Answered step by step

Verified Expert Solution

Question

1 Approved Answer

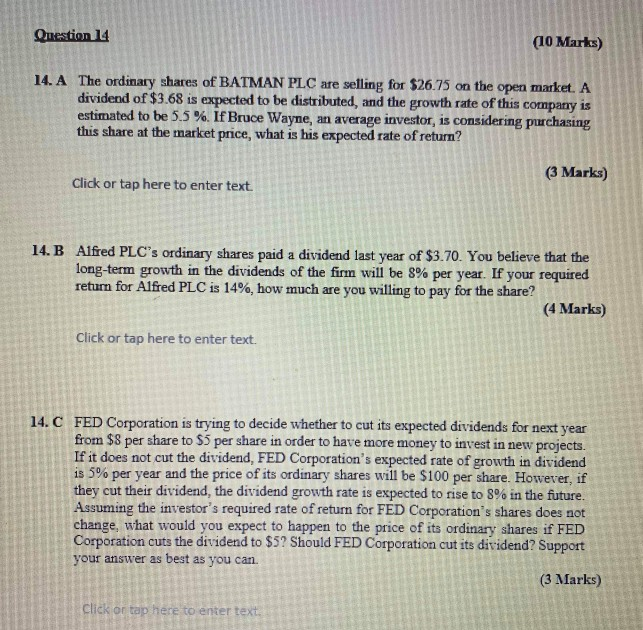

Question 14 (10 Marks) 14. A The ordinary shares of BATMAN PLC are selling for $26.75 on the open market. A dividend of $3.68 is

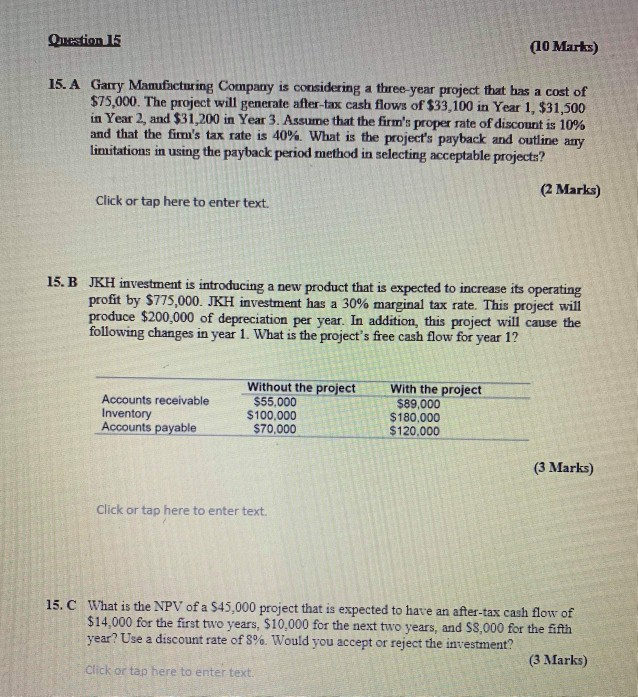

Question 14 (10 Marks) 14. A The ordinary shares of BATMAN PLC are selling for $26.75 on the open market. A dividend of $3.68 is expected to be distributed, and the growth rate of this company is estimated to be 5.5%. If Bruce Wayne, an average investor, is considering purchasing this share at the market price, what is his expected rate of return? (3 Marks) Click or tap here to enter text 14. B Alfred PLC's ordinary shares paid a dividend last year of $3.70. You believe that the long-term growth in the dividends of the firm will be 8% per year. If your required return for Alfred PLC is 14%, how much are you willing to pay for the share? (4 Marks) Click or tap here to enter text. 14.C FED Corporation is trying to decide whether to cut its expected dividends for next year from $8 per share to $5 per share in order to have more money to invest in new projects. If it does not cut the dividend, FED Corporation's expected rate of growth in dividend is 5% per year and the price of its ordinary shares will be $100 per share. However, if they cut their dividend, the dividend growth rate is expected to rise to 8% in the future. Assuming the investor's required rate of return for FED Corporation's shares does not change, what would you expect to happen to the price of its ordinary shares if FED Corporation cuts the dividend to $5? Should FED Corporation cut its dividend? Support your answer as best as you can (3 Marks) click or tap here to enter text. Question 15 (10 Marks) 15. A Garry Manufacturing Company is considering a three-year project that has a cost of $75,000. The project will generate after-tax cash flows of $33,100 in Year 1, $31,500 in Year 2, and $31,200 in Year 3. Assume that the firm's proper rate of discount is 10% and that the firm's tax rate is 40%. What is the project's payback and outline atry limitations in using the payback period method in selecting acceptable projects? (2 Marks) Click or tap here to enter text. 15.B KH investment is introducing a new product that is expected to increase its operating profit by $775,000. JKH investment has a 30% marginal tax rate. This project will produce $200,000 of depreciation per year. In addition, this project will cause the following changes in year 1. What is the project's free cash flow for year 1? Accounts receivable Inventory Accounts payable Without the project $55,000 $100,000 $70,000 With the project $89,000 $180,000 $120.000 (3 Marks) Click or tap here to enter text. 15. C What is the NPV of a $45,000 project that is expected to have an after-tax cash flow of $14,000 for the first two years, $10,000 for the next two years, and $8,000 for the fifth year? Use a discount rate of 8%. Would you accept or reject the investment? (3 Marks) Click or tap here to enter text

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started