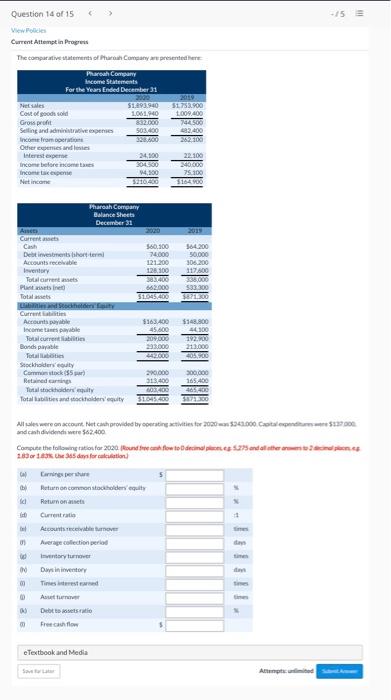

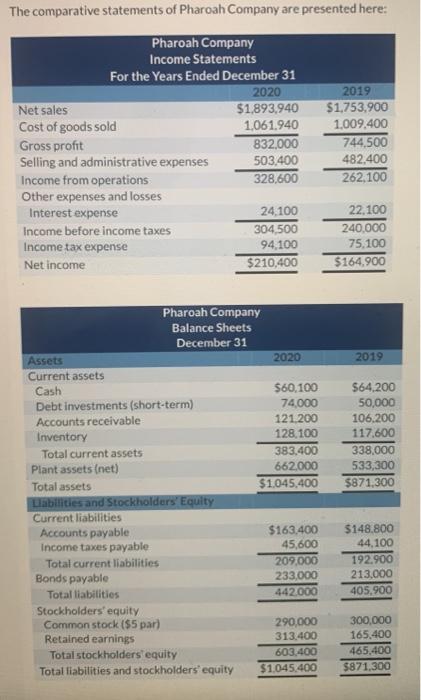

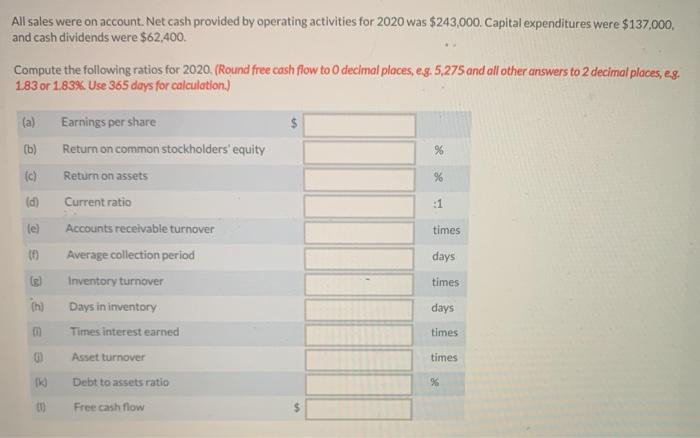

Question 14 of 15 View Police Current Attemptin Progress The comparative statement of Comprendere Pharoah Company Income Statements For the Year Ended December 31 Neses S120 51753.00 Cost of good old 1.061.940 1009.400 Gross profit 832.000 2000 Selling and administratives 503.400 2.400 Income from.com 262100 Other pees and lines Interest expense 22.100 Income before comes 30 3407000 Income takespense 4,500 75.100 Net income $184VO Pharoah Company Balance sheets December 31 2011 Cash AN Current Debt investments Accounts receivable Inventory Totalcarentes Patinet Total 560.100 74.000 121200 128.00 383.400 662000 50345400 564.200 50.000 306.200 117.800 338,000 533 300 $871300 $14.00 Current Accounts payable Incometams pable Total current Boris payable Total Stockholders Commons (5) Retained ning Total stock Total abilities and total equity $363.400 45.600 209.000 293.000 42.000 10 213.000 400 300.000 165.400 20.000 318.400 and condividend were 562.400 Alleron court. Fontent provided by operating activities for 20170-534000. Cote$27.000 Compute the follows tattoo for 2020. Round Heckfore to decides alterce 200ordforcation 1 Rutan en common stockholdery equity Returns Current ratio Acousiano 0) Average collection period tid Inventory Das inventory Tiness Free flow eTextbook and Media Atlantis The comparative statements of Pharoah Company are presented here: Pharoah Company Income Statements For the Years Ended December 31 2020 Net sales $1.893,940 Cost of goods sold 1.061.940 Gross profit 832.000 Selling and administrative expenses 503.400 Income from operations 328,600 Other expenses and losses Interest expense 24.100 Income before income taxes 304 500 Income tax expense 94.100 Net income $210,400 2019 $1,753,900 1,009,400 744,500 482.400 262,100 22,100 240,000 75.100 $164,900 2019 $64,200 50,000 106.200 117,600 338.000 533,300 $871,300 Pharoah Company Balance Sheets December 31 Assets 2020 Current assets Cash $60,100 Debt investments (short-term) 74.000 Accounts receivable 121,200 Inventory 128.100 Total current assets 383,400 Plant assets (net) 662,000 Total assets $1.045.400 Llabilities and Stockholders' Equity Current liabilities Accounts payable $163.400 Income taxes payable 45,600 Total current liabilities 209,000 Bonds payable 233,000 Total liabilities 442.000 Stockholders' equity Common stock ($5 par 290,000 Retained earnings 313.400 Total stockholders' equity 603.400 Total liabilities and stockholders' equity $1.045.400 $148.800 44,100 192.900 213,000 405.900 300,000 165,400 465,400 $871,300 All sales were on account. Net cash provided by operating activities for 2020 was $243,000. Capital expenditures were $137,000, and cash dividends were $62,400 Compute the following ratios for 2020. (Round free cash flow to decimal places, eg,5,275 and all other answers to 2 decimal places, eg. 183 or 1.83%. Use 365 days for calculation.) (a) (b) % (c) 96 (d) :1 le) times Earnings per share Return on common stockholders' equity Return on assets Current ratio Accounts receivable turnover Average collection period Inventory turnover Days in inventory Times interest earned Asset turnover Debt to assets ratio days times thi days times times 10 % 00) Free cash flow $