Answered step by step

Verified Expert Solution

Question

1 Approved Answer

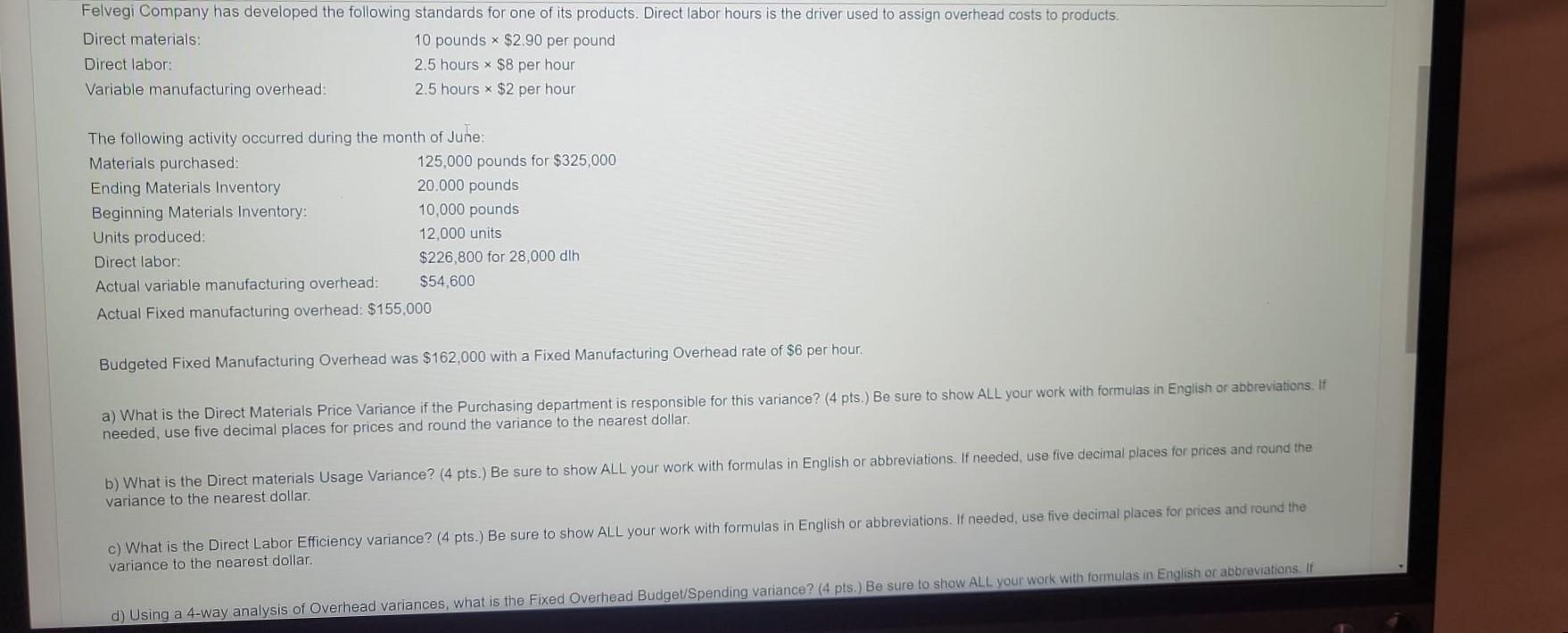

Felvegi Company has developed the following standards for one of its products. Direct labor hours is the driver used to assign overhead costs to

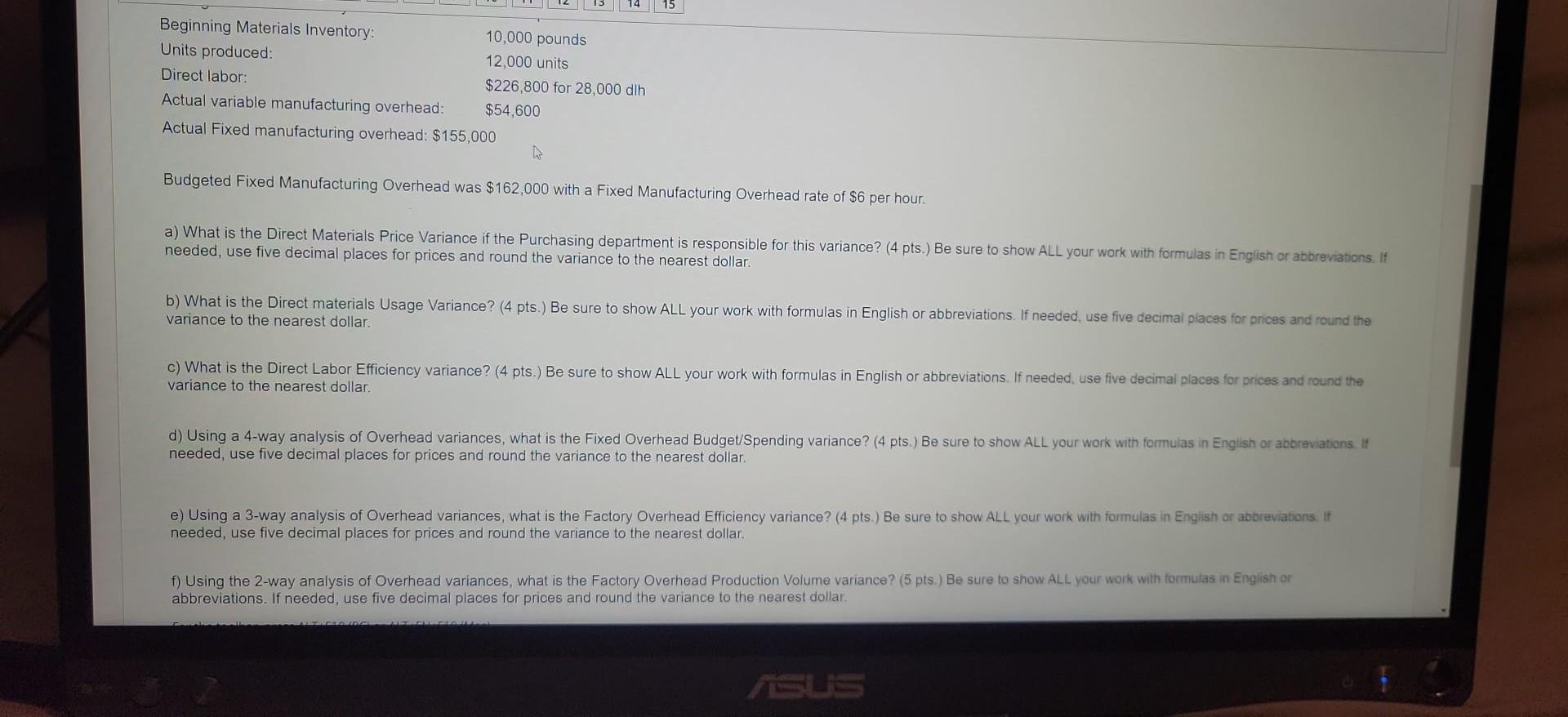

Felvegi Company has developed the following standards for one of its products. Direct labor hours is the driver used to assign overhead costs to products. Direct materials: 10 pounds $2.90 per pound Direct labor: 2.5 hours $8 per hour Variable manufacturing overhead: 2.5 hours $2 per hour The following activity occurred during the month of June: Materials purchased: Ending Materials Inventory Beginning Materials Inventory: Units produced: Direct labor: Actual variable manufacturing overhead: Actual Fixed manufacturing overhead: $155,000 125,000 pounds for $325,000 20.000 pounds 10,000 pounds 12,000 units $226,800 for 28,000 dlh $54,600 Budgeted Fixed Manufacturing Overhead was $162,000 with a Fixed Manufacturing Overhead rate of $6 per hour. a) What is the Direct Materials Price Variance if the Purchasing department is responsible for this variance? (4 pts.) Be sure to show ALL your work with formulas in English or abbreviations. If needed, use five decimal places for prices and round the variance to the nearest dollar. b) What is the Direct materials Usage Variance? (4 pts.) Be sure to show ALL your work with formulas in English or abbreviations. If needed, use five decimal places for prices and round the variance to the nearest dollar. c) What is the Direct Labor Efficiency variance? (4 pts.) Be sure to show ALL your work with formulas in English or abbreviations. If needed, use five decimal places for prices and round the variance to the nearest dollar. d) Using a 4-way analysis of Overhead variances, what is the Fixed Overhead Budget/Spending variance? (4 pts.) Be sure to show ALL your work with formulas in English or abbreviations. If Beginning Materials Inventory: Units produced: Direct labor: Actual variable manufacturing overhead: Actual Fixed manufacturing overhead: $155,000 10,000 pounds 12,000 units $226,800 for 28,000 dlh $54,600 4 Budgeted Fixed Manufacturing Overhead was $162,000 with a Fixed Manufacturing Overhead rate of $6 per hour. a) What is the Direct Materials Price Variance if the Purchasing department is responsible for this variance? (4 pts.) Be sure to show ALL your work with formulas in English or abbreviations. If needed, use five decimal places for prices and round the variance to the nearest dollar. b) What is the Direct materials Usage Variance? (4 pts.) Be sure to show ALL your work with formulas in English or abbreviations. If needed, use five decimal places for prices and round the variance to the nearest dollar. c) What is the Direct Labor Efficiency variance? (4 pts.) Be sure to show ALL your work with formulas in English or abbreviations. If needed, use five decimal places for prices and round the variance to the nearest dollar. d) Using a 4-way analysis of Overhead variances, what is the Fixed Overhead Budget/Spending variance? (4 pts.) Be sure to show ALL your work with formulas in English or abbreviations. If needed, use five decimal places for prices and round the variance to the nearest dollar. e) Using a 3-way analysis of Overhead variances, what is the Factory Overhead Efficiency variance? (4 pts.) Be sure to show ALL your work with formulas in English or abbreviations. If needed, use five decimal places for prices and round the variance to the nearest dollar. f) Using the 2-way analysis of Overhead variances, what is the Factory Overhead Production Volume variance? (5 pts.) Be sure to show ALL your work with formulas in English or abbreviations. If needed, use five decimal places for prices and round the variance to the nearest dollar.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

QUESTION 1 a Direct Materials Price Variance Actual Price Cost of materials purchased Quantity purchased Actual Price 325000 125000 pounds Actual Price 260 per pound Standard Price Standard cost per p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started