Answered step by step

Verified Expert Solution

Question

1 Approved Answer

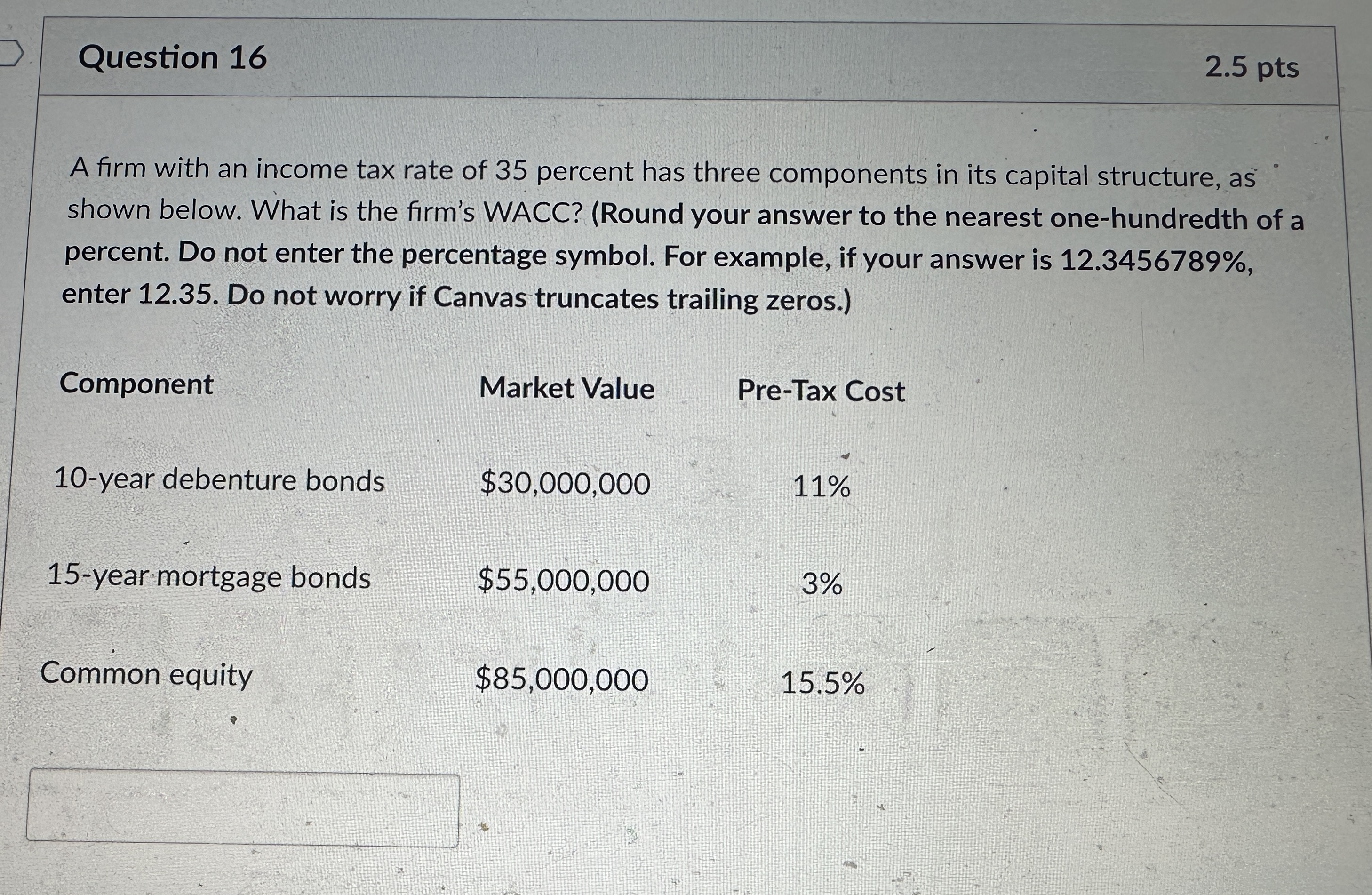

Question 16 2.5 pts A firm with an income tax rate of 35 percent has three components in its capital structure, as shown below.

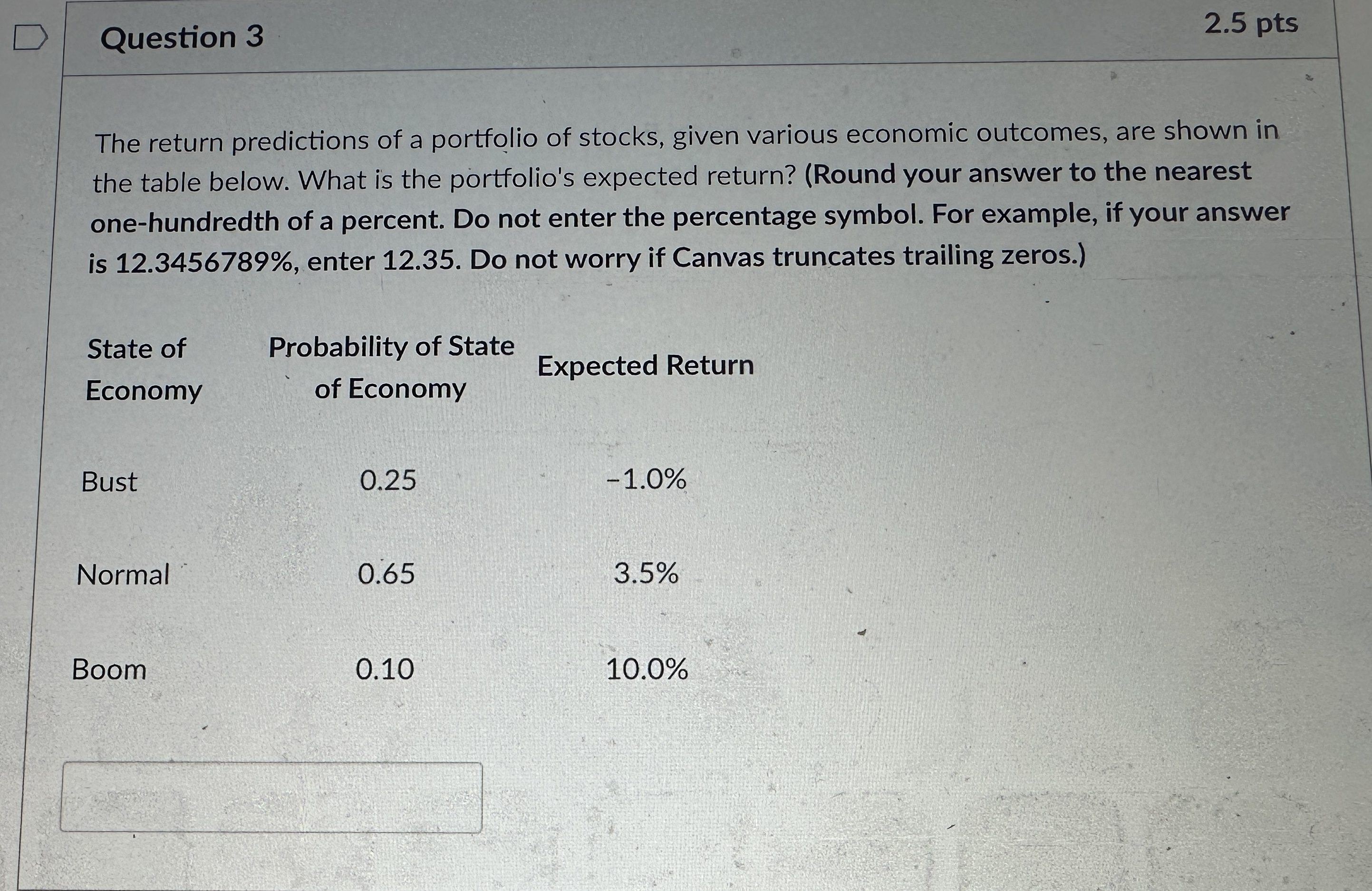

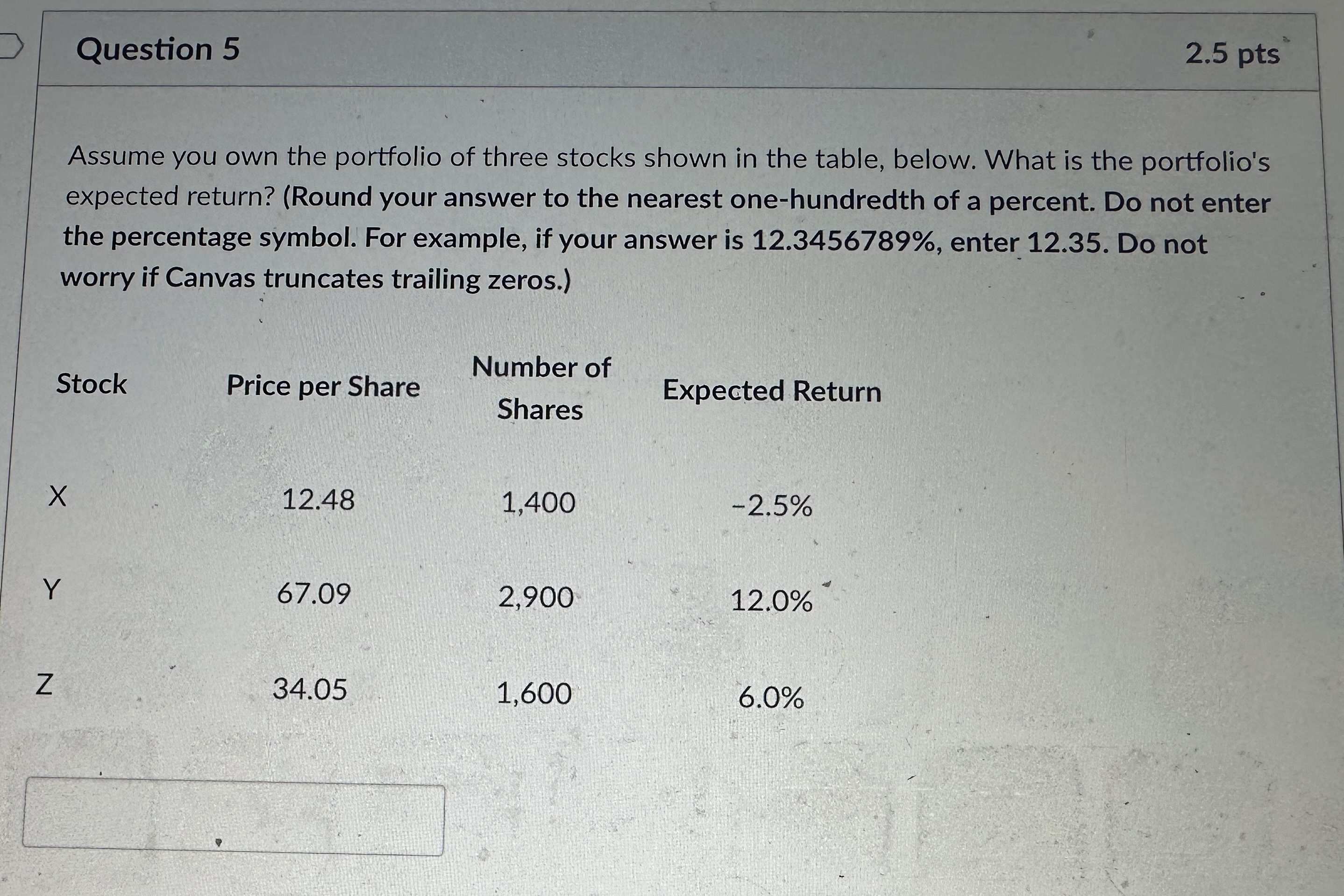

Question 16 2.5 pts A firm with an income tax rate of 35 percent has three components in its capital structure, as shown below. What is the firm's WACC? (Round your answer to the nearest one-hundredth of a percent. Do not enter the percentage symbol. For example, if your answer is 12.3456789%, enter 12.35. Do not worry if Canvas truncates trailing zeros.) Component Market Value Pre-Tax Cost 10-year debenture bonds $30,000,000 11% 15-year mortgage bonds $55,000,000 3% Common equity $85,000,000 15.5% 4 Question 3 2.5 pts The return predictions of a portfolio of stocks, given various economic outcomes, are shown in the table below. What is the portfolio's expected return? (Round your answer to the nearest one-hundredth of a percent. Do not enter the percentage symbol. For example, if your answer is 12.3456789%, enter 12.35. Do not worry if Canvas truncates trailing zeros.) State of Economy Probability of State Expected Return of Economy Bust 0.25 -1.0% Normal 0.65 3.5% Boom 0.10 10.0% Question 5 2.5 pts Assume you own the portfolio of three stocks shown in the table, below. What is the portfolio's expected return? (Round your answer to the nearest one-hundredth of a percent. Do not enter the percentage symbol. For example, if your answer is 12.3456789%, enter 12.35. Do not worry if Canvas truncates trailing zeros.) Number of Stock Price per Share Expected Return Shares X 12.48 1,400 -2.5% Y 67.09 2,900 12.0% Z 34.05 1,600 6.0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started