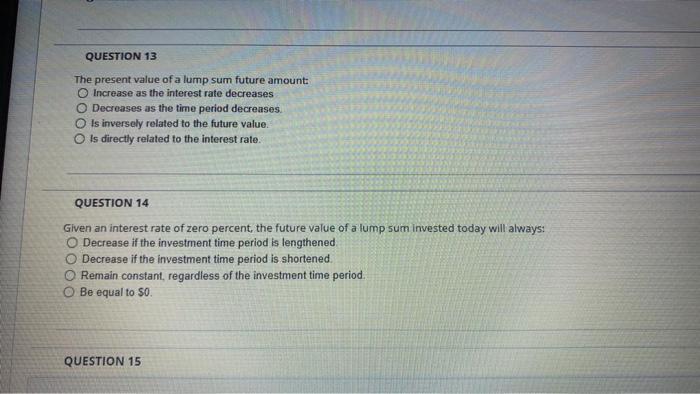

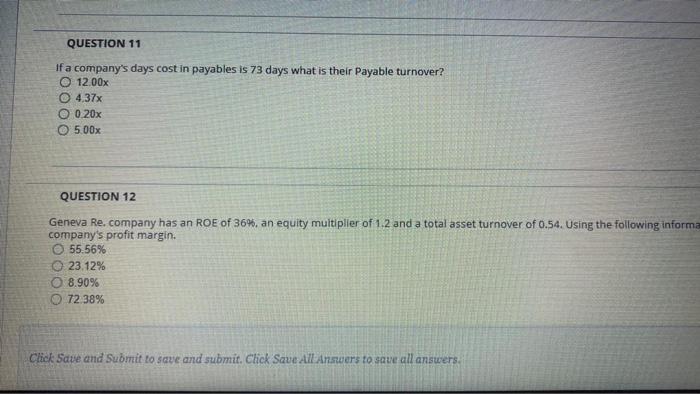

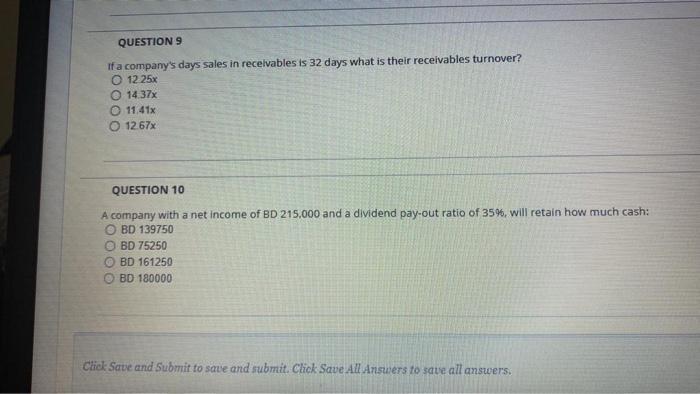

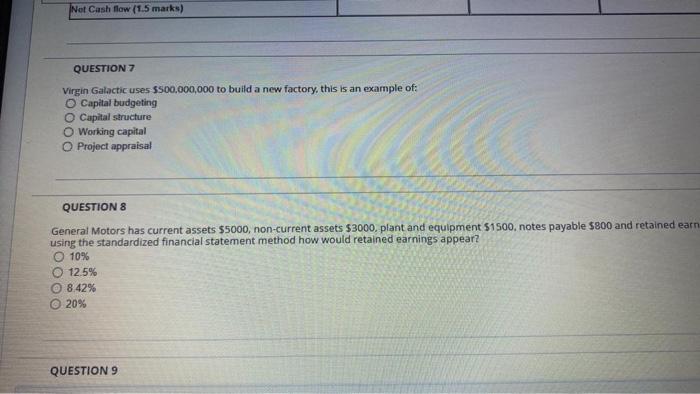

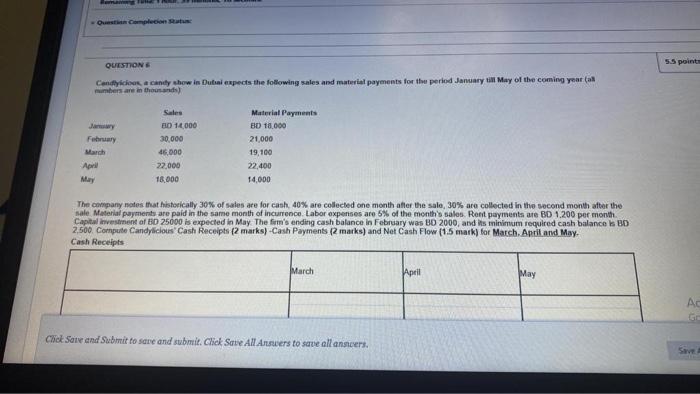

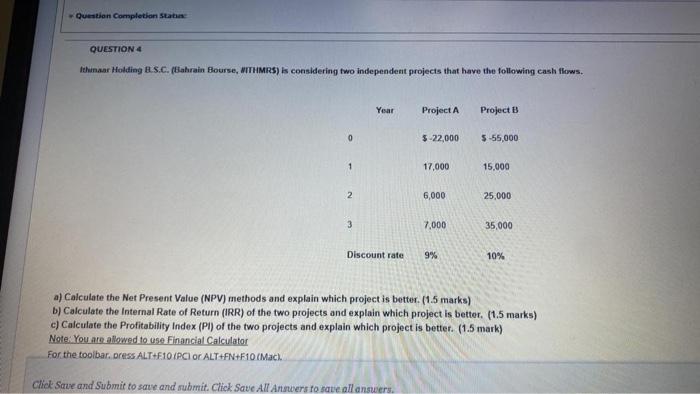

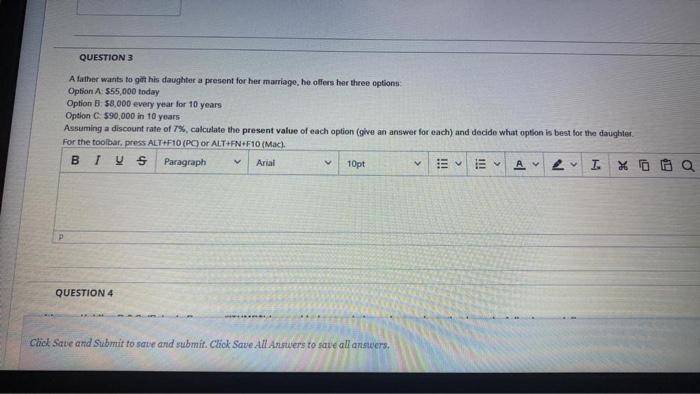

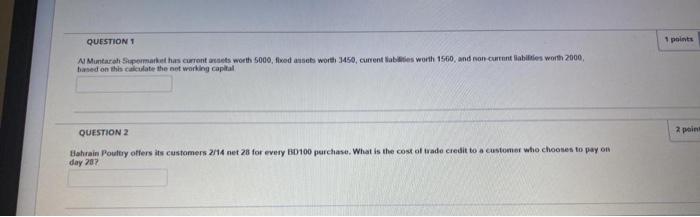

QUESTION 13 The present value of a lump sum future amount: O Increase as the interest rate decreases O Decreases as the time period decreases. Is inversely related to the future value. Is directly related to the interest rate. QUESTION 14 Given an interest rate of zero percent, the future value of a lump sum invested today will always: Decrease if the investment time period is lengthened O Decrease if the investment time period is shortened. O Remain constant, regardless of the investment time period. O Be equal to $0. QUESTION 15 QUESTION 11 If a company's days cost in payables is 73 days what is their Payable turnover? 12.00x 4.37x 0,20x 5.00x QUESTION 12 Geneva Re. company has an ROE of 36%, an equity multiplier of 1.2 and a total asset turnover of 0.54. Using the following informa company's profit margin. O 55.56% 23.12% 8.90% 72.38% Click Save and Submit to save and submit. Click Save All Answers to save all answers. QUESTION 9 If a company's days sales in receivables is 32 days what is their receivables turnover? O 12.25x 14.37x 11.41x O 12.67x QUESTION 10 A company with a net income of BD 215.000 and a dividend pay-out ratio of 35%, will retain how much cash: OBD 139750 OBD 75250 OBD 161250 BD 180000 Click Save and Submit to save and submit. Click Save All Answers to save all answers. Net Cash flow (1.5 marks) QUESTION 7 Virgin Galactic uses $500,000,000 to build a new factory, this is an example of: O Capital budgeting O Capital structure O Working capital O Project appraisal QUESTION 8 General Motors has current assets $5000, non-current assets $3000, plant and equipment $1500, notes payable $800 and retained earn.. using the standardized financial statement method how would retained earnings appear? O 10% 12.5% 8.42% 20% QUESTION 9 Remang TU Question Completion Status QUESTION Candyicious, a candy show in Dubai expects the following sales and material payments for the period January till May of the coming year (all numbers are in thousands) Sales Material Payments BD 14,000 BD 18.000 30,000 21,000 February March 46,000 19,100 April 22,000 22,400 May 18,000 14,000 The company notes that historically 30% of sales are for cash, 40% are collected one month after the sale, 30% are collected in the second month after the sale Material payments are paid in the same month of incurrence. Labor expenses are 5% of the month's sales. Rent payments are BD 1.200 per month. Capital investment of BD 25000 is expected in May. The firm's ending cash balance in February was BD 2000, and its minimum required cash balance is BD 2,500. Compute Candylicious Cash Receipts (2 marks) -Cash Payments (2 marks) and No Flow (1.5 mark) for March. April and May. Cash Receipts March April May Click Save and Submit to save and submit. Click Save All Answers to save all answers. 5.5 points Ac Go Save A Question Completion Statu QUESTION 4 Ithmaar Holding B.S.C. (Bahrain Bourse, WITHMRS) is considering two independent projects that have the following cash flows. Year Project A Project B $-22,000 $-55,000 17,000 15,000 6,000 25,000 3 7,000 35,000 Discount rate 9% 10% a) Calculate the Net Present Value (NPV) methods and explain which project is better. (1.5 marks) b) Calculate the Internal Rate of Return (IRR) of the two projects and explain which project is better. (1.5 marks) c) Calculate the Profitability Index (Pl) of the two projects and explain which project is better. (1.5 mark) Note: You are allowed to use Financial Calculator For the toolbar. press ALT+F10 (PC) or ALT+FN+F10 (Mack Click Save and Submit to save and submit. Click Save All Answers to save all answers. 2 QUESTION 3 A father wants to get his daughter a present for her marriage, he offers her three options: Option A: $55,000 today Option B: $8,000 every year for 10 years Option C $90,000 in 10 years Assuming a discount rate of 7%, calculate the present value of each option (give an answer for each) and decide what option is best for the daughter. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial V 10pt Ev Ev A 2 QUESTION 4 Click Save and Submit to save and submit. Click Save All Answers to save all answers,