Answered step by step

Verified Expert Solution

Question

1 Approved Answer

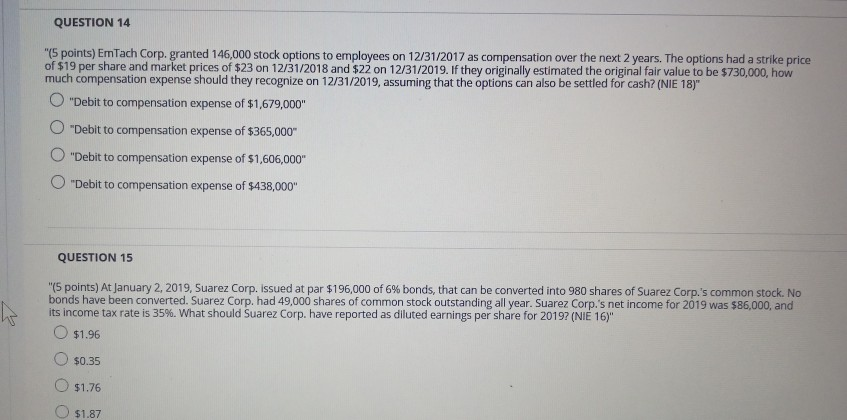

QUESTION 14 (5 points) EmTach Corp. granted 146,000 stock options to employees on 12/31/2017 as compensation over the next 2 years. The options had a

QUESTION 14 "(5 points) EmTach Corp. granted 146,000 stock options to employees on 12/31/2017 as compensation over the next 2 years. The options had a strike price of $19 per share and market prices of $23 on 12/31/2018 and $22 on 12/31/2019. If they originally estimated the original fair value to be $730,000, how much compensation expense should they recognize on 12/31/2019, assuming that the options can also be settled for cash? (NIE 18)" "Debit to compensation expense of $1,679,000" O "Debit to compensation expense of $365,000 O "Debit to compensation expense of $1,606,000" "Debit to compensation expense of $438,000" QUESTION 15 "15 points) At January 2, 2019, Suarez Corp. issued at par $196,000 of 6% bonds, that can be converted into 980 shares of Suarez Corp.'s common stock. No bonds have been converted. Suarez Corp. had 49,000 shares of common stock outstanding all year. Suarez Corp.'s net income for 2019 was $86,000, and its income tax rate is 35%. What should Suarez Corp. have reported as diluted earnings per share for 2019? (NIE 16)" O $1.96 O $0.35 O $1.76 $1.87

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started