Answered step by step

Verified Expert Solution

Question

1 Approved Answer

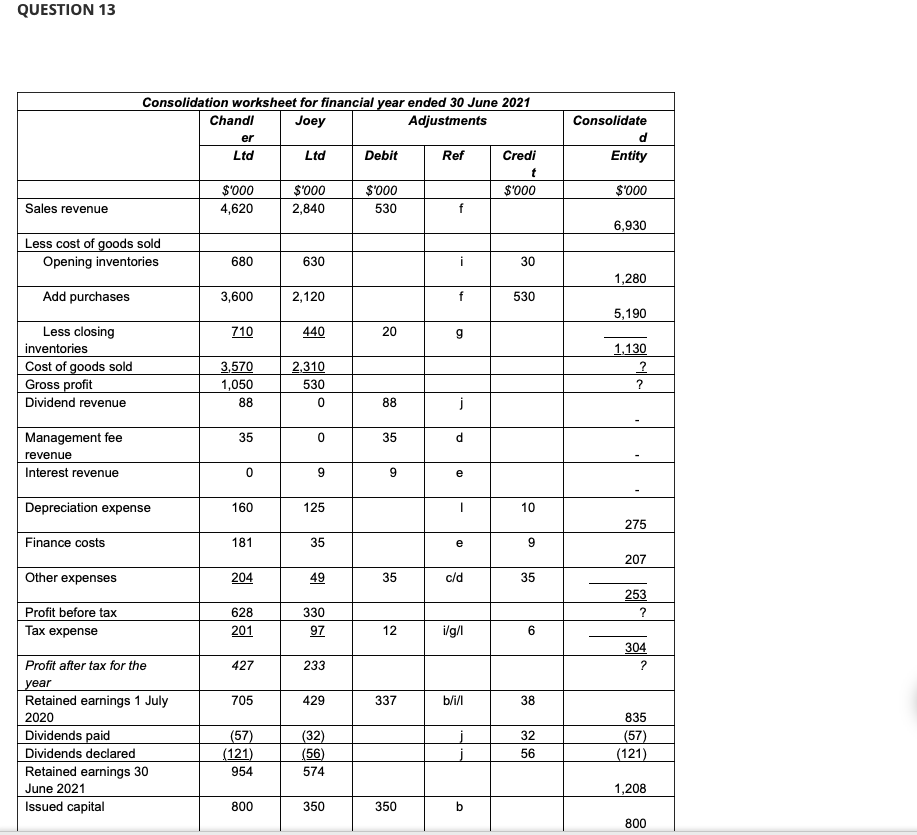

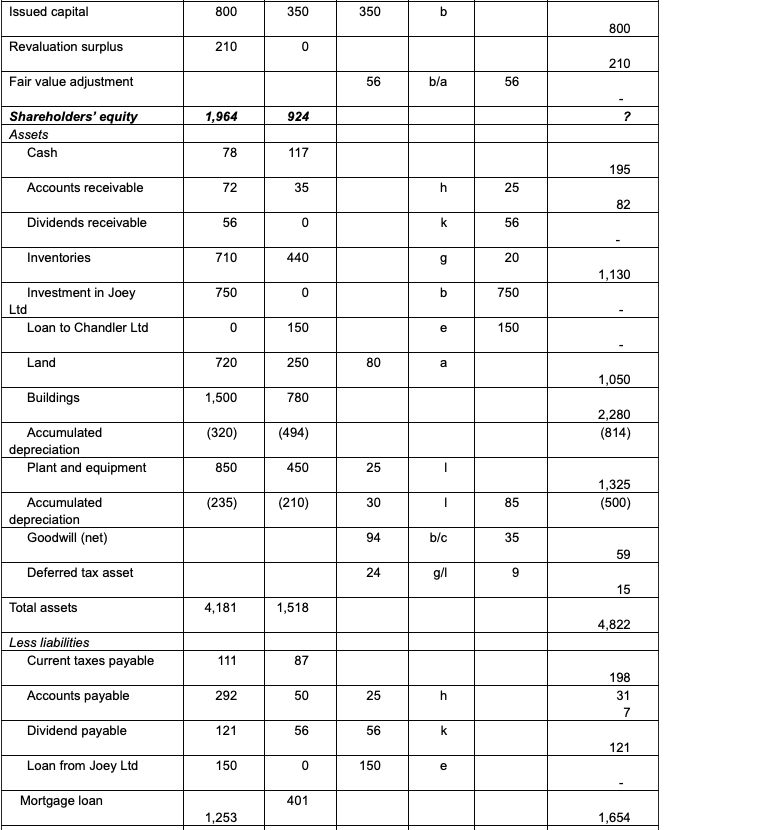

QUESTION 13 Consolidation worksheet for financial year ended 30 June 2021 Chandl Joey Adjustments Consolidate er d Ltd Ltd Debit Ref Credi Entity t

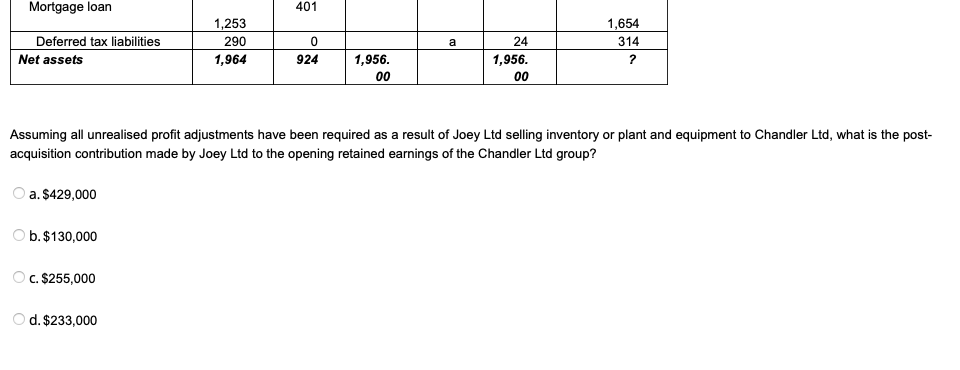

QUESTION 13 Consolidation worksheet for financial year ended 30 June 2021 Chandl Joey Adjustments Consolidate er d Ltd Ltd Debit Ref Credi Entity t $'000 $'000 $'000 $'000 $'000 Sales revenue 4,620 2,840 530 f 6,930 Less cost of goods sold Opening inventories 680 630 Add purchases 3,600 2,120 Less closing 710 440 20 g inventories Cost of goods sold 3,570 2,310 Gross profit 1,050 530 30 1,280 f 530 5,190 1,130 3 ? Dividend revenue 88 0 88 Management fee 35 0 35 d revenue Interest revenue 0 9 9 e Depreciation expense 160 125 10 275 Finance costs 181 35 e 9 207 Other expenses 204 49 35 c/d 35 253 Profit before tax 628 330 ? Tax expense 201 97 12 i/g/l 6 304 Profit after tax for the 427 233 ? year Retained earnings 1 July 705 429 337 b/i/l 38 2020 835 Dividends paid (57) (32) 32 (57) Dividends declared (121) (56) 56 (121) Retained earnings 30 954 574 June 2021 1,208 Issued capital 800 350 350 b 800 Issued capital 800 350 350 b 800 Revaluation surplus 210 0 210 Fair value adjustment 56 b/a 56 Shareholders' equity 1,964 924 ? Assets Cash 78 117 195 Accounts receivable 72 35 h 25 82 Dividends receivable 56 0 k 56 Inventories 710 440 20 20 Investment in Joey 1,130 750 0 b 750 Ltd Loan to Chandler Ltd 0 150 e 150 Land 720 250 80 a Buildings 1,500 780 Accumulated (320) (494) 1,050 2,280 (814) depreciation Plant and equipment 850 450 25 Accumulated (235) (210) 30 depreciation Goodwill (net) Deferred tax asset 1,325 85 (500) 94 b/c 35 59 24 g/l 6 15 Total assets 4,181 1,518 4,822 Less liabilities Current taxes payable 111 87 Accounts payable 292 50 25 198 31 7 Dividend payable 121 56 56 k 121 Loan from Joey Ltd 150 0 150 e Mortgage loan 401 1,253 1,654 Mortgage loan 401 1,253 Deferred tax liabilities Net assets 290 0 1,964 924 1,956. 00 a 24 1,654 314 1,956. ? 00 Assuming all unrealised profit adjustments have been required as a result of Joey Ltd selling inventory or plant and equipment to Chandler Ltd, what is the post- acquisition contribution made by Joey Ltd to the opening retained earnings of the Chandler Ltd group? a. $429,000 b. $130,000 c. $255,000 Od. $233,000

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the postacquisition contribution made by Joey Ltd to the opening retained earnings of C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started