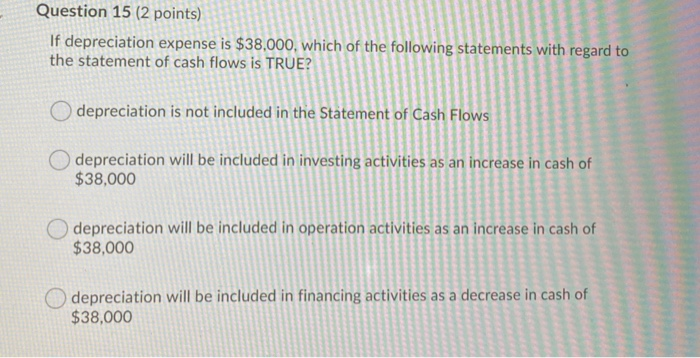

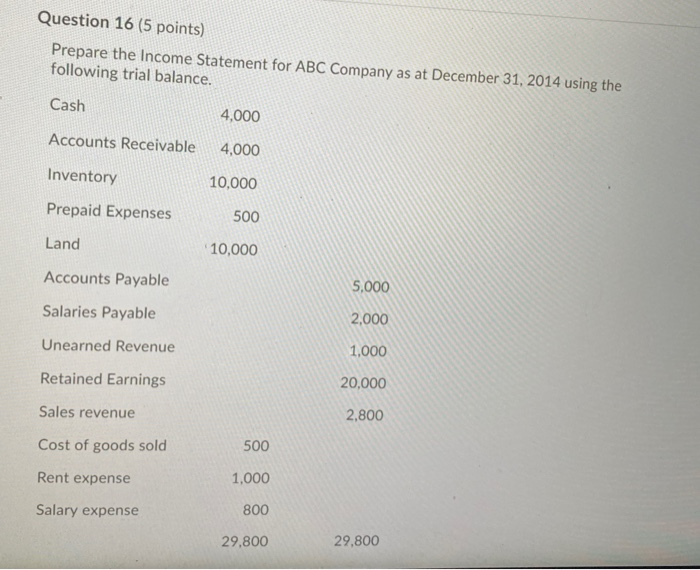

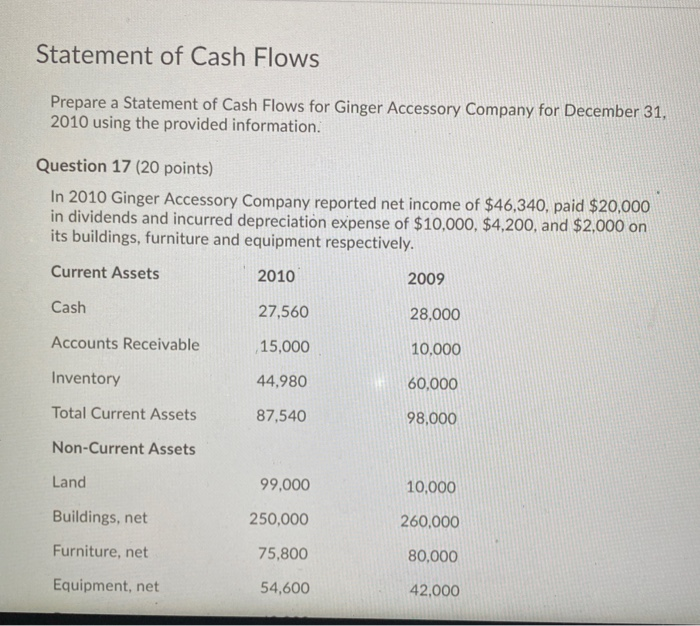

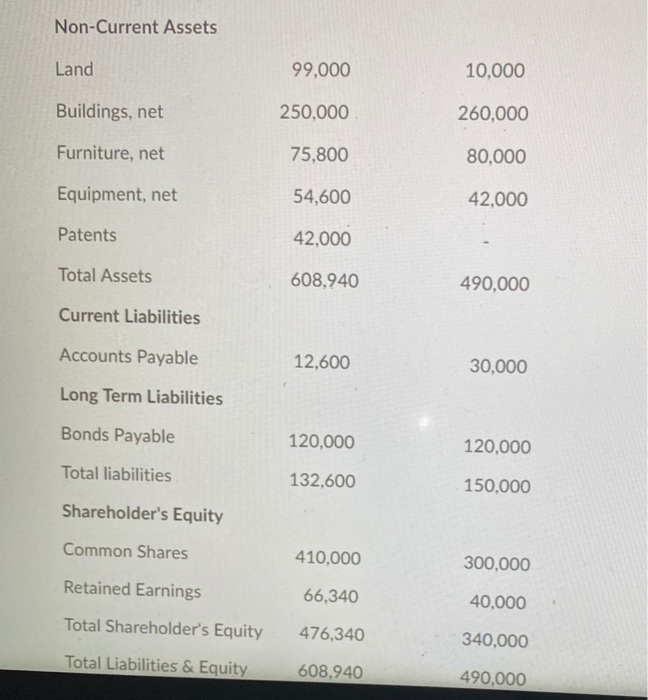

Question 15 (2 points) If depreciation expense is $38,000, which of the following statements with regard to the statement of cash flows is TRUE? O depreciation is not included in the Statement of Cash Flows depreciation will be included in investing activities as an increase in cash of $38,000 depreciation will be included in operation activities as an increase in cash of $38,000 depreciation will be included in financing activities as a decrease in cash of $38,000 Question 16 (5 points) Prepare the Income Statement for ABC Company as at December 31, 2014 using the following trial balance. Cash 4,000 Accounts Receivable 4,000 Inventory 10,000 Prepaid Expenses 500 Land 10,000 Accounts Payable 5,000 Salaries Payable 2,000 Unearned Revenue 1,000 Retained Earnings 20,000 Sales revenue 2,800 Cost of goods sold 500 Rent expense 1,000 Salary expense 800 29,800 29,800 Statement of Cash Flows Prepare a Statement of Cash Flows for Ginger Accessory Company for December 31, 2010 using the provided information. Question 17 (20 points) In 2010 Ginger Accessory Company reported net income of $46,340, paid $20,000 in dividends and incurred depreciation expense of $10,000, $4,200, and $2,000 on its buildings, furniture and equipment respectively. Current Assets 2010 2009 Cash 27,560 28,000 Accounts Receivable 15,000 10,000 Inventory 44,980 60,000 Total Current Assets 87,540 98,000 Non-Current Assets Land 99,000 10,000 Buildings, net 250,000 260,000 80,000 Furniture, net 75,800 Equipment, net 54,600 42,000 Non-Current Assets Land 99,000 10,000 Buildings, net 250,000 260,000 Furniture, net 75,800 80,000 Equipment, net 54,600 42,000 Patents 42,000 Total Assets 608,940 490,000 Current Liabilities Accounts Payable 12,600 30,000 Long Term Liabilities Bonds Payable 120,000 120,000 Total liabilities 132,600 150,000 Shareholder's Equity Common Shares 410.000 300,000 Retained Earnings 66,340 40,000 Total Shareholder's Equity 476,340 340,000 Total Liabilities & Equity 608,940 490,000 Bonds Payable 120,000 120,000 Total liabilities 132,600 150,000 Shareholder's Equity Common Shares 410,000 300,000 Retained Earnings 66,340 40,000 Total Shareholder's Equity 476,340 340,000 Total Liabilities & Equity 608,940 490,000