Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 13: Robert bought a rental property ten years ago for $320,000, with $80,000 of the cost allocated to the land and $240,000 to

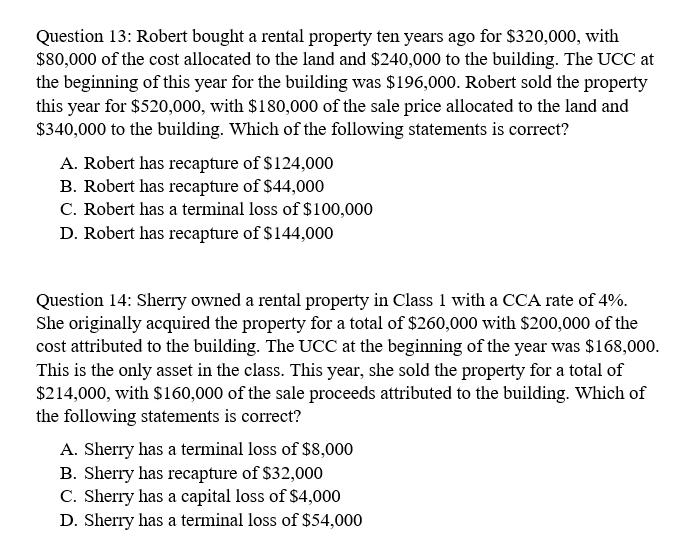

Question 13: Robert bought a rental property ten years ago for $320,000, with $80,000 of the cost allocated to the land and $240,000 to the building. The UCC at the beginning of this year for the building was $196,000. Robert sold the property this year for $520,000, with $180,000 of the sale price allocated to the land and $340,000 to the building. Which of the following statements is correct? A. Robert has recapture of $124,000 B. Robert has recapture of $44,000 C. Robert has a terminal loss of $100,000 D. Robert has recapture of $144,000 Question 14: Sherry owned a rental property in Class 1 with a CCA rate of 4%. She originally acquired the property for a total of $260,000 with $200,000 of the cost attributed to the building. The UCC at the beginning of the year was $168,000. This is the only asset in the class. This year, she sold the property for a total of $214,000, with $160,000 of the sale proceeds attributed to the building. Which of the following statements is correct? A. Sherry has a terminal loss of $8,000 B. Sherry has recapture of $32,000 C. Sherry has a capital loss of $4,000 D. Sherry has a terminal loss of $54,000

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Salution 13 Account Building Sale value Legg building ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started