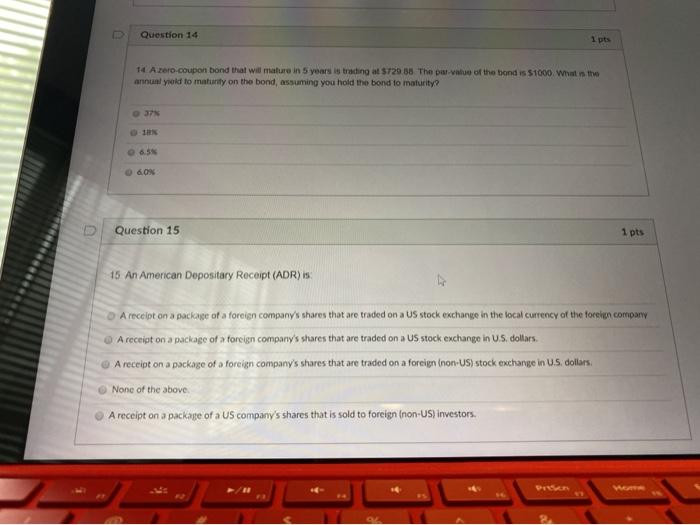

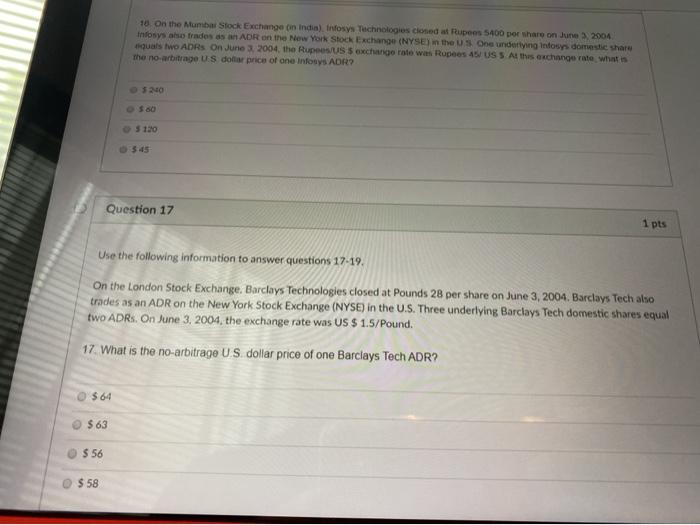

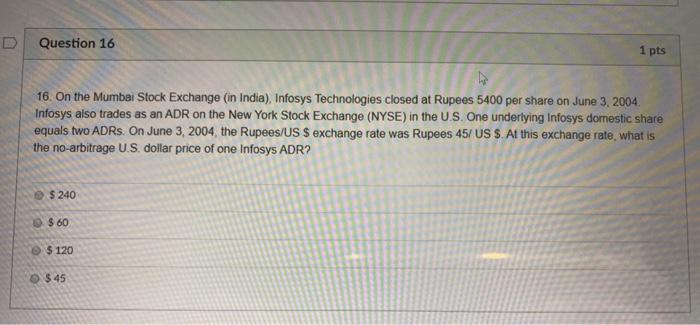

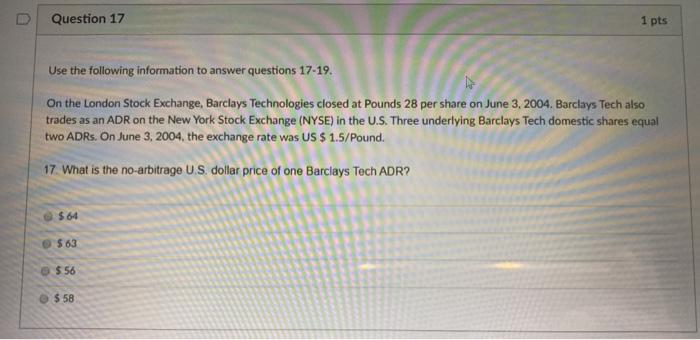

Question 14 1 pts 14 Azero.coupon bond that will mature in 5 years i tracing at $729 88 The pat value of the band is $1000. What the annual yold to maturity on the bond, assuming you hold the bond to maturity 6.ON Question 15 1 pts 15 An American Depository Receipt (ADR) is: A receipt on a package of a foreign company's shares that are traded on a US stock exchange in the local currency of the forehan company A receipt on a package of a foreign company's shares that are traded on a US stock exchange in US dollars. A receipt on a package of a foreign company's shares that are traded on a foreign (non-US) stock exchange in US dollars. None of the above A receipt on a package of a US company's shares that is sold to foreign (non-US) investors. DAS VE 10. On the Mumbal Stock Exchange in India). Infosys Technologies closed at Rupees 5400 por share on June 3, 2004 Infosys as trades as an ADR on the New York Stock Exchange (NYSE) in the US One underlying intoss domestic share quals two ADRs On June 3, 2004, the Rupees US 5 exchange rate was Rupees 4 US 5 At the exchange rate what is the no arbitrage US dollar price of one Infosys ADR? 5240 5120 345 Question 17 1 pts Use the following information to answer questions 17-19. On the London Stock Exchange. Barclays Technologies closed at Pounds 28 per share on June 3, 2004. Barclays Tech also trades as an ADR on the New York Stock Exchange (NYSE) in the U.S. Three underlying Barclays Tech domestic shares equal two ADRs. On June 3, 2004, the exchange rate was US $ 1.5/Pound. 17. What is the no-arbitrage US dollar price of one Barclays Tech ADR? $ 64 $63 $ 56 $ 58 Question 14 1 pts 14 A zero-coupon bond that will mature in 5 years is trading at $729 88. The par-value of the bond is $1000 What is the annual yield to maturity on the bond assuming you hold the bond to maturity? 37% 18% 6.5% 6.0% Question 15 1 pts 15. An American Depositary Receipt (ADR) is A receipt on a package of a foreign company's shares that are traded on a US stock exchange in the local currency of the foreign company A receipt on a package of a foreign company's shares that are traded on a US stock exchange in US dollars. A receipt on a package of a foreign company's shares that are traded on a foreign (non-US) stock exchange in U.S. dollars. None of the above A receipt on a package of a US company's shares that is sold to foreign (non-US) investors. Question 16 Question 16 1 pts 16. On the Mumbai Stock Exchange (in India), Infosys Technologies closed at Rupees 5400 per share on June 3, 2004 Infosys also trades as an ADR on the New York Stock Exchange (NYSE) in the U.S. One underlying Infosys domestic share equals two ADRs. On June 3, 2004, the Rupees/US $ exchange rate was Rupees 45/US S. At this exchange rate, what is the no-arbitrage U.S. dollar price of one Infosys ADR? $ 240 $ 60 $ 120 $.45 Question 17 1 pts Use the following information to answer questions 17-19. On the London Stock Exchange, Barclays Technologies closed at Pounds 28 per share on June 3, 2004. Barclays Tech also trades as an ADR on the New York Stock Exchange (NYSE) in the U.S. Three underlying Barclays Tech domestic shares equal two ADRs. On June 3, 2004, the exchange rate was US $ 1.5/Pound. 17. What is the no-arbitrage U.S. dollar price of one Barclays Tech ADR? $ 64 $ 63 $56 $ 58