Answered step by step

Verified Expert Solution

Question

1 Approved Answer

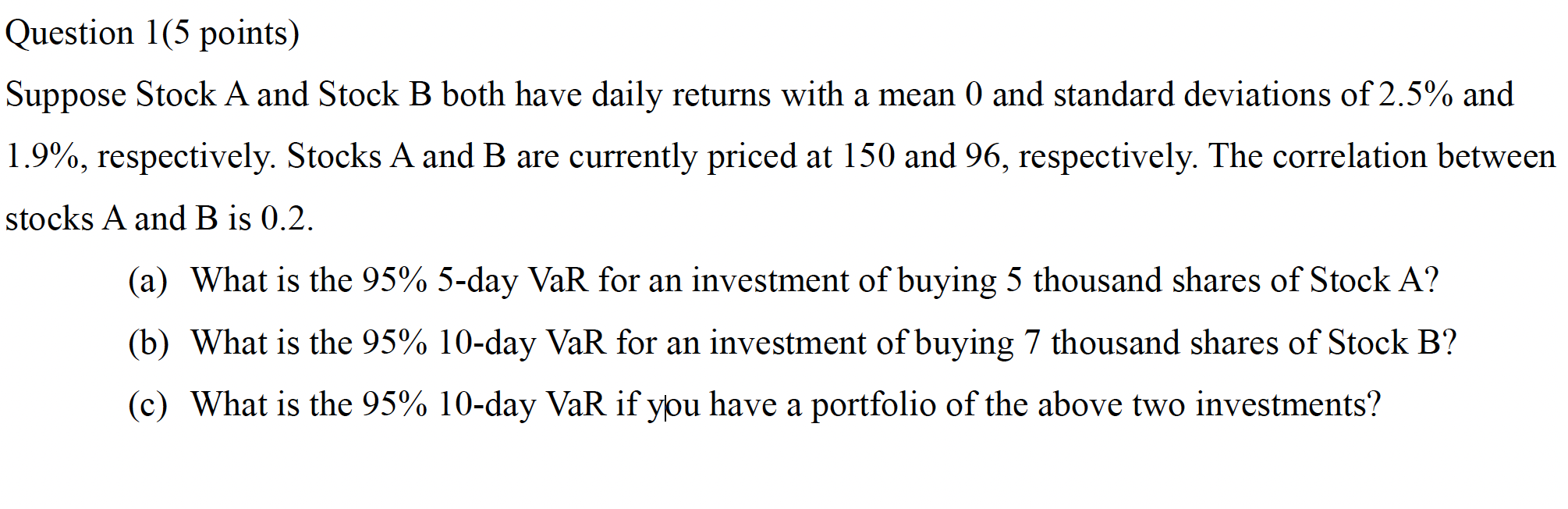

Question 1(5 points) Suppose Stock A and Stock B both have daily returns with a mean 0 and standard deviations of 2.5% and 1.9%,

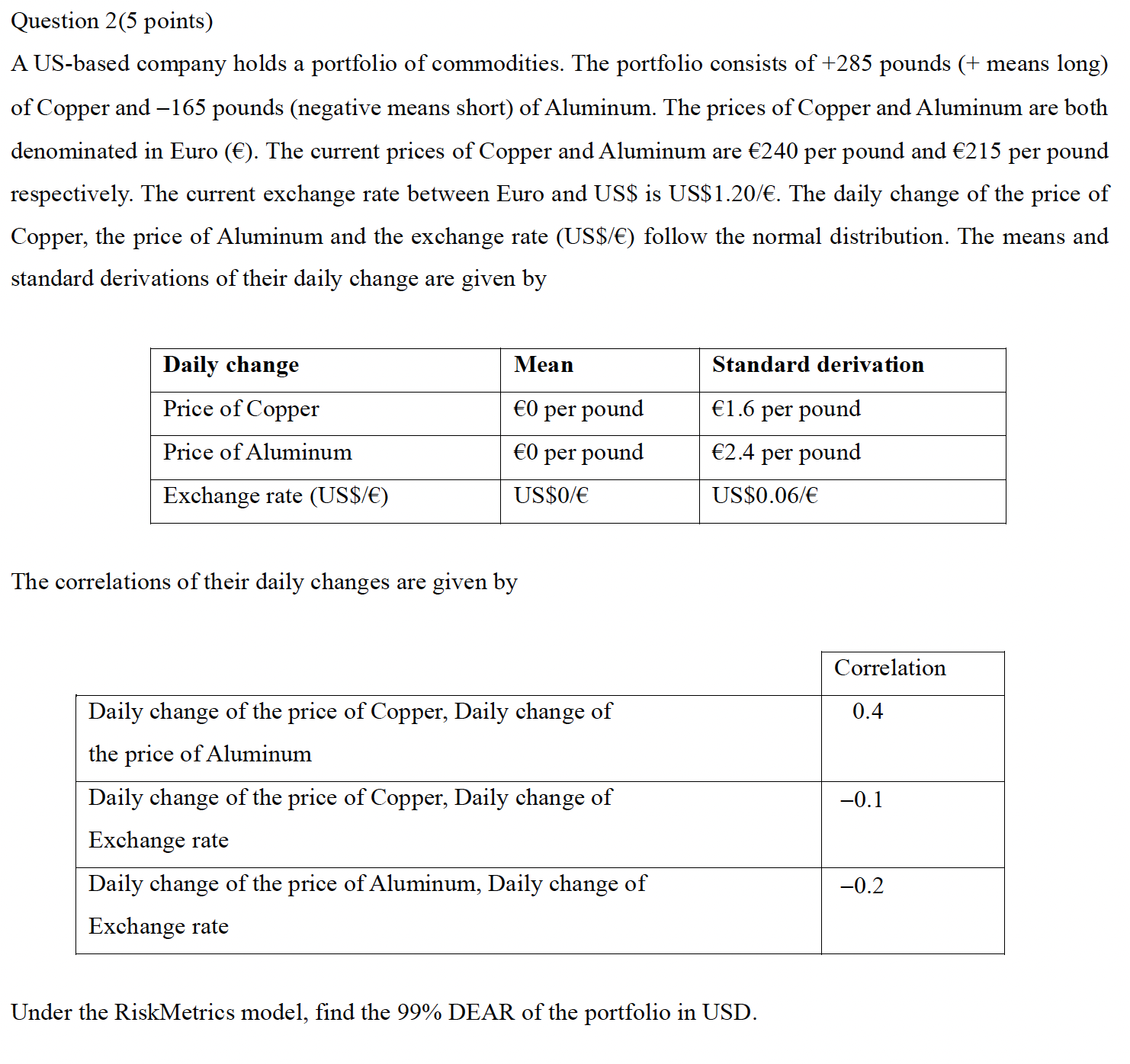

Question 1(5 points) Suppose Stock A and Stock B both have daily returns with a mean 0 and standard deviations of 2.5% and 1.9%, respectively. Stocks A and B are currently priced at 150 and 96, respectively. The correlation between stocks A and B is 0.2. (a) What is the 95% 5-day VaR for an investment of buying 5 thousand shares of Stock A? (b) What is the 95% 10-day VaR for an investment of buying 7 thousand shares of Stock B? (c) What is the 95% 10-day VaR if you have a portfolio of the above two investments? Question 2(5 points) A US-based company holds a portfolio of commodities. The portfolio consists of +285 pounds (+ means long) of Copper and 165 pounds (negative means short) of Aluminum. The prices of Copper and Aluminum are both denominated in Euro (). The current prices of Copper and Aluminum are 240 per pound and 215 per pound respectively. The current exchange rate between Euro and US$ is US$1.20/. The daily change of the price of Copper, the price of Aluminum and the exchange rate (US$/) follow the normal distribution. The means and standard derivations of their daily change are given by Daily change Price of Copper Price of Aluminum Exchange rate (US$/) The correlations of their daily changes are given by Mean Standard derivation 0 per pound 1.6 per pound 0 per pound 2.4 per pound US$0/ US$0.06/ Daily change of the price of Copper, Daily change of Correlation 0.4 the price of Aluminum Daily change of the price of Copper, Daily change of Exchange rate -0.1 Daily change of the price of Aluminum, Daily change of Exchange rate -0.2 Under the RiskMetrics model, find the 99% DEAR of the portfolio in USD.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started