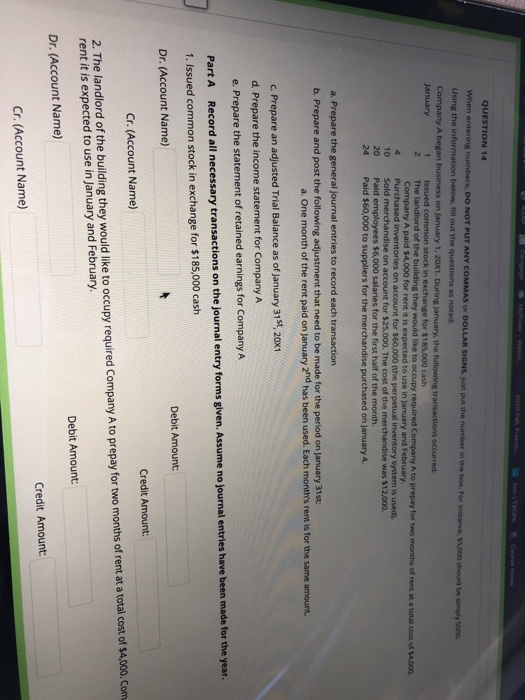

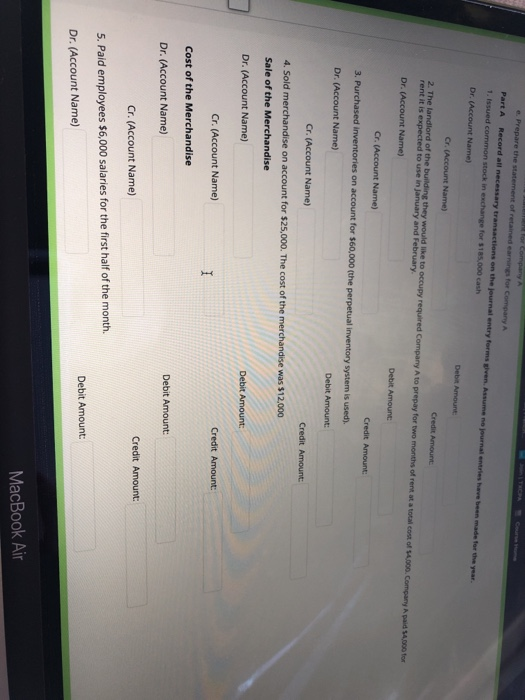

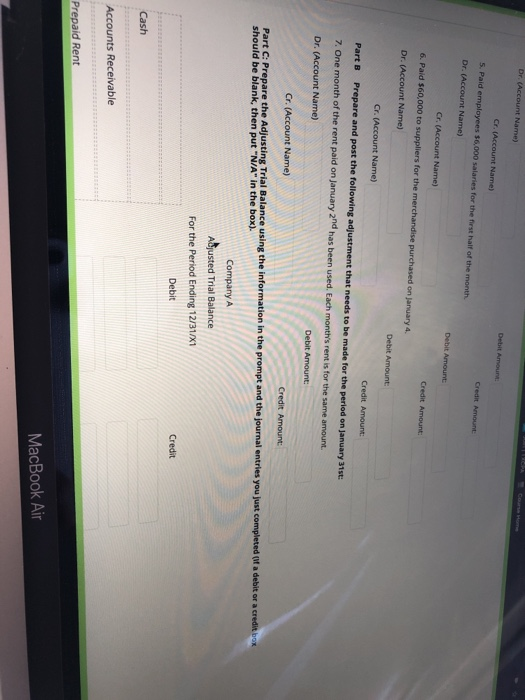

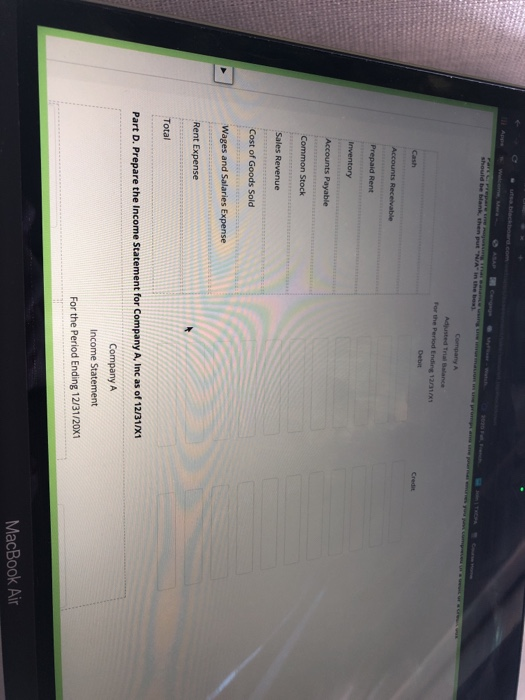

QUESTION 14 When entering numbers, DO NOT PUT ANY COMMASO DOLLAR SIGNS. Just put the number in the box. For instance, 15.000 should be simply 500 Using the information below, fill out the questions as noted; Company A began business on January 1, 20X1. During January, the following transactions occurred: January 1 Issued common stock in exchange for $185,000 cash 2 The landlord of the building they would like to occupy required Company A to prepay for two months of rent at a total cost of 14.000 Company A paid $4,000 for rent it is expected to use in January and February 4 Purchased Inventories on account for $60,000 (the perpetual inventory system is used). 10 Sold merchandise on account for $25,000. The cost of the merchandise was $12,000 20 Pald employees $6,000 salaries for the first half of the month. 24 Paid $60,000 to suppliers for the merchandise purchased on January 4. a. Prepare the general journal entries to record each transaction b. Prepare and post the following adjustment that need to be made for the period on January 31st: a. One month of the rent paid on January 2nd has been used. Each month's rent is for the same amount. c. Prepare an adjusted Trial Balance as of January 31st, 20x1 d. Prepare the income statement for Company A e. Prepare the statement of retained earnings for Company A Part A Record all necessary transactions on the journal entry forms given. Assume no journal entries have been made for the year. 1. Issued common stock in exchange for $185,000 cash Dr. (Account Name) Debit Amount Credit Amount: Cr. (Account Name) 2. The landlord of the building they would like to occupy required Company A to prepay for two months of rent at a total cost of $4,000.com rent it is expected to use in January and February Debit Amount: Dr. (Account Name) Credit Amount: Cr. (Account Name) for Company A . Prepare the statement of retained earn for Company Part A Record all necessary transactions on the journal entry forms lven. Assume no journal entries have been made for the year. 1. Issued common stock in exchange for $185.000 cash Dr. (Account Name) Debe Amount Cr. Account Name) Credit Amount 2. The landlord of the building they would like to occupy required Company A to prepay for two months of rentata total cost of $4,000. Company Apaid 14,000 to rent it is expected to use in January and February Dr. (Account Name) Debit Amount Cr. (Account Name) Credit Amount: 3. Purchased Inventories on account for $60,000 (the perpetual inventory system is used). Dr. (Account Name) Debit Amount: Cr. (Account Name) Credit Amount: 4. Sold merchandise on account for $25,000. The cost of the merchandise was $12,000 Sale of the Merchandise Dr. (Account Name) Debit Amount: Cr. (Account Name) Credit Amount: 1 Cost of the Merchandise Dr. (Account Name) Debit Amount: Cr. (Account Name) Credit Amount: 5. Paid employees $6,000 salaries for the first half of the month. Debit Amount: Dr. (Account Name) MacBook Air Dr. (Account Name) Cr. (Account Name) 5. Pald employees $6,000 salaries for the first half of the month Dr. (Account Name) Credit Amount Debit Amount Cr. (Account Name) Credit Amount 6. Paid $60,000 to suppliers for the merchandise purchased on January 4 Dr. (Account Name) Debit Amount: Gr.(Account Name) Credit Amount Part B Prepare and post the following adjustment that needs to be made for the period on January 31st: 7. One month of the rent paid on January 2nd has been used. Each month's rent is for the same amount Dr. (Account Name) Debit Amount: Cr. (Account Name) Credit Amount: Part C: Prepare the Adjusting Trial Balance using the information in the prompt and the journal entries you just completed (if a debit or a credit 100 should be blank, then put "N/A" in the box). Company A Adjusted Trial Balance For the Period Ending 12/31/X1 Debit Credit Cash Accounts Receivable Prepaid Rent MacBook Air company a Det Cash Accounts Receivable Prepaid Rent Inventory Accounts Payable Common Stock Sales Revenue Cost of Goods Sold Wages and Salaries Expense Rent Expense Total Part D. Prepare the Income Statement for Company A, Inc as of 12/31/X1 Company A Income Statement For the Period Ending 12/31/20X1 MacBook Air Total Part D. Prepare the income Statement for Company A Inc as of 12/31 Company income Statement For the Period Ending 12/31/01 Operating Expenses: Total Operating Expense Part E. Prepare the Statement of Retained Earnings for Company A as of 12/31/X1 Company A Statement of Retained Earnings For the Period Ending 12/31/20X1 MacBook Air U Period Ending 12/31/20X1 Operating Expenses: Total Operating Expense " Part E. Prepare the Statement of Retained Earnings for Company A as of 12/31/X1 Company A Statement of Retained Earnings For the Period Ending 12/31/20X1 MacBook Air QUESTION 14 When entering numbers, DO NOT PUT ANY COMMASO DOLLAR SIGNS. Just put the number in the box. For instance, 15.000 should be simply 500 Using the information below, fill out the questions as noted; Company A began business on January 1, 20X1. During January, the following transactions occurred: January 1 Issued common stock in exchange for $185,000 cash 2 The landlord of the building they would like to occupy required Company A to prepay for two months of rent at a total cost of 14.000 Company A paid $4,000 for rent it is expected to use in January and February 4 Purchased Inventories on account for $60,000 (the perpetual inventory system is used). 10 Sold merchandise on account for $25,000. The cost of the merchandise was $12,000 20 Pald employees $6,000 salaries for the first half of the month. 24 Paid $60,000 to suppliers for the merchandise purchased on January 4. a. Prepare the general journal entries to record each transaction b. Prepare and post the following adjustment that need to be made for the period on January 31st: a. One month of the rent paid on January 2nd has been used. Each month's rent is for the same amount. c. Prepare an adjusted Trial Balance as of January 31st, 20x1 d. Prepare the income statement for Company A e. Prepare the statement of retained earnings for Company A Part A Record all necessary transactions on the journal entry forms given. Assume no journal entries have been made for the year. 1. Issued common stock in exchange for $185,000 cash Dr. (Account Name) Debit Amount Credit Amount: Cr. (Account Name) 2. The landlord of the building they would like to occupy required Company A to prepay for two months of rent at a total cost of $4,000.com rent it is expected to use in January and February Debit Amount: Dr. (Account Name) Credit Amount: Cr. (Account Name) for Company A . Prepare the statement of retained earn for Company Part A Record all necessary transactions on the journal entry forms lven. Assume no journal entries have been made for the year. 1. Issued common stock in exchange for $185.000 cash Dr. (Account Name) Debe Amount Cr. Account Name) Credit Amount 2. The landlord of the building they would like to occupy required Company A to prepay for two months of rentata total cost of $4,000. Company Apaid 14,000 to rent it is expected to use in January and February Dr. (Account Name) Debit Amount Cr. (Account Name) Credit Amount: 3. Purchased Inventories on account for $60,000 (the perpetual inventory system is used). Dr. (Account Name) Debit Amount: Cr. (Account Name) Credit Amount: 4. Sold merchandise on account for $25,000. The cost of the merchandise was $12,000 Sale of the Merchandise Dr. (Account Name) Debit Amount: Cr. (Account Name) Credit Amount: 1 Cost of the Merchandise Dr. (Account Name) Debit Amount: Cr. (Account Name) Credit Amount: 5. Paid employees $6,000 salaries for the first half of the month. Debit Amount: Dr. (Account Name) MacBook Air Dr. (Account Name) Cr. (Account Name) 5. Pald employees $6,000 salaries for the first half of the month Dr. (Account Name) Credit Amount Debit Amount Cr. (Account Name) Credit Amount 6. Paid $60,000 to suppliers for the merchandise purchased on January 4 Dr. (Account Name) Debit Amount: Gr.(Account Name) Credit Amount Part B Prepare and post the following adjustment that needs to be made for the period on January 31st: 7. One month of the rent paid on January 2nd has been used. Each month's rent is for the same amount Dr. (Account Name) Debit Amount: Cr. (Account Name) Credit Amount: Part C: Prepare the Adjusting Trial Balance using the information in the prompt and the journal entries you just completed (if a debit or a credit 100 should be blank, then put "N/A" in the box). Company A Adjusted Trial Balance For the Period Ending 12/31/X1 Debit Credit Cash Accounts Receivable Prepaid Rent MacBook Air company a Det Cash Accounts Receivable Prepaid Rent Inventory Accounts Payable Common Stock Sales Revenue Cost of Goods Sold Wages and Salaries Expense Rent Expense Total Part D. Prepare the Income Statement for Company A, Inc as of 12/31/X1 Company A Income Statement For the Period Ending 12/31/20X1 MacBook Air Total Part D. Prepare the income Statement for Company A Inc as of 12/31 Company income Statement For the Period Ending 12/31/01 Operating Expenses: Total Operating Expense Part E. Prepare the Statement of Retained Earnings for Company A as of 12/31/X1 Company A Statement of Retained Earnings For the Period Ending 12/31/20X1 MacBook Air U Period Ending 12/31/20X1 Operating Expenses: Total Operating Expense " Part E. Prepare the Statement of Retained Earnings for Company A as of 12/31/X1 Company A Statement of Retained Earnings For the Period Ending 12/31/20X1 MacBook Air