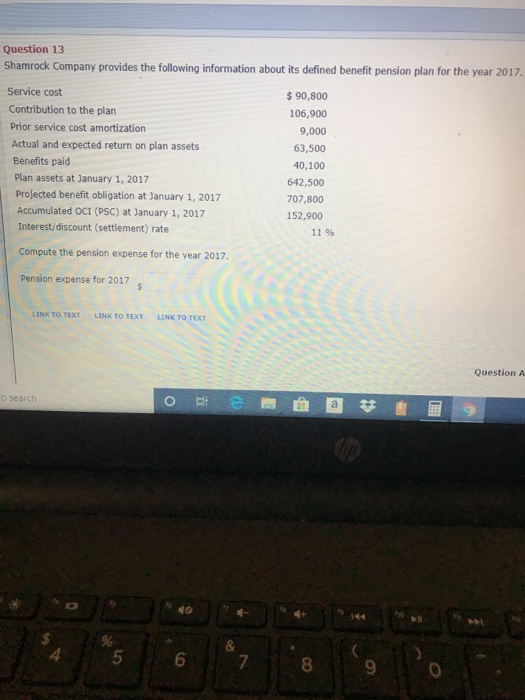

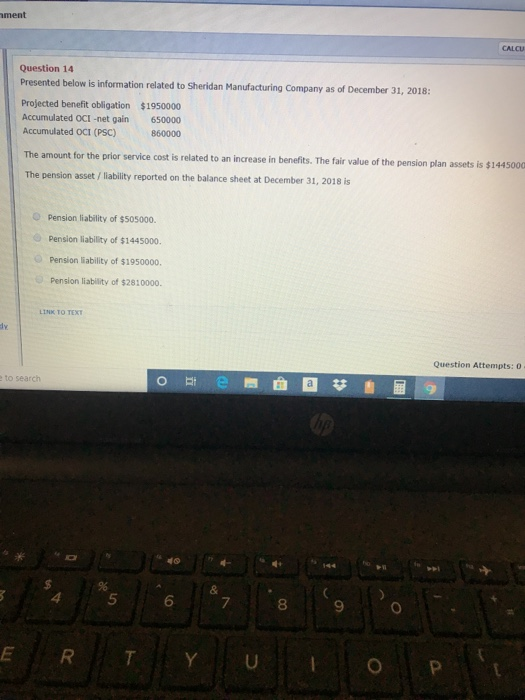

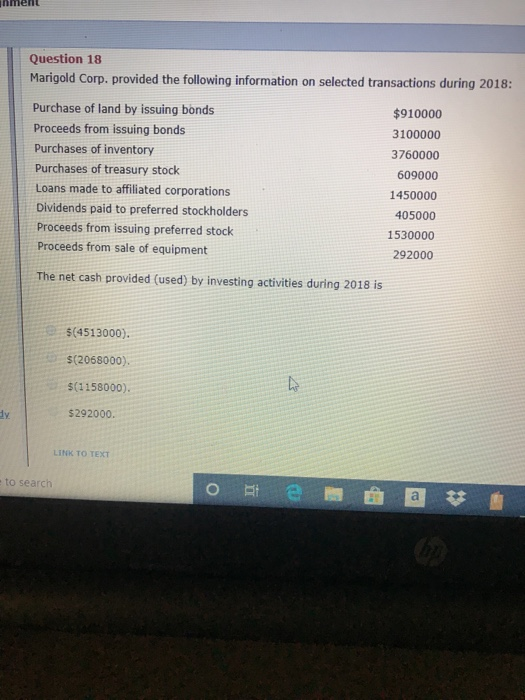

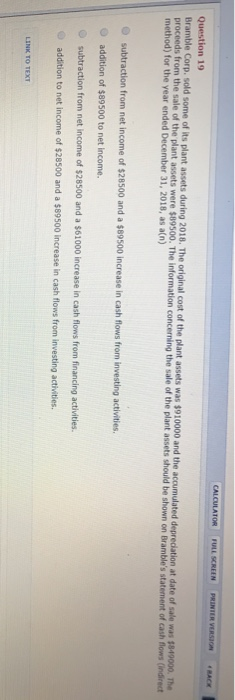

Question 13 Shamrock Company provides the following information about its defined benefit pension plan for the year 2017. Service cost $ 90,800 Contribution to the plan 106,900 Prior service cost amortization 9,000 Actual and expected return on plan assets 63,500 Benefits paid 40,100 Plan assets at January 1, 2017 642,500 Projected benefit obligation at January 1, 2017 707,800 Accumulated OCI (PSC) at January 1, 2017 152,900 Interest/discount (settlement) rate 11 % Compute the pension expense for the year 2017, Pension expense for 2017 LINK TO TEXT LINK TO TEXT UNK TO TEXT Question A o search o e a ament Question 14 Presented below is information related to Sheridan Manufacturing Company as of December 31, 2018: Projected benefit obligation $1950000 Accumulated OCI-net gain 650000 Accumulated OCI (PSC) 860000 The amount for the prior service cost is related to an increase in benefits. The fair value of the pension plan assets is $1445000 The pension asset / liability reported on the balance sheet at December 31, 2018 is Pension liability of $505000. Pension liability of $1445000 Pension liability of $1950000. Pension liability of $2810000. Question Attempts: 0 to search o Bie a * Anment Question 18 Marigold Corp. provided the following information on selected transactions during 2018: Purchase of land by issuing bonds Proceeds from issuing bonds Purchases of inventory Purchases of treasury stock Loans made to affiliated corporations Dividends paid to preferred stockholders Proceeds from issuing preferred stock Proceeds from sale of equipment $910000 3100000 3760000 609000 1450000 405000 1530000 292000 The net cash provided (used) by investing activities during 2018 is $(4513000). $(2068000). $(1158000). $292000. LINK TO TEXT to search o e a Question 19 Bramble Corp. sold some of its plant assets during 2018. The original cost of the plant assets was $910000 and the accumulated depreciation at date of sole was 1849000. The proceeds from the sale of the plant assets were $89500. The information concerning the sale of the plant assets should be shown on Bramble's statement of cash flow method) for the year ended December 31, 2018, as () indirect CALCULATOR POLSCREEN PRINTER VERSION subtraction from net income of $28500 and a $9500 increase in cash flows from investing activities. addition of $89500 to net income. Subtraction from net income of $28500 and a $61000 increase in cash flows from financing activities addition to net income of $28500 and a $89500 increase in cash flows from investing activities TO TEXT