Answered step by step

Verified Expert Solution

Question

1 Approved Answer

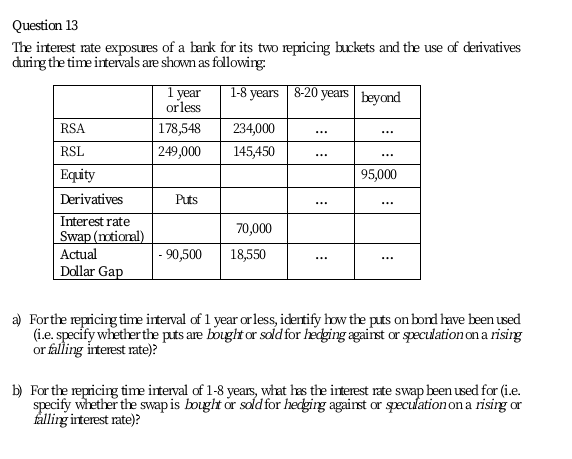

Question 13 The interest rate exposures of a bank for its two repricing buckets and the use of derivatives during the time intervals are shown

Question 13 The interest rate exposures of a bank for its two repricing buckets and the use of derivatives during the time intervals are shown as following 1 year 1-8 years 8-20 years beyond orless RSA 178,548 234,000 RSL 249,000 145,450 Equity 95,000 Derivatives Puts Interest rate 70,000 Swap (motional) Actual - 90,500 18,550 Dollar Gap ... ... ... ... a) Forthe repricing time interval of 1 year orless, identify how the puts on bond have been used (i.e. specify whether the puts are bought or sold for hedging against or speculation on a rising or falling interest rate)? b) For the repricing time interval of 1-8 years, what hes the interest rate swap been used for (i.e. specify whether the swap is bought or sold for hedging against or speculation on a rising or falling interest rate)? Question 13 The interest rate exposures of a bank for its two repricing buckets and the use of derivatives during the time intervals are shown as following 1 year 1-8 years 8-20 years beyond orless RSA 178,548 234,000 RSL 249,000 145,450 Equity 95,000 Derivatives Puts Interest rate 70,000 Swap (motional) Actual - 90,500 18,550 Dollar Gap ... ... ... ... a) Forthe repricing time interval of 1 year orless, identify how the puts on bond have been used (i.e. specify whether the puts are bought or sold for hedging against or speculation on a rising or falling interest rate)? b) For the repricing time interval of 1-8 years, what hes the interest rate swap been used for (i.e. specify whether the swap is bought or sold for hedging against or speculation on a rising or falling interest rate)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started