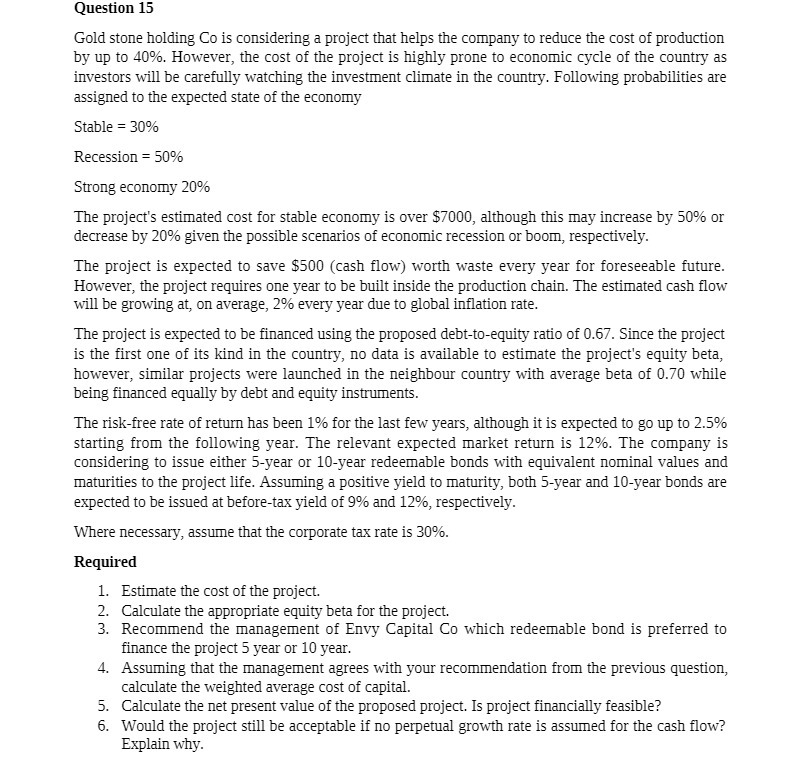

Question 15 Gold stone holding Co is considering a project that helps the company to reduce the cost of production by up to 40%. However, the cost of the project is highly prone to economic cycle of the country as investors will he carefully watching the investment climate in the country. Following probabilities are assigned to the expected state of the economy Stable = 30% Recession = 50% Strong economy 20% The project's estimated cost for stable economy is over $2000, although this may increase by 50% or decrease by 20% given the possible scenarios of economic recession or boom, respectively. The project is expected to save $500 (cash flow] worth waste every year for foreseeable future. However, the project requires one year to be built inside the production chain. The estimated cash flow will be growing at, on average, 2% every year due to global ination rate. The project is expected to be nanced using the proposed debtto-equity ratio of 0.63". Since the project is the first one of its kind in the country, no data is available to estimate the project's equity beta, however, similar projects were launched in the neighbour country with average beta of 0.20 while being financed equally by debt and equity instruments. The riskfree rate of return has been 1% for the last few years, although it is expected to go up to 2.5% starting from the following year. The relevant expected market return is 12%. The company is considering to issue either 5-year or 10year redeemable bonds with equivalent nominal values and maturities to the project life. Assuming a positive yield to mattn'ity, both 5year and 10year bonds are expected to be issued at beforetax yield of 9% and 12%, respectively. 1Where necessary, assume that the corporate tax rate is 30%. Required 1. Estimate the cost of the project. 2. Calculate the appropriate equity beta for the project. 3. Recommend the management of Envy lCapital Co which redeemable bond is preferred to nance the project 5 year or 10 year. 4. assuming that the management agrees with your recommendation from the previous question, calculate the weighted average cost of capital. 5. Calculate the net present value of the proposed project. Is project financially feasible? . Would the project still be acceptable if no perpetual growth rate is assumed for the cash flow? Explain why