Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 15 6 pts The ASX 20 index is currently trading at 2000 points and is widely expected to pay a dividend (DPS) equal to

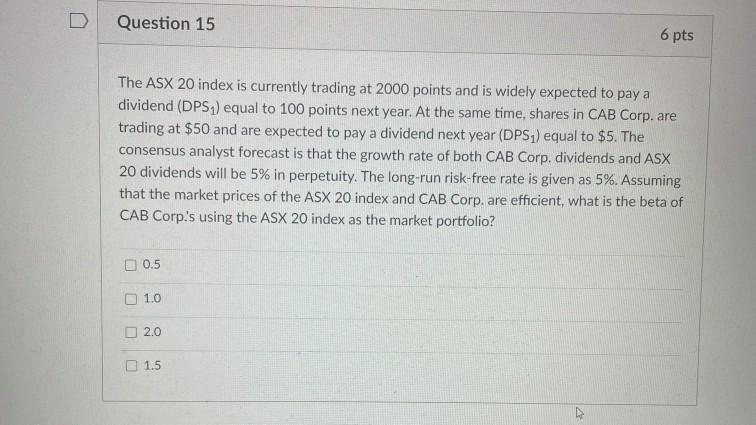

Question 15 6 pts The ASX 20 index is currently trading at 2000 points and is widely expected to pay a dividend (DPS) equal to 100 points next year. At the same time, shares in CAB Corp.are trading at $50 and are expected to pay a dividend next year (DPS) equal to $5. The consensus analyst forecast is that the growth rate of both CAB Corp. dividends and ASX 20 dividends will be 5% in perpetuity. The long-run risk-free rate is given as 5%. Assuming that the market prices of the ASX 20 index and CAB Corp. are efficient, what is the beta of CAB Corp.'s using the ASX 20 index as the market portfolio? 0.5 U 1.0 2.0 1.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started