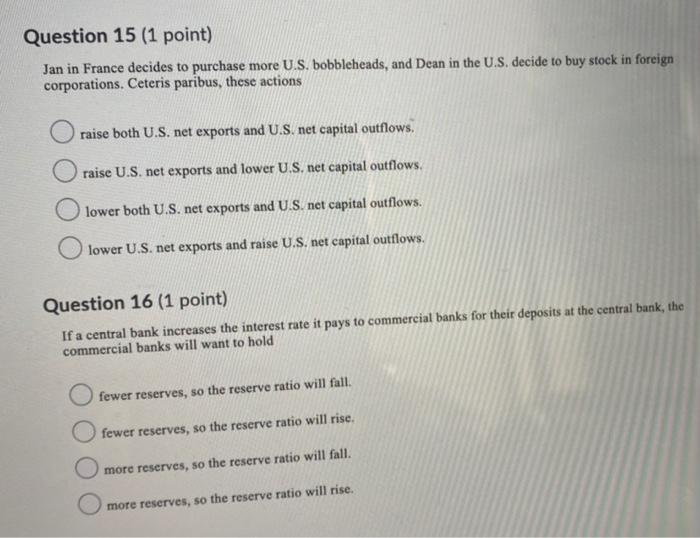

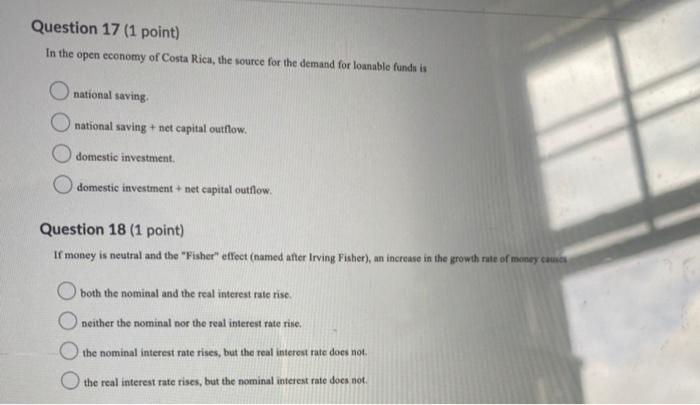

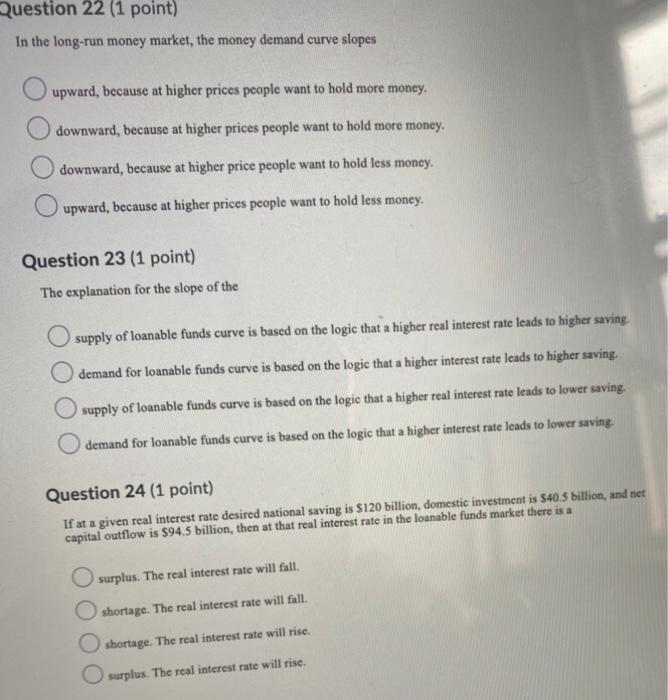

Question 15 (1 point) Jan in France decides to purchase more U.S. bobbleheads, and Dean in the U.S. decide to buy stock in foreign corporations. Ceteris paribus, these actions raise both U.S. net exports and U.S. net capital outflows. raise U.S. net exports and lower U.S. net capital outflows. lower both U.S. net exports and U.S. net capital outflows. lower U.S. net exports and raise U.S. net capital outflows. Question 16 (1 point) If a central bank increases the interest rate it pays to commercial banks for their deposits at the central bank, the commercial banks will want to hold fewer reserves, so the reserve ratio will fall. fewer reserves, so the reserve ratio will rise. more reserves, so the reserve ratio will fall. more reserves, so the reserve ratio will rise. Question 17 (1 point) In the open economy of Costa Rica, the source for the demand for lounable funds is national saving O national saving + net capital outflow. domestic investment domestic investment + net capital outflow. Question 18 (1 point) If money is neutral and the "Fisher" effect (named after Irving Fisher), an increase in the growth rate of money cama both the nominal and the real interest rate rise neither the nominal nor the real interest rate rise. the nominal interest rate rises, but the real interest rate does not O the real interest rate rises, but the nominal interest rate does not Question 22 (1 point) In the long-run money market, the money demand curve slopes upward, because at higher prices people want to hold more money. downward, because at higher prices people want to hold more money. downward, because at higher price people want to hold less money. upward, because at higher prices people want to hold less money. Question 23 (1 point) The explanation for the slope of the O supply of loanable funds curve is based on the logic that a higher real interest rate leads to higher saving demand for loanable funds curve is based on the logic that a higher interest rate leads to higher saving. supply of loanable funds curve is based on the logic that a higher real interest rate leads to lower saving. demand for loanable funds curve is based on the logic that a higher interest rate leads to lower saving. Question 24 (1 point) If at a given real interest rate desired national saving is $120 billion, domestic investment is $40.5 billion, and net capital outflow is $94.5 billion, then at that real interest rate in the loanable funds market there is a O surplus. The real interest rate will fall. shortage. The real interest rate will fall. shortage. The real interest rate will rise. surplus. The real interest rate will rise