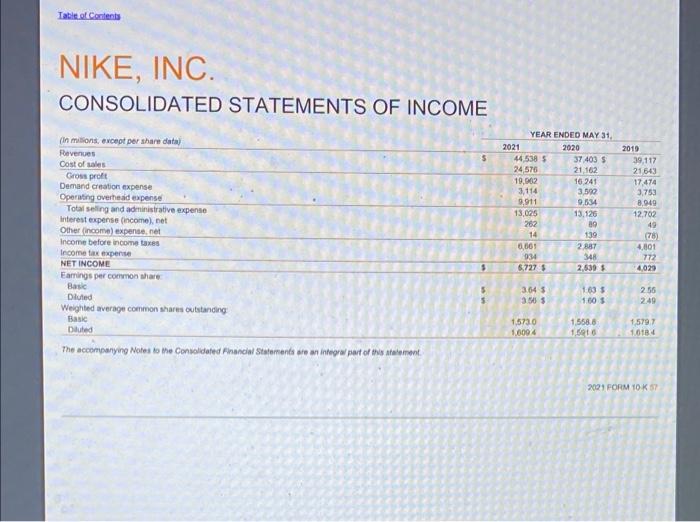

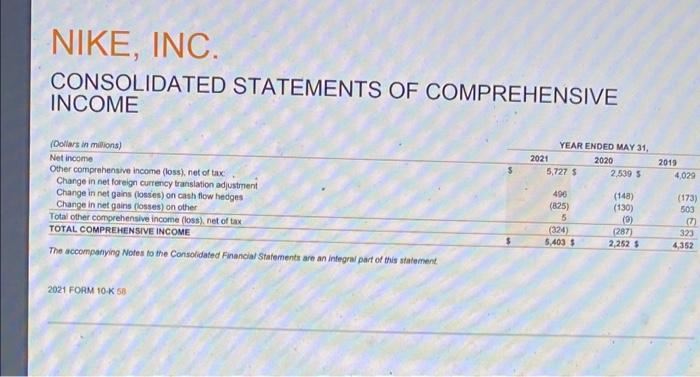

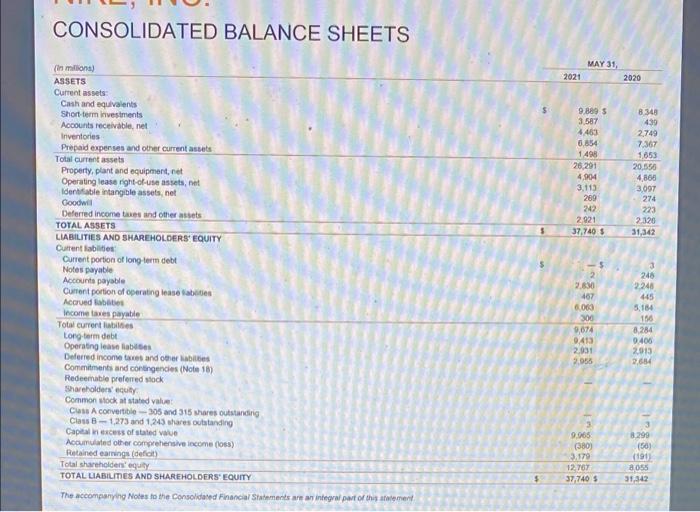

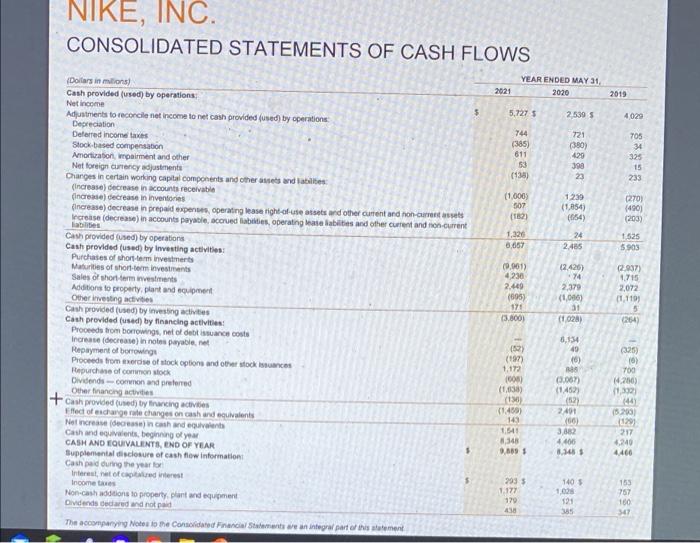

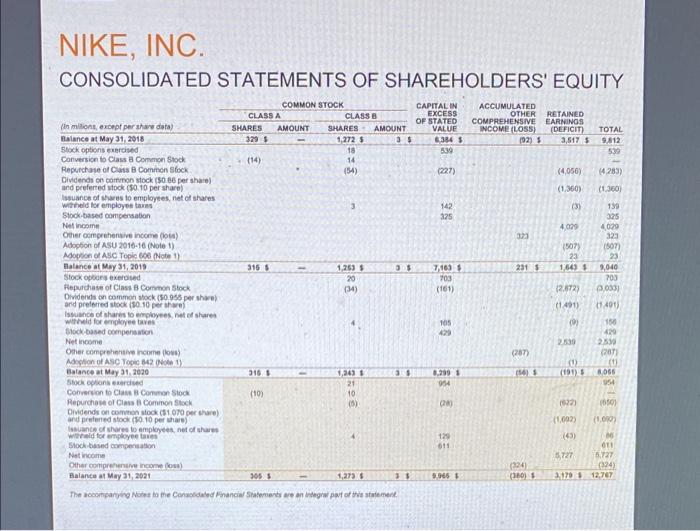

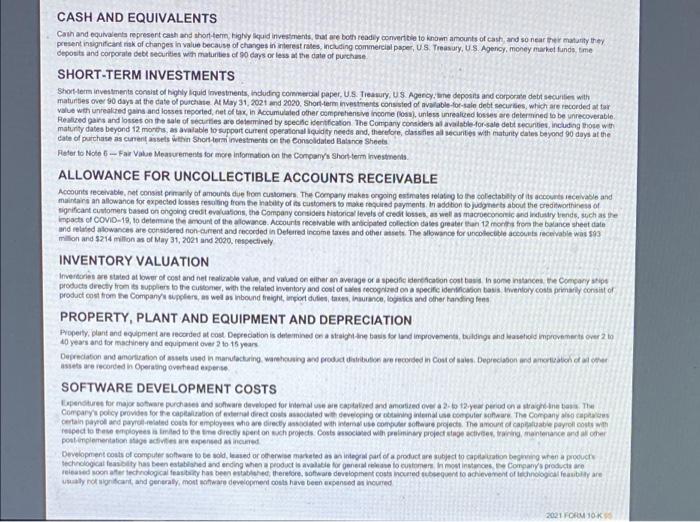

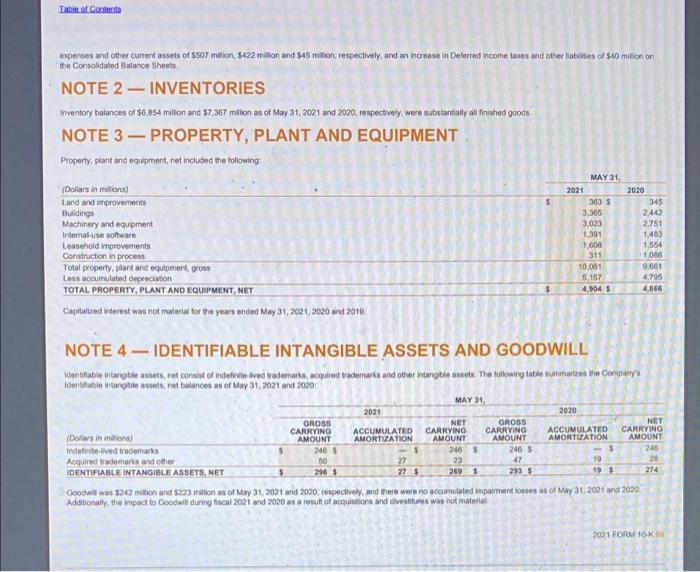

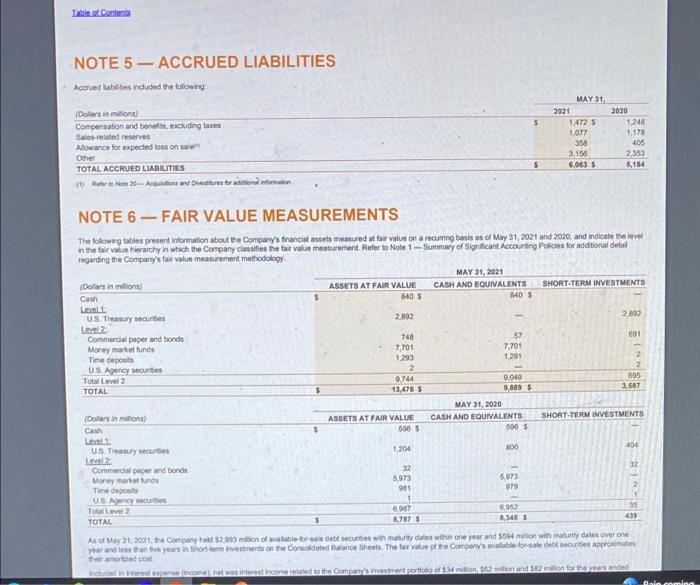

Question 13 When Nike collects an accounts receivable from a customer a. net income does not change. Ob. total assets increase. O c. retained earnings increase. Od. accounts payable decreases. Table of Contents NIKE, INC. CONSOLIDATED STATEMENTS OF INCOME (in millions, except per share data) 2021 Revenues Cost of sales Gross profit Demand creation expense Operating overhead expense Total selling and administrative expense interest expense (income), net Other (income) expense, net Income before income taxes Income tax expense NET INCOME Earrings per common share Basic Diluted Weighted average common shares outstanding Basic Diluted The accompanying Notes to the Consolidated Financial Statements are an integral part of this stalement $ S YEAR ENDED MAY 31, 2020 37,403 S 21,162 16.241 3,592 9,534 13,126 89 139 44,538 $ 24,576 19,962 3,114 9,911 13,025 262 14 0,001 934 6,727 $ 3.64 $ 3.50 $ 1,573.0 1,000 4 2.887 348 2,539 $ 1.63 $ 1.60 $ 2019 1,558.8 1,5016 39,117 21,643 17,474 3,753 8,949 12,702 49 (78) 4,801 772 4,029 2.56 2.49 1,579.7 1.0184 2021 FORM 10-K 57 NIKE, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME YEAR ENDED MAY 31, (Dollars in millions) 2021 2020 Net income 2,539 S Other comprehensive income (loss), net of tax Change in net foreign currency translation adjustment Change in net gains (losses) on cash flow hedges Change in net gains (losses) on other (148) (130) () Total other comprehensive income (loss), net of tax (287) TOTAL COMPREHENSIVE INCOME 2,252 S The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement 2021 FORM 10-K 58 5,727 S 496 (825) 5 (324) 5,403 $ 2019 4,029 (173) 503 ( 323 4,352 CONSOLIDATED BALANCE SHEETS (in millions) ASSETS Current assets: Cash and equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Operating lease right-of-use assets, net Identifiable intangible assets, net Goodwill Deferred income taxes and other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current fabilities Current portion of long-term debt Notes payable Accounts payable Current portion of operating lease sablities Accrued Rablities Income taxes payable Total current liabilities Long-term debt Operating lease labies Deferred income taxes and other liabilbes Commitments and contingencies (Note 18) Redeemable preferred stock Shareholders' equity Common stock at stated value: Class A convertible-305 and 315 shares outstanding, Class 8-1,273 and 1,243 shares outstanding Capital in excess of stated value Accumulated other comprehensive income (loss) Retained earnings (deficit) Total shareholders' equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement $ 2021 MAY 31, 9,889 S 3,587 4463 6,854 1498 26,291 4,904 3,113 269 242 2.921 37,740 2 2.830 467 6.063 306 9,674 9413 2,931 2,955 9.965 (380) 3.179 12,767 37,740 2020 8.348 439 2,749 7.367 1,653 20,556 4,866 3,097 274 223 2.320 31,342 3 248 2,248 445 5,184 156 8,284 9.406 2.913 2,684 8,299 (56) (191) 8.055 31,342 NIKE, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (Dollars in milions) 2021 Cash provided (used) by operations: Net income Adjustments to reconcile net income to net cash provided (used) by operations: Depreciation Deferred income taxes Stock-based compensation Amortization, impairment and other Net foreign currency adjustments Changes in certain working capital components and other assets and abilities: (Increase) decrease in accounts receivable (Increase) decrease in inventories (Increase) decrease in prepaid expenses, operating lease right-of-use assets and other current and non-current assets Increase (decrease) in accounts payable, accrued liabilities, operating lease liabilities and other current and non-current labilities Cash provided (used) by operations Cash provided (used) by investing activities: Purchases of short-term investments Maturities of short-term investments Sales of short-term investments Additions to property, plant and equipment Other investing activities Cash provided (used) by investing activities Cash provided (used) by financing activities: Proceeds from borrowings, net of debt issuance costs Increase (decrease) in notes payable, net Repayment of borrowings Proceeds from exercise of stock options and other stock issuances Repurchase of common stock Dividends-common and preferred Other financing activities +Cash provided (used) by financing activities Effect of exchange rate changes on cash and equivalents Net increase (decrease) in cash and equivalents Cash and equivalents, beginning of year CASH AND EQUIVALENTS, END OF YEAR Supplemental disclosure of cash flow information: Cash paid during the year for Interest, net of capitalized interest Income taxes Non-cash additions to property, plant and equipment Dividends declared and not paid The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement $ 5,727 S 744 (385) 611 53 (138) (1,000) 507 (182) 1,326 6,657 (9.901) 4,230 2,449 (695) 171 (3.000) (52) (197) 1.172 YEAR ENDED MAY 31, 2020 2,539 S 721 (380) 429 390 23 1239 (1,854) (054) 24 2,485 (2,426) 74 2,379 (1,006) 31 (1,028) 6,134 49 (6) (008) (1,038) (136) (1,459) 143 1.541 8,348 9,809 293 $ 1.177 179 438 845 (3.067) (1452) (52) 2,401 3,882 4.406 8,348 (66) 140 $ 1,028 121 385 2019 4,029 705 34 325 15 233 (270) (490) (203) 1,525 5,903 (2.937) 1715 2,072 (1,119) 5 (264) (325) (6) 700 (4,286) (1,332) (44) (5,200) (129) 217 4,240 4,466 153 757 160 347 NIKE, INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY COMMON STOCK CAPITAL IN ACCUMULATED CLASS A OTHER RETAINED COMPREHENSIVE EARNINGS (in milions, except per share data) Balance at May 31, 2018 INCOME (LOSS) (DEFICIT) TOTAL CLASS B SHARES AMOUNT 1,272 35 SHARES AMOUNT 329 EXCESS OF STATED VALUE 6,384 539 (92) 3,517 9,812 Stock options exercised 18 539 Conversion to Class 8 Common Stock Repurchase of Class B Common Sfock (227) (4,056) (4,283) Dividends on common stock (50 86 per share) and preferred stock ($0.10 per share) (1,360) (1,360) Issuance of shares to employees, net of shares withheld for employee taxes 142 (3) 139 Stock-based compensation 325 325 Net income 4,029 Other comprehensive income (loss) Adoption of ASU 2016-16 (Note 1) Adoption of ASC Topic 600 (Note 1) 323 (507) 23 9,040 703 Balance at May 31, 2019 7,163 $ Stock optors exercised 703 (161) (3,033) Repurchase of Class B Common Stock Dividends on common stock ($0.955 per share) and preferred stock (50.10 per share) (1401) Issuance of shares to employees, net of shares withheld for employee taxes 105 150 Stock-based compensation 429 429 Net income 2,530 Other comprehensive income (loss) Adoption of ASC Topic 842 (Note 1) (287) (1) Balance at May 31, 2020 316 S 8.299 Stock options exercised 954 Conversion to Class B Common Stock (10) Repurchase of Class B Common Stock (5) Dividends on common stock ($1.070 per share) and preferred stock ($0.10 per share) Issuance of shares to employees, net of shares withheld for employee taxes Stock-based compensation Net income Other comprehensive income (loss) Balance at May 31, 2021 305 1,273 15 The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement 316 6 14 (54) 1,253 S 20 (34) 1,243 S 21 10 35 35 (28) 129 611 9.966 323 231 $ (287) (14) (324) (300) 4,029 (507) 23 1,643 (2.872) (1491) (9) 2.539 (1) (191) (622) (1,002) (43) 8,056 954 (650) (1,000) M 611 5,727 5.727 (324) 3,179 $ 12,767 CASH AND EQUIVALENTS Cash and equivalents represent cash and short-term, highly liquid investments, that are both readily convertible to known amounts of cash, and so near their maturity they present insignificant risk of changes in value because of changes in interest rates, including commercial paper, US Treasury, U.S. Agency, money market funds, time deposits and corporate debt securities with maturities of 90 days or less at the date of purchase. SHORT-TERM INVESTMENTS Short-term investments consist of highly liquid investments, including commercial paper, U.S. Treasury, US Agency, time deposits and corporate debit securities with maturbes over 90 days at the date of purchase At May 31, 2021 and 2020, Short-term investments consisted of available-for-sale debt securities, which are recorded at tair value with unrealized gains and losses reported, net of tax, in Accumulated other comprehensive income (loss), unless unrealized losses are determined to be unrecoverable. Realized gains and losses on the sale of securities are determined by specific identification. The Company considers all available-for-sale debt securities, including those with maturity dates beyond 12 months, as available to support current operational liquidity needs and, therefore, classifies all securities with maturity clates beyond 90 days at the cate of purchase as current assets within Short-term investments on the Consolidated Balance Sheets Refer to Note 6-Fair Value Measurements for more information on the Company's Short-term investments ALLOWANCE FOR UNCOLLECTIBLE ACCOUNTS RECEIVABLE Accounts receivable, net consist primarily of amounts due from customers. The Company makes ongoing estimates relating to the collectability of its accounts receivable and maintains an allowance for expected losses resulting from the inability of its customers to make required payments. In addition to judgmerts about the creditworthiness of significant customers based on ongoing credit evaluations, the Company considers historical levels of credit losses, as well as macroeconomic and industry trends, such as the impacts of COVID-19, to determine the amount of the allowance. Accounts receivable with anticipated collection dates greater than 12 months from the balance sheet date and related allowances are considered non-current and recorded in Deferred income taxes and other assets. The allowance for uncollectible accounts receivable was $93 million and $214 million as of May 31, 2021 and 2020, respectively INVENTORY VALUATION Inventories are stated at lower of cost and net realizable value, and valued on either an average or a specific idenfication cost basis. In some instances, the Company ships products directly from its suppliers to the customer, with the related inventory and cost of sales recognized on a specific identification basis. Inventory costs primarily consist of product cost from the Company's suppliers, as well as inbound freight, import duties, taxes, insurance, logistics and other handling fees PROPERTY, PLANT AND EQUIPMENT AND DEPRECIATION Property, plant and equipment are recorded at cost. Depreciation is determined on a straight-ine basis for land improvements, buildings and leasehold improvements over 2 to 40 years and for machinery and equipment over 2 to 15 years Depreciation and amortization of assets used in manufacturing, warehousing and product distribution are recorded in Cost of sales. Depreciation and amortization of all other assets are recorded in Operating overhead expense SOFTWARE DEVELOPMENT COSTS Expenditures for major software purchases and software developed for internal use are capitalized and amortized over a 2-to 12-year period on a straigh-line basis. The Company's policy provides for the capitalization of external direct costs associated with developing or obtaining internal use computer software. The Company also capitalis certain payroll and payrol-related costs for employees who are directly associated with internal use computer software projects. The amount of capitaluable payroll costs with respect to these employees is limited to the time directly spent on such projects. Costs associated with preliminary project stage activides, training, maintenance and all other post-implementation stage activities are expensed as incurred Development costs of computer software to be sold, leased or otherwise marketed as an integral part of a product are subject to capitalization beginning when a products technological feasibility has been established and ending when a product is available for general release to customers in most instances, the Company's products are released soon after technological feasibility has been established, therefore, software development costs incurred subsequent to achievement of technological feasibility are usually not significant, and generally, most software development costs have been expensed as incurred 2021 FORM 10 KS Table of Contents expenses and other current assets of $507 million, 5422 million and $45 million, respectively, and an increase in Deferred income taxes and other liabilities of 540 million on the Consolidated Balance Sheets NOTE 2-INVENTORIES Inventory balances of $6,854 million and $7.367 million as of May 31, 2021 and 2020, respectively, were substantially all finished goods NOTE 3 PROPERTY, PLANT AND EQUIPMENT Property, plant and equipment, net included the following: MAY 31, (Dollars in millions) Land and improvements 363 $ 345 Buildings 3,365 2,442 Machinery and equipment 3,023 2,751 Internal-use software 1,391 1483 Leasehold improvements 1,608 1,554 Construction in process 311 1,000 Total property, plant and equipment, gross 10.061 9.661 Less accumulated depreciation 5,157 4,795 TOTAL PROPERTY, PLANT AND EQUIPMENT, NET 4,904 4,866 Capitalized interest was not material for the years ended May 31, 2021, 2020 and 2019 NOTE 4-IDENTIFIABLE INTANGIBLE ASSETS AND GOODWILL identifiable intangible assets, net consist of indefinite-lived trademarks, acquired trademarks and other intangible assets. The following table summarizes the Company's Identifiable intangible assets, net balances as of May 31, 2021 and 2020 MAY 31, 2021 2020 NET (Dollars in mitions) Indefinite-lived trademarks GROSS CARRYING AMOUNT 246 $ 50 296 1 NET ACCUMULATED CARRYING AMORTIZATION AMOUNT 1 246 $ 27 23 27 $ 269 $ GROSS CARRYING AMOUNT 246 5 5 ACCUMULATED CARRYING AMORTIZATION AMOUNT