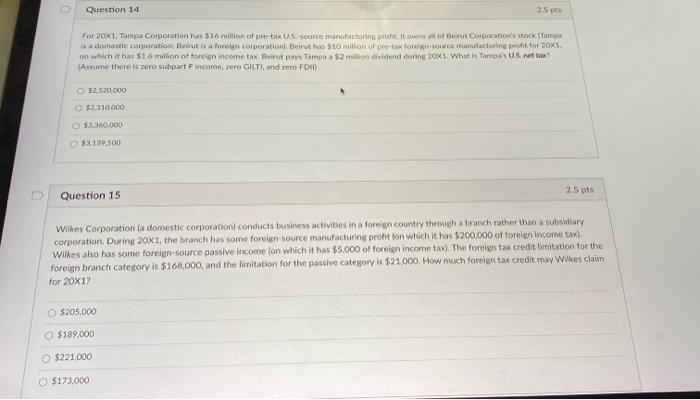

Question 14 250 For 20x1.Tampa Corporation to $16 million of pre-tax US-source manutacturing cont. Itowns or of Bent Corporation's stock (ampa a domestic corporation, Dirut in a foreign corporation, Beirut has $10 million of pre-taxtore source manufacturing profile for 20X1 on which it has $1.6 million of for an income tax Beirut pas Tamos a $2 million dividend during 2041 What is Tamos US netto (Assume there is more subpart Fincome.zero GILTI, and zero FDI) 52.5.20.000 110.000 53.360.000 53139.500 25 pts Question 15 Wilkes Corporation la domestic corporation conducts business activities in a foreign country through a branch rather than a subsidiary corporation. During 20x1, the branch has some forelen source manufacturing profitton which it has $200,000 of forelen livcome tax). Wilkes also has some foreign-source passive income on which it has $5,000 of foreign income tax). The foreign tax credit limitation for the foreign branch Category is $168,000, and the limitation for the passive category is $21.000. How much foreign tax credit may Wlkes claim for 20X12 $205,000 $189.000 $221,000 $173,000 Question 14 250 For 20x1.Tampa Corporation to $16 million of pre-tax US-source manutacturing cont. Itowns or of Bent Corporation's stock (ampa a domestic corporation, Dirut in a foreign corporation, Beirut has $10 million of pre-taxtore source manufacturing profile for 20X1 on which it has $1.6 million of for an income tax Beirut pas Tamos a $2 million dividend during 2041 What is Tamos US netto (Assume there is more subpart Fincome.zero GILTI, and zero FDI) 52.5.20.000 110.000 53.360.000 53139.500 25 pts Question 15 Wilkes Corporation la domestic corporation conducts business activities in a foreign country through a branch rather than a subsidiary corporation. During 20x1, the branch has some forelen source manufacturing profitton which it has $200,000 of forelen livcome tax). Wilkes also has some foreign-source passive income on which it has $5,000 of foreign income tax). The foreign tax credit limitation for the foreign branch Category is $168,000, and the limitation for the passive category is $21.000. How much foreign tax credit may Wlkes claim for 20X12 $205,000 $189.000 $221,000 $173,000