Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 16 ~ 20 The current annual sales of Flower Bud, Inc are $178,000. Sales are expected to increase by 4% next year. The company

Question 16 ~ 20

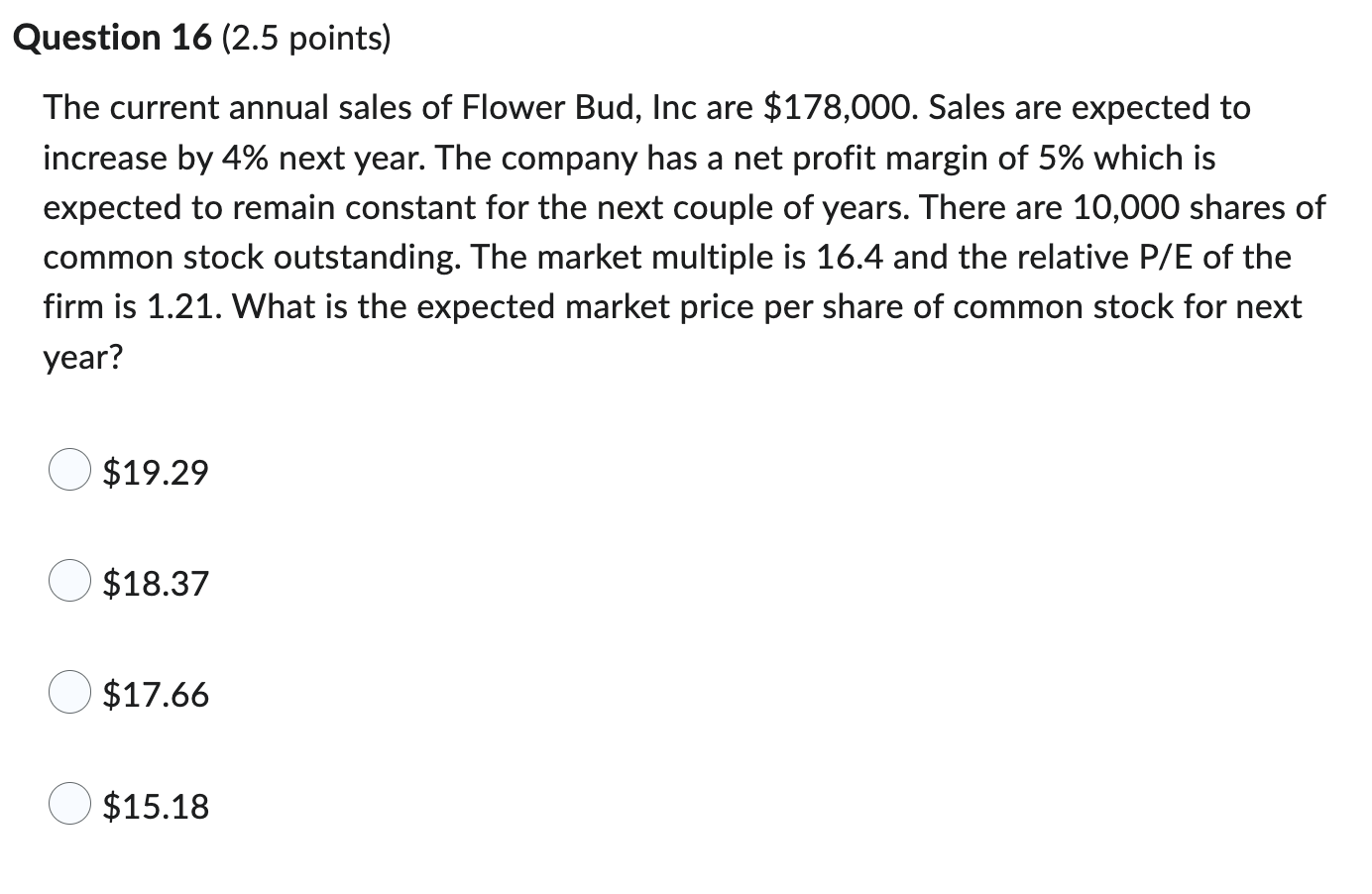

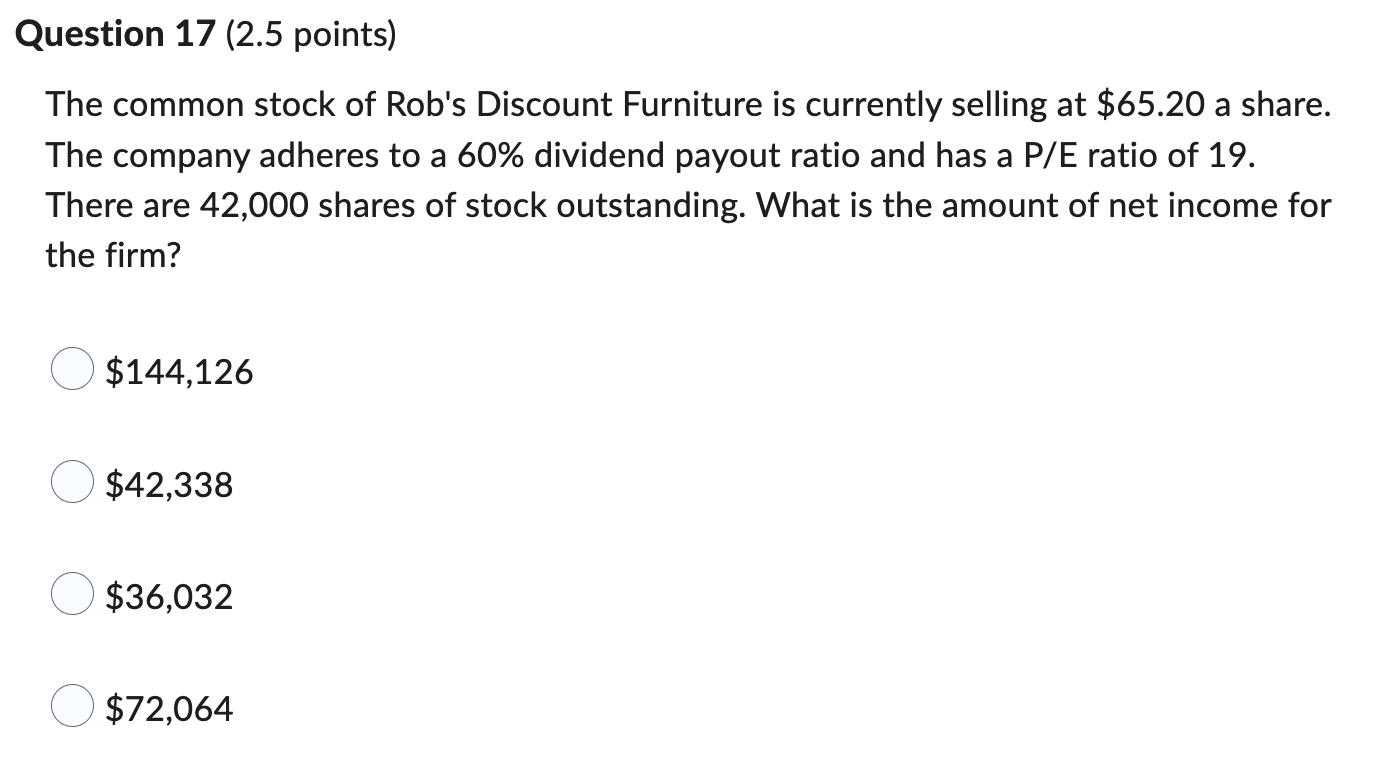

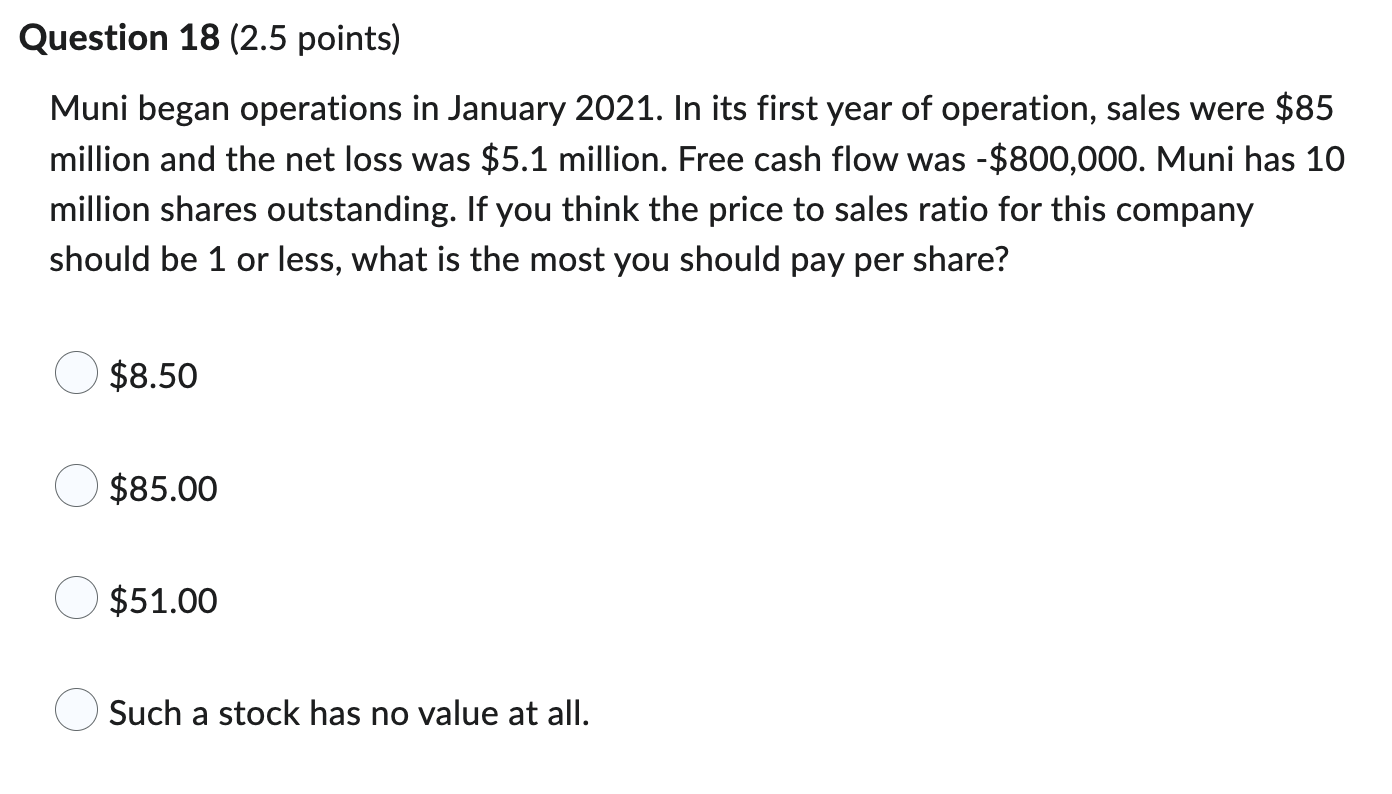

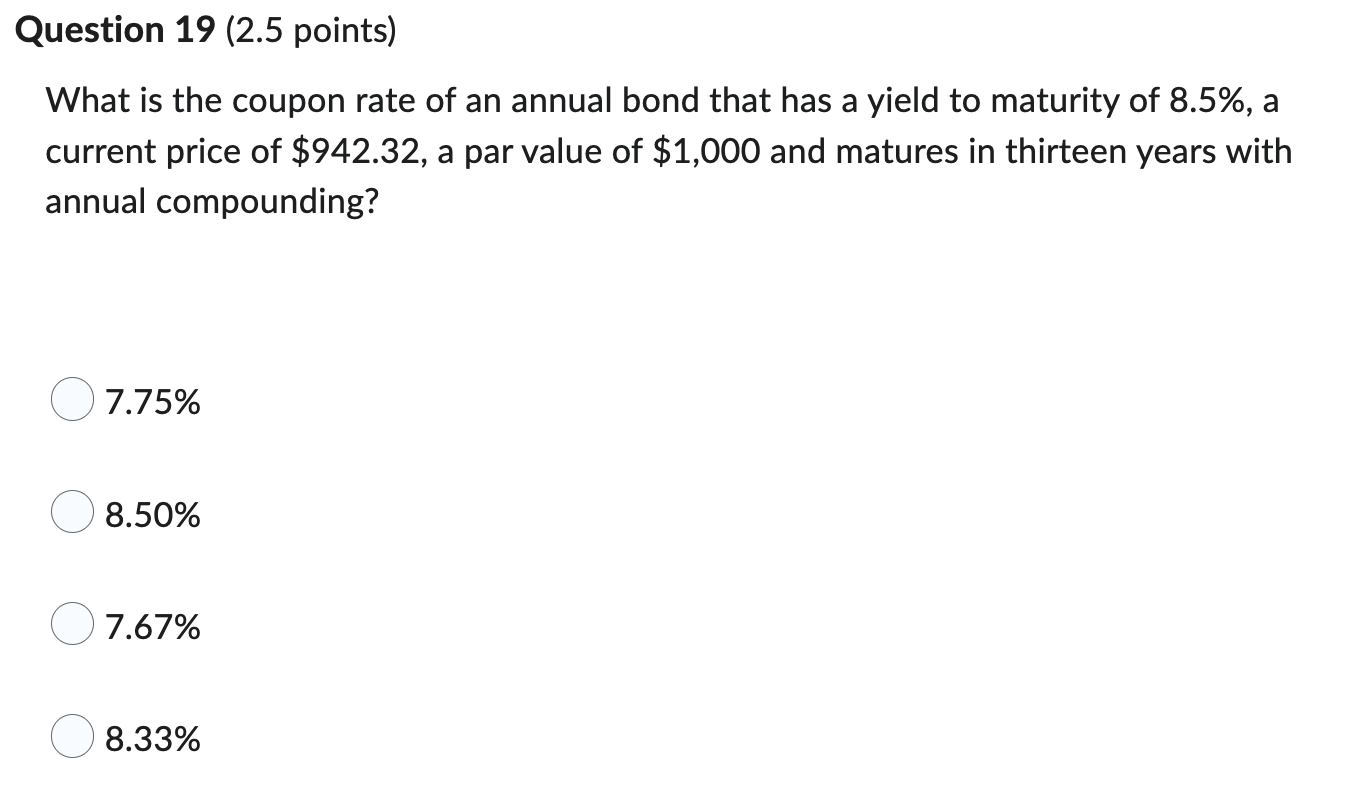

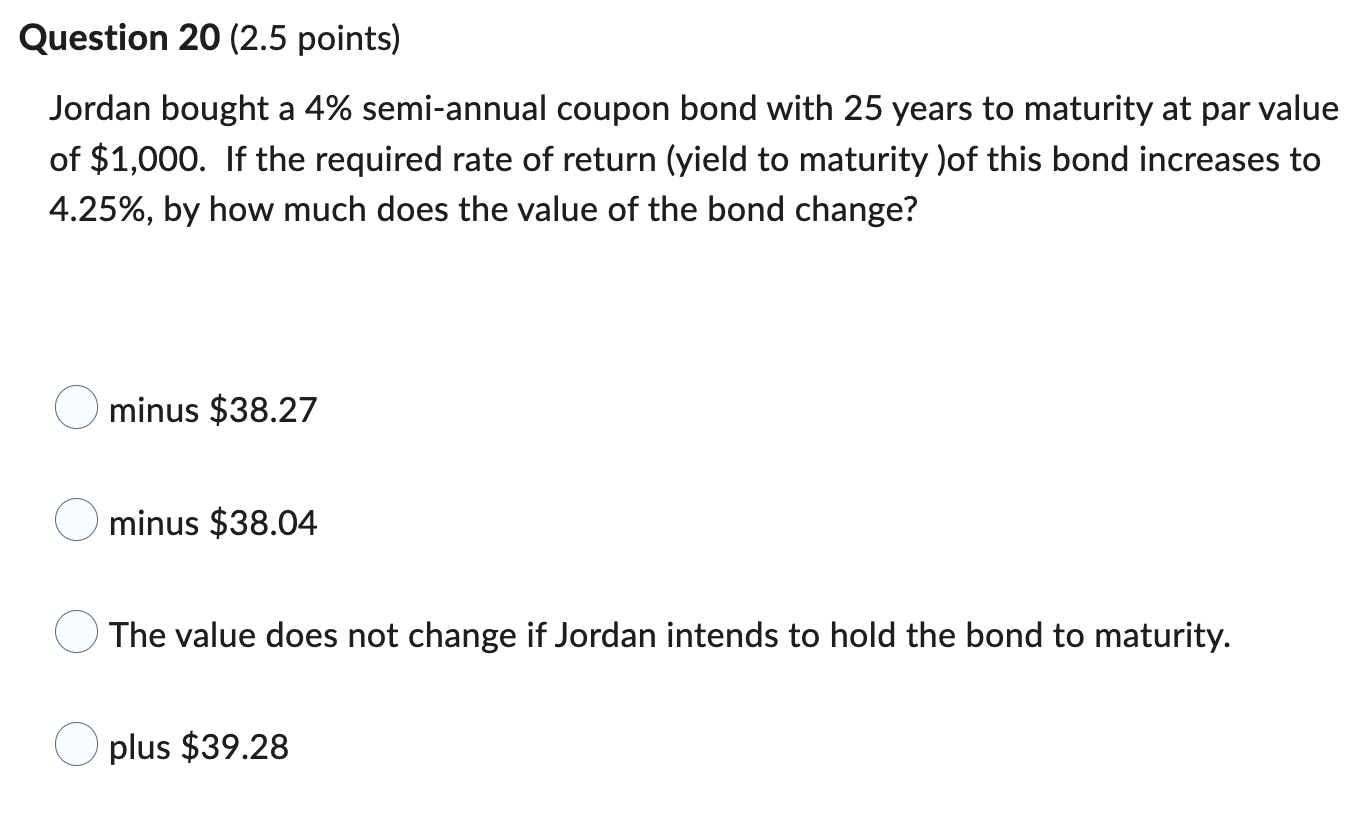

The current annual sales of Flower Bud, Inc are $178,000. Sales are expected to increase by 4% next year. The company has a net profit margin of 5% which is expected to remain constant for the next couple of years. There are 10,000 shares of common stock outstanding. The market multiple is 16.4 and the relative P/E of the firm is 1.21. What is the expected market price per share of common stock for next year? $19.29 $18.37 $17.66 $15.18 The common stock of Rob's Discount Furniture is currently selling at $65.20 a share. The company adheres to a 60\% dividend payout ratio and has a P/E ratio of 19. There are 42,000 shares of stock outstanding. What is the amount of net income for the firm? $144,126 $42,338 $36,032 $72,064 Muni began operations in January 2021. In its first year of operation, sales were $85 million and the net loss was $5.1 million. Free cash flow was $800,000. Muni has 10 million shares outstanding. If you think the price to sales ratio for this company should be 1 or less, what is the most you should pay per share? $8.50 $85.00 $51.00 Such a stock has no value at all. What is the coupon rate of an annual bond that has a yield to maturity of 8.5%, a current price of $942.32, a par value of $1,000 and matures in thirteen years with annual compounding? 7.75% 8.50% 7.67% 8.33\% Jordan bought a 4\% semi-annual coupon bond with 25 years to maturity at par value of $1,000. If the required rate of return (yield to maturity )of this bond increases to 4.25%, by how much does the value of the bond change? minus $38.27 minus $38.04 The value does not change if Jordan intends to hold the bond to maturity. plus $39.28

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started