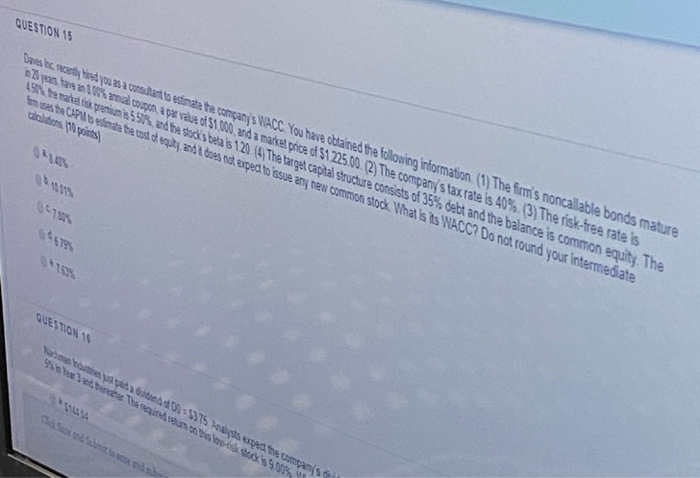

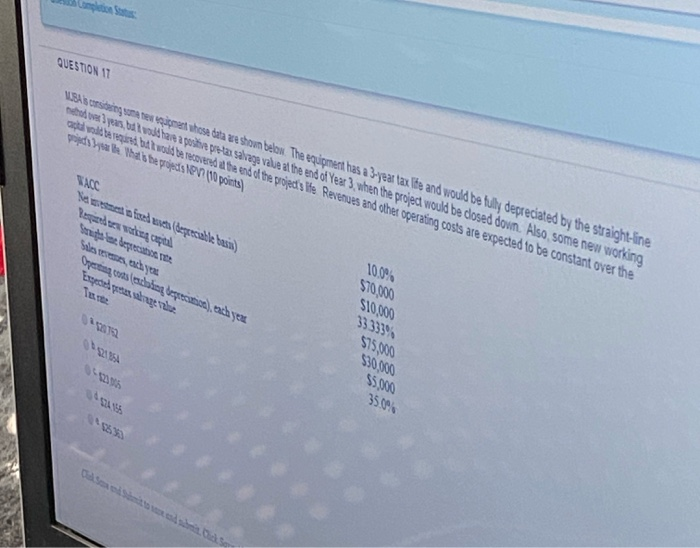

QUESTION 15 Dans rested you as a constant to estimate te companys WACC You have dualined the following information (1) The firm's noncalable bonds mature nye u 105 , p V 01516 and a market price $122500 (2) The company's tax rate is 40% (3) The risk-free rate is 15 temas premium 8597, at saksbeha's 120 The target capital structure consists of 35% debt and the balance is common equity. The imate C o nde te asko gut, and does not exped to issue any ten common stock. What is Is WACC? Do not round your intermediate ice (pets) 0678 QUESTION S i 15 km Thamon tisu- QUESTION 11 VISAS inge t whose dala wa show below. The equipment has a 3-year tax Vte and would be fully depreciated by the straight-line olyan d han apu a salvaga vee al the end of Year 3 when the project would be dosed down. Also some nen working at vi betwold be ever be end the pieds The Revenues and other operating costs are expected to be constant over the odbybe that the prosent points) S Yesu t ine depreciable al ) Oresting sedang bercuti Exportage bach yea. 100% $70.500 $10.900 33333% 575.900 $30.900 5550 3500 QUESTION 15 Dans rested you as a constant to estimate te companys WACC You have dualined the following information (1) The firm's noncalable bonds mature nye u 105 , p V 01516 and a market price $122500 (2) The company's tax rate is 40% (3) The risk-free rate is 15 temas premium 8597, at saksbeha's 120 The target capital structure consists of 35% debt and the balance is common equity. The imate C o nde te asko gut, and does not exped to issue any ten common stock. What is Is WACC? Do not round your intermediate ice (pets) 0678 QUESTION S i 15 km Thamon tisu- QUESTION 11 VISAS inge t whose dala wa show below. The equipment has a 3-year tax Vte and would be fully depreciated by the straight-line olyan d han apu a salvaga vee al the end of Year 3 when the project would be dosed down. Also some nen working at vi betwold be ever be end the pieds The Revenues and other operating costs are expected to be constant over the odbybe that the prosent points) S Yesu t ine depreciable al ) Oresting sedang bercuti Exportage bach yea. 100% $70.500 $10.900 33333% 575.900 $30.900 5550 3500