Answered step by step

Verified Expert Solution

Question

1 Approved Answer

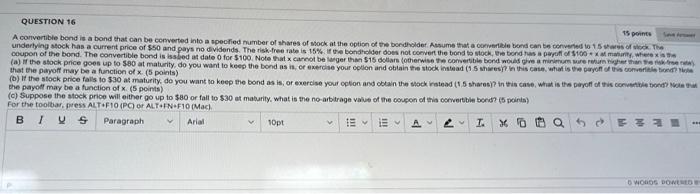

QUESTION 16 15 points Save wer A convertible bond is a bond that can be converted into a specified number of shares of stock

QUESTION 16 15 points Save wer A convertible bond is a bond that can be converted into a specified number of shares of stock at the option of the bondholder. Assume that a convertible bond can be converted to 1.5 shares of stock. The underlying stock has a current price of $50 and pays no dividends. The risk-free rate is 15% If the bondholder does not convert the bond to stock, the bond has a payoff of $100 xat maturity, where x is the coupon of the bond. The convertible bond is issued at date 0 for $100. Note that x cannot be larger than $15 dollars (otherwise the convertible bond would give a minimum sure return higher than the risk-t (a) if the stock price goes up to $80 at maturity, do you want to keep the bond as is, or exercise your option and obtain the stock instead (1.5 shares)? in this case, what is the payoff of this convertible bond? Note that the payoff may be a function of x. (5 points) (b) If the stock price fails to $30 at maturity, do you want to keep the bond as is, or exercise your option and obtain the stock instead (1.5 shares)? In this case, what is the payoff of this convertible bond? Note that the payoff may be a function of x. (5 points) (c) Suppose the stock price will either go up to $80 or fall to $30 at maturity, what is the no-arbitrage value of the coupon of this convertible bond? (5 points) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac) BIVS Paragraph v Arial v 10pt A 0 WORDS DOWERED

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started