Question

Question 14 (1 point) Money Market Mutual Fund shares are, Question 14 options: A) Always equal to one dollar. B) Always equal to or greater

Question 14 (1 point)

Money Market Mutual Fund shares are,

Question 14 options:

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

|

Use this information to answer the following three questions.

AES Corporation and WEC are both public utility companies. A hedge fund manager believes that AES stock is cheap relative to is expected performance and WEC is over-priced relative to its expected performance. She has no view about what the stock market will do in general so she decides to take a hedged position in the amount of $10,000,000.

Question 15 (1 point)

In order to invest in her view that AES is likely to increase in price relative to WEC she should.

Question 15 options:

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

|

Question 16 (1 point)

If AES stock increases in value by 9% and WES increases by 7% then the Hedge Funds will earn a profit (+) or take a loss (-) in the amount of

Question 16 options:

|

|

Question 17 (1 point)

If AES stock decreases in value by 9% and WES decreases by 12% then the Hedge Funds will earn a profit (+) or take a loss (-) in the amount of

Question 17 options:

|

|

Question 18 (1 point)

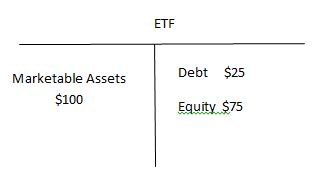

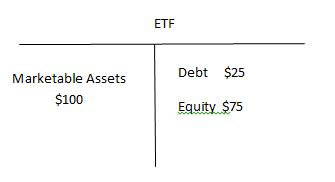

Consider the levered ETF above.

If the value of the marketable assets increases by 25% what will the new dollar valueof the equity stake be?

Question 18 options:

|

|

Question 19 (1 point)

Consider the levered ETF above.

If the value of the marketable assets decreases by 25% what will the percentage return too the equity holders be?

Question 19 options:

|

|

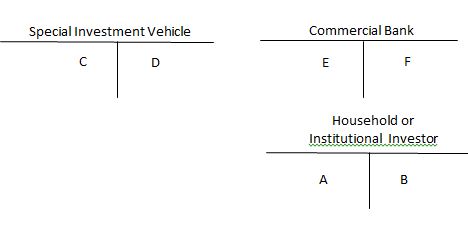

Question 20 (1 point)

Consider the figure above. The letter "D" occupies the place of what financial instrument?

Question 20 options:

Question 21 (1 point)

Exchange Traded Funds have certain advantages over index mutual funds in terms of taxation.

Question 21 options:

|

|

| ||

|

|

|

Question 22 (1 point)

Private Equity Companies

Question 22 options:

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

|

Question 23 (1 point)

Captive structures are created by intermediaries to

Question 23 options:

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

|

Question 24 (1 point)

Assets that have been used to create asset-backed securities include all of the following except,

Question 24 options:

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

|

Question 25 (1 point)

While life insurance companies have portfolios that are similar to pension plans, the portfolios of property casualty companies tend to be shorter term, fixed income securities.

Question 25 options:

|

|

| ||

|

|

|

Question 26 (1 point)

A Bank decides to use create an SIV and use its portfolio of credit card debt to raise funds for new lending. The process is illustrated in the following figure.

Use the terms, Portfolio of Credit Card Debt, Asset Backed Securities, "New Funds" to replace the appropriate letters in the figure.

Question 26 options:

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

|

Question 27 (1 point)

A Commercial Bank is,

Question 27 options:

|

| A depository intermediary. |

|

| A direct market. |

|

| A captive structure. |

|

| An intermediary that issues non-marketable equity claims against itself. |

|

| A contingent intermediary. |

|

| An investment Intermediary. |

Question 28 (1 point)

A Finance Company is,

Question 28 options:

|

| A depository intermediary. |

|

| A direct market. |

|

| A captive structure. |

|

| An intermediary that issues non-marketable equity claims against itself. |

|

| A contingent intermediary. |

|

| An investment Intermediary. |

Question 29 (1 point)

The New York Stock Exchange is,

Question 29 options:

|

| A depository intermediary. |

|

| A direct market. |

|

| A captive structure. |

|

| An intermediary that issues non-marketable equity claims against itself. |

|

| A contingent intermediary. |

|

| An investment Intermediary. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started