Question

Question 14 You are given the following data on call and put premiums in pence per share for Company ABC shares which are currently priced

Question 14

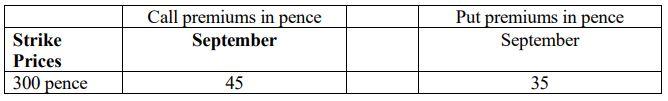

You are given the following data on call and put premiums in pence per share for Company ABC shares which are currently priced in the market at 315 pence. Each contract refers to 1000 shares.

(i) You are unsure if the share price will either fall or rise so decide to adopt a long straddle strategy. Discuss the total net profit (+) or net loss (-) in pounds of the strategy at the following share prices on expiration of the contract.

(a) 150 pence

(b) 250 pence

(c) 350 pence

(d) 500 pence

(ii) State all share prices on expiration that will lead to zero profits from this strategy.

Call premiums in pence September Put premiums in pence September Strike Prices 300 pence 45 35Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started