Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 16 (3 points) Receivables are usually a significant portion of total current liabilities total liabilities total current assets. total assets Question 17 (3 points)

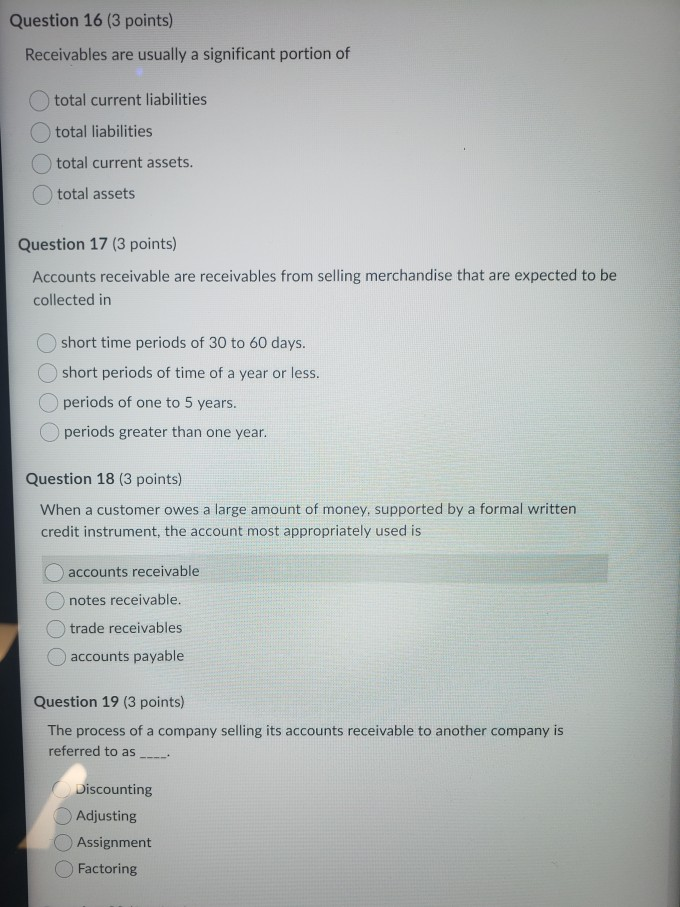

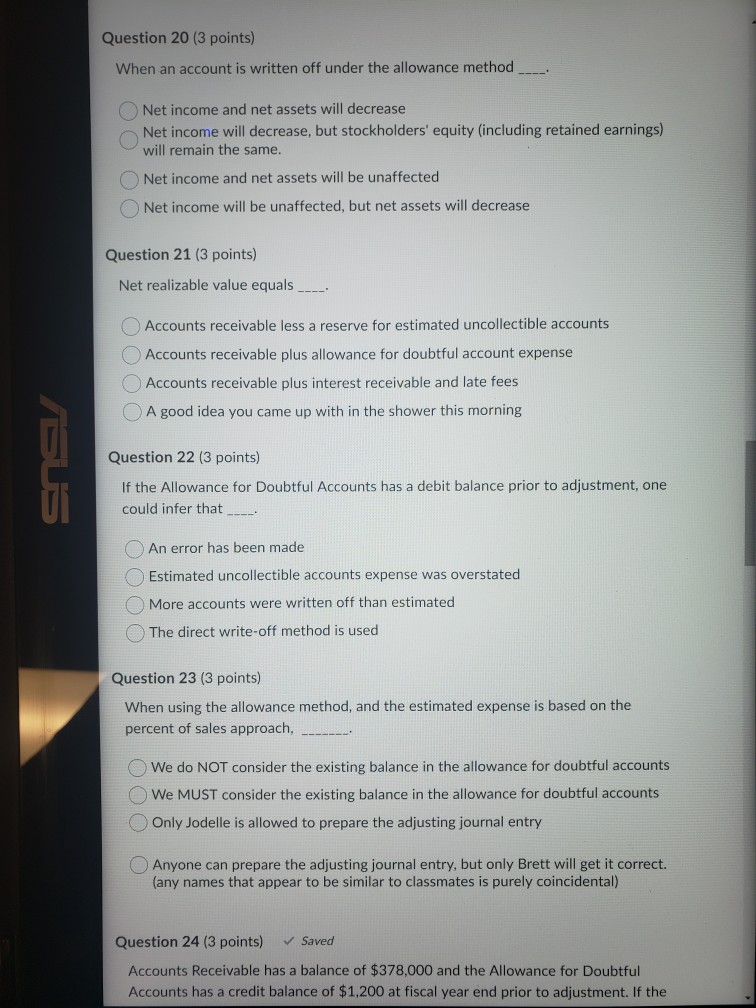

Question 16 (3 points) Receivables are usually a significant portion of total current liabilities total liabilities total current assets. total assets Question 17 (3 points) Accounts receivable are receivables from selling merchandise that are expected to be collected in short time periods of 30 to 60 days. short periods of time of a year or less. periods of one to 5 years. periods greater than one year. Question 18 (3 points) When a customer owes a large amount of money, supported by a formal written credit instrument, the account most appropriately used is accounts receivable notes receivable. trade receivables accounts payable Question 19 (3 points) The process of a company selling its accounts receivable to another company is referred to as --- Discounting Adjusting Assignment Factoring Question 20 (3 points) When an account is written off under the allowance method ___ Net income and net assets will decrease Net income will decrease, but stockholders' equity (including retained earnings) will remain the same. Net income and net assets will be unaffected Net income will be unaffected, but net assets will decrease Question 21 (3 points) Net realizable value equals ____ Accounts receivable less a reserve for estimated uncollectible accounts Accounts receivable plus allowance for doubtful account expense Accounts receivable plus interest receivable and late fees A good idea you came up with in the shower this morning Question 22 (3 points) If the Allowance for Doubtful Accounts has a debit balance prior to adjustment, one could infer that An error has been made Estimated uncollectible accounts expense was overstated More accounts were written off than estimated The direct write-off method is used Question 23 (3 points) When using the allowance method, and the estimated expense is based on the percent of sales approach, We do NOT consider the existing balance in the allowance for doubtful accounts We MUST consider the existing balance in the allowance for doubtful accounts Only Jodelle is allowed to prepare the adjusting journal entry Anyone can prepare the adjusting journal entry, but only Brett will get it correct. (any names that appear to be similar to classmates is purely coincidental) Question 24 (3 points) Saved Accounts Receivable has a balance of $378,000 and the Allowance for Doubtful Accounts has a credit balance of $1,200 at fiscal year end prior to adjustment. If the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started