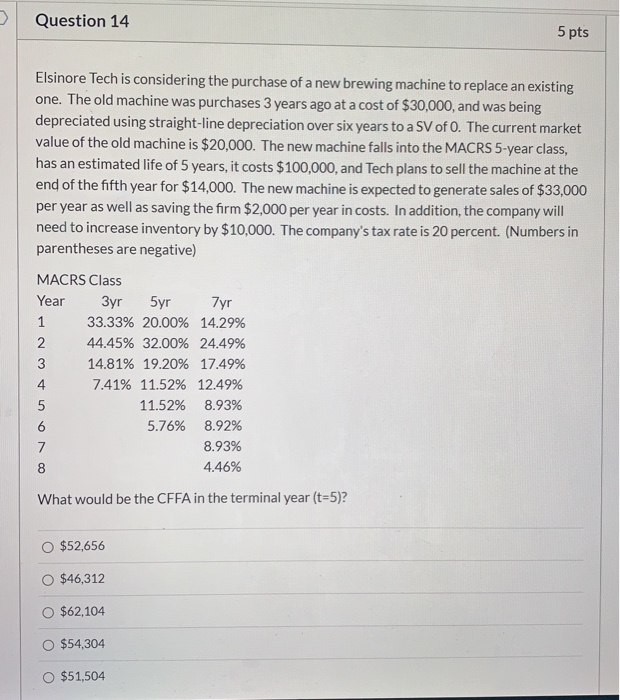

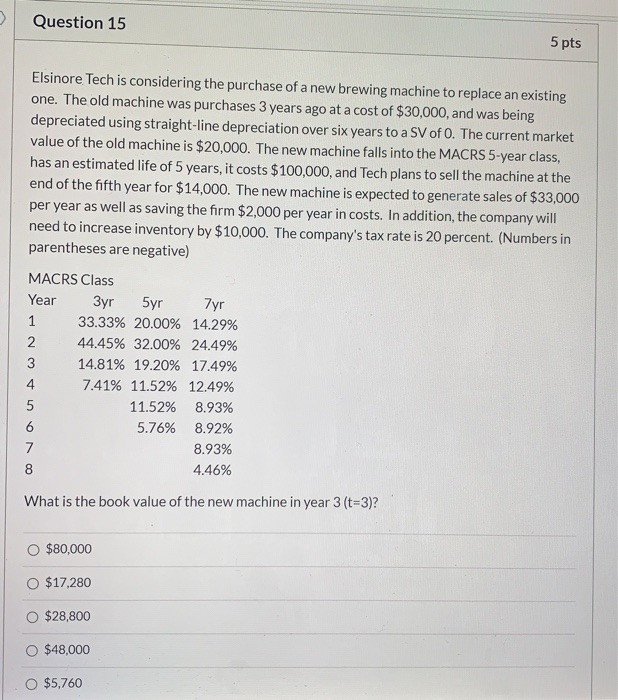

Question 14 5 pts Elsinore Tech is considering the purchase of a new brewing machine to replace an existing one. The old machine was purchases 3 years ago at a cost of $30,000, and was being depreciated using straight-line depreciation over six years to a SV of O. The current market value of the old machine is $20,000. The new machine falls into the MACRS 5-year class, has an estimated life of 5 years, it costs $100,000, and Tech plans to sell the machine at the end of the fifth year for $14,000. The new machine is expected to generate sales of $33,000 per year as well as saving the firm $2,000 per year in costs. In addition, the company will need to increase inventory by $10,000. The company's tax rate is 20 percent. (Numbers in parentheses are negative) 1 MACRS Class Year 3yr 5yr 7yr 33.33% 20.00% 14.29% 2 44.45% 32.00% 24.49% 3 14.81% 19.20% 17.49% 4 7.41% 11.52% 12.49% 5 11.52% 8.93% 6 5.76% 8.92% 7 8.93% 8 4.46% What would be the CFFA in the terminal year (t=5)? $52,656 $46,312 $62,104 $54,304 $51,504 Question 15 5 pts Elsinore Tech is considering the purchase of a new brewing machine to replace an existing one. The old machine was purchases 3 years ago at a cost of $30,000, and was being depreciated using straight-line depreciation over six years to a SV of 0. The current market value of the old machine is $20,000. The new machine falls into the MACRS 5-year class, has an estimated life of 5 years, it costs $100,000, and Tech plans to sell the machine at the end of the fifth year for $14,000. The new machine is expected to generate sales of $33,000 per year as well as saving the firm $2,000 per year in costs. In addition, the company will need to increase inventory by $10,000. The company's tax rate is 20 percent. (Numbers in parentheses are negative) MACRS Class Year 3yr 5yr 7yr 1 33.33% 20.00% 14.29% 2 44.45% 32.00% 24.49% 3 14.81% 19.20% 17.49% 4 7.41% 11.52% 12.49% 5 11.52% 8.93% 6 5.76% 8.92% 7 8.93% 8 4.46% What is the book value of the new machine in year 3 (t=3)? $80,000 $17,280 $28,800 $48,000 O $5,760