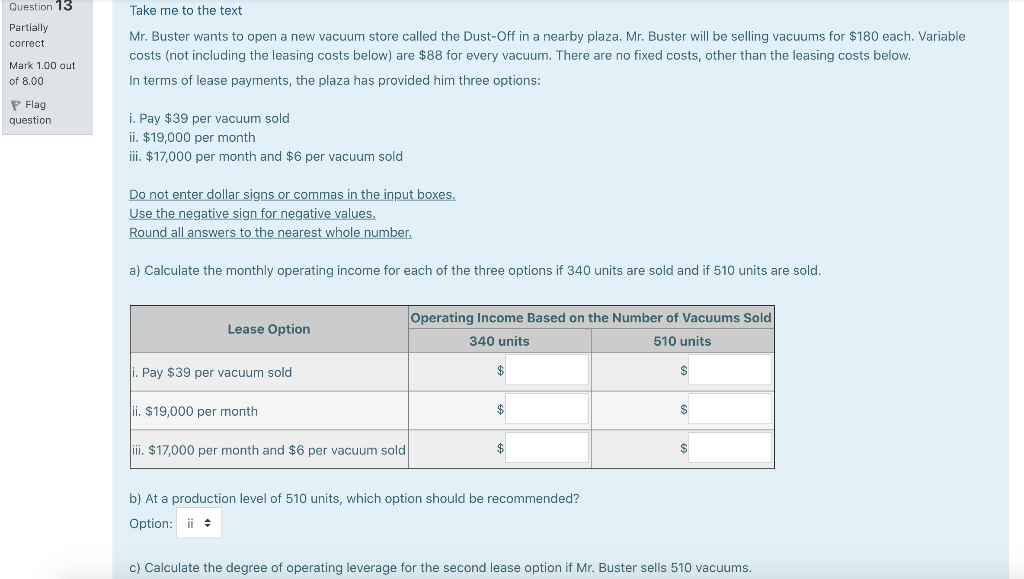

Question 13 Partially correct Mark 1.00 out of 8.00 P Flag question Take me to the text Mr. Buster wants to open a new

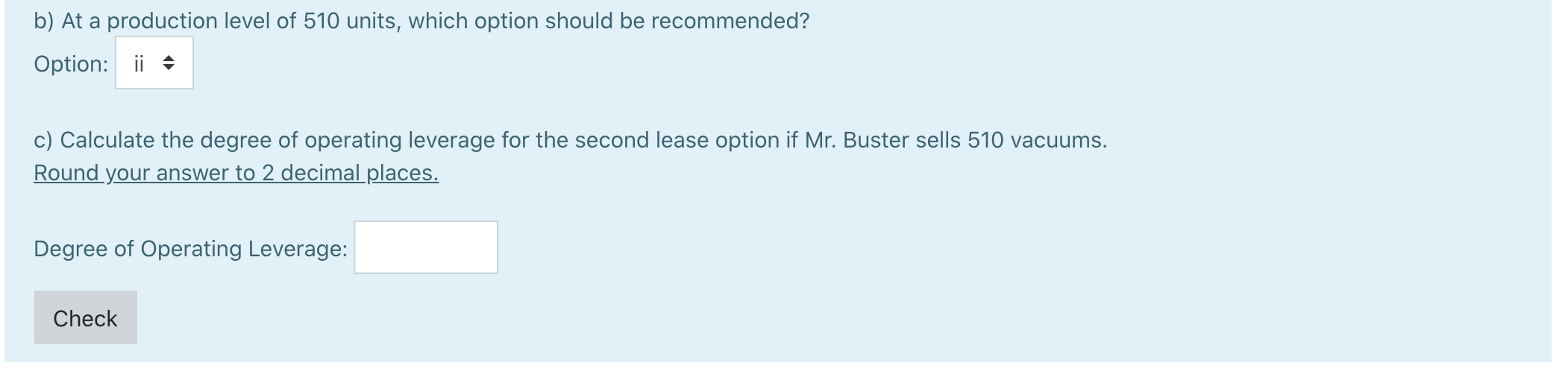

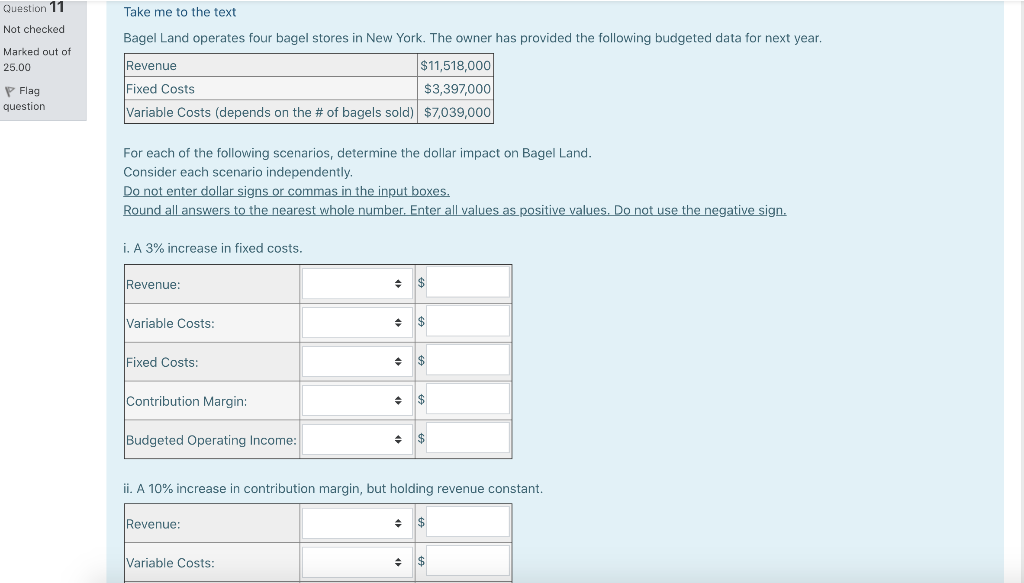

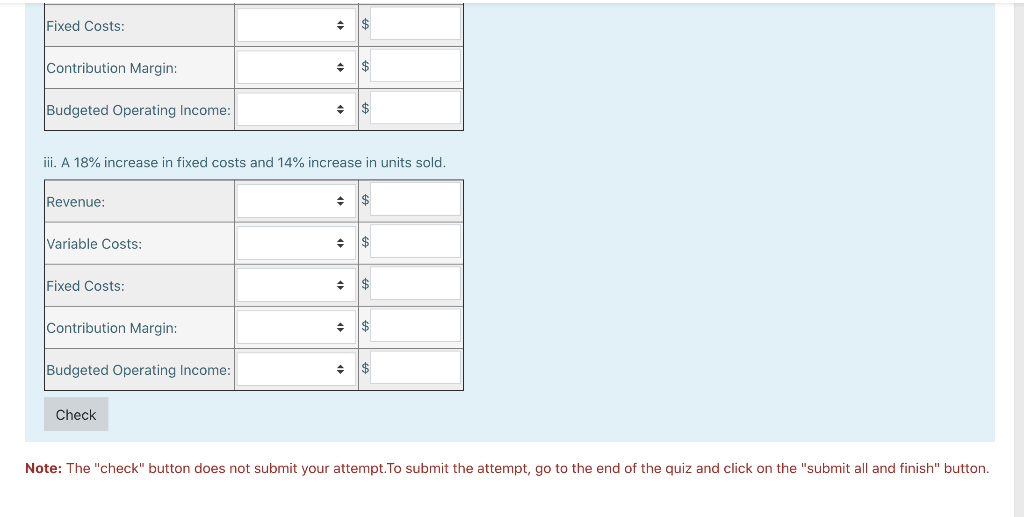

Question 13 Partially correct Mark 1.00 out of 8.00 P Flag question Take me to the text Mr. Buster wants to open a new vacuum store called the Dust-Off in a nearby plaza. Mr. Buster will be selling vacuums for $180 each. Variable costs (not including the leasing costs below) are $88 for every vacuum. There are no fixed costs, other than the leasing costs below. In terms of lease payments, the plaza has provided him three options: i. Pay $39 per vacuum sold ii. $19,000 per month iii. $17,000 per month and $6 per vacuum sold Do not enter dollar signs or commas in the input boxes. Use the negative sign for negative values. Round all answers to the nearest whole number. a) Calculate the monthly operating income for each of the three options if 340 units are sold and if 510 units are sold. Lease Option i. Pay $39 per vacuum sold ii. $19,000 per month iii. $17,000 per month and $6 per vacuum sold Operating Income Based on the Number of Vacuums Sold 340 units 510 units $ $ b) At a production level of 510 units, which option should be recommended? Option: ii $ $ $ c) Calculate the degree of operating leverage for the second lease option if Mr. Buster sells 510 vacuums. b) At a production level of 510 units, which option should be recommended? Option: ii c) Calculate the degree of operating leverage for the second lease option if Mr. Buster sells 510 vacuums. Round your answer to 2 decimal places. Degree of Operating Leverage: Check Question 11 Not checked Marked out of 25.00 P Flag question. Take me to the text Bagel Land operates four bagel stores in New York. The owner has provided the following budgeted data for next year. Revenue $11,518,000 $3,397,000 Fixed Costs Variable Costs (depends on the # of bagels sold) $7,039,000 For each of the following scenarios, determine the dollar impact on Bagel Land. Consider each scenario independently. Do not enter dollar signs or commas in the input boxes. Round all answers to the nearest whole number. Enter all values as positive values. Do not use the negative sign. i. A 3% increase in fixed costs. Revenue: Variable Costs: Fixed Costs: Contribution Margin: Budgeted Operating Income: Revenue: Variable Costs: $ $ ii. A 10% increase in contribution margin, but holding revenue constant. $ + $ + $ $ Fixed Costs: Contribution Margin: Budgeted Operating Income: Revenue: Variable Costs: iii. A 18% increase in fixed costs and 14% increase in units sold. Fixed Costs: Contribution Margin: Budgeted Operating Income: = $ Check $ + $ $ $ $ $ $ Note: The "check" button does not submit your attempt. To submit the attempt, go to the end of the quiz and click on the "submit all and finish" button.

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Solution At Z 3000 m T26865K p0701 p0909 kgm ai 3287 ms u52536 145833 ms Mu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started