Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 14 2 pts The observed phenomenon in the bond market, that the yields on the lowest class of investment grade bonds (BBB-in the S&P

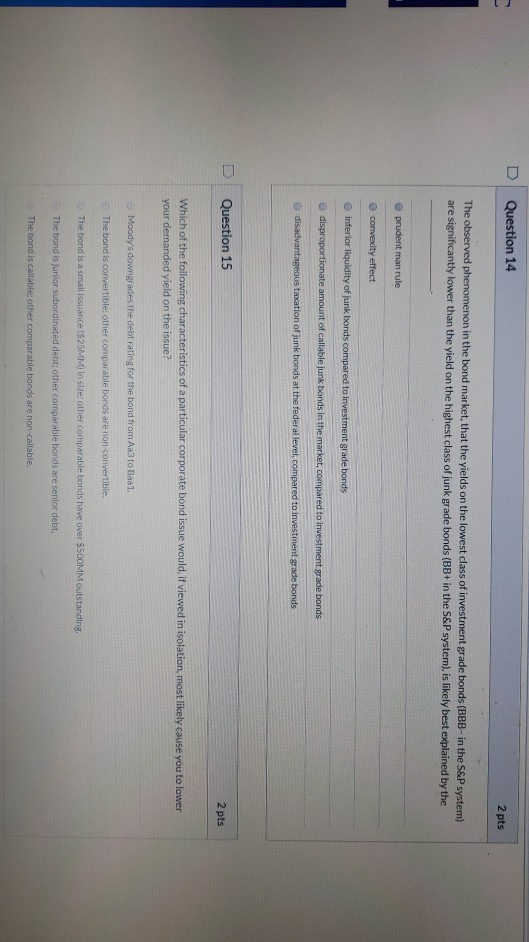

Question 14 2 pts The observed phenomenon in the bond market, that the yields on the lowest class of investment grade bonds (BBB-in the S&P system) are significantly lower than the yield on the highest class of junk grade bonds (BB+ in the S&P system), is likely best explained by the prudent man rule convexity effect inferior liquidity of junk bonds compared to investment grade bonds disproportionate amount of calable junk bonds in the market, compared to investment grade bonds disadvantageous taxation of junk bonds at the federal level, compared to investment grade bonds D Question 15 2 pts Which of the following characteristics of a particular corporate bond issue would. If viewed in isolation, most likely cause you to lower your demanded yield on the issue? Moody's downgrades the debt rating for the bond from Aa3 to Baal. The bond is convertible, other comparable bonds are non-convertible. The bond is a small issuance ($25MM) in size other comparable bonds have over SSCOMM Outstanding The bond is junior subordinated debt; other comparable bonds are senior debt. The bond is callable: other comparable bonds are non-callable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started