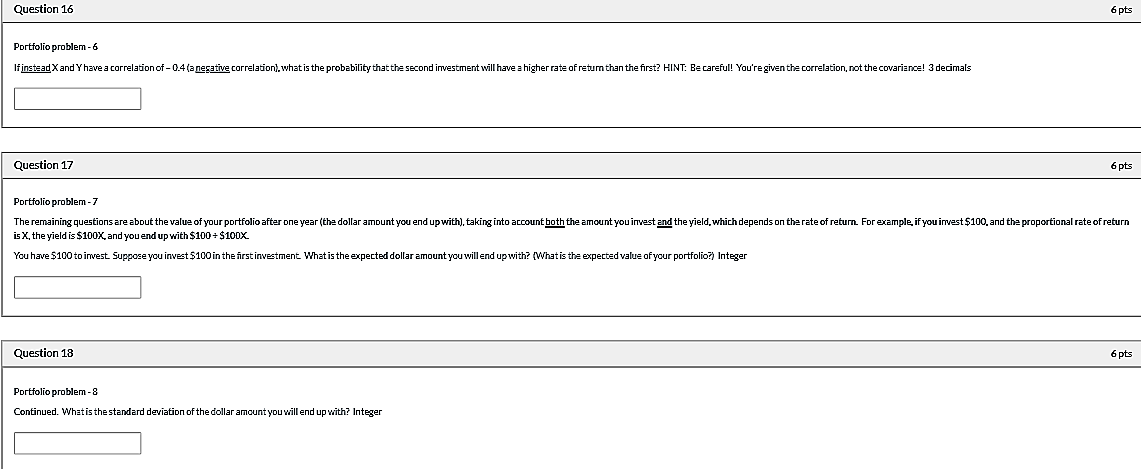

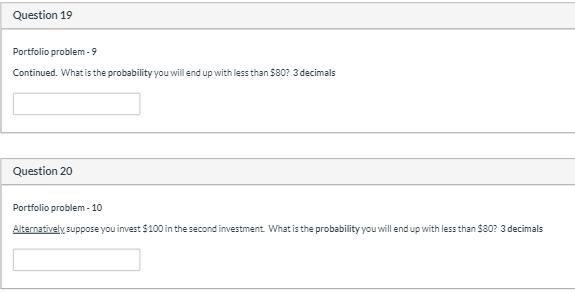

Question 16 6 pts Portfolio problem - 6 If instead X and Y have a correlation of -0.4(a nesative correlation), what is the probability that the second investment will have a higher rate of return than the first? HINT: Be careful! You're given the correlation, not the covariance! 3 decimals Question 17 6 pts Portfolio problem-7 The remaining questions are about the value of your portfolio after one year (the dollar amount you end up with), taking into account both the amount you invest and the yield, which depends on the rate of return. For example, if you invest $100, and the proportional rate of return is X, the yield is $100X, and you end up with $100+$100X. You have $100 to invest Suppose you invest $100 in the firstinvestment What is the expected dollar amount you will end up with? (Whatis the expected value of your portfolio Integer Question 18 6 pts Portfolio problem - 8 Continued. Whatis the standard deviation of the dollar amount you will end up with? Integer Question 19 Portfolio problem - 9 Continued. What is the probability you will end up with less than $807 3 decimals Question 20 Portfolio problem - 10 Alternatively suppose you invest $100 in the second investment What is the probability you will end up with less than $80? 3 decimals Question 16 6 pts Portfolio problem - 6 If instead X and Y have a correlation of -0.4(a nesative correlation), what is the probability that the second investment will have a higher rate of return than the first? HINT: Be careful! You're given the correlation, not the covariance! 3 decimals Question 17 6 pts Portfolio problem-7 The remaining questions are about the value of your portfolio after one year (the dollar amount you end up with), taking into account both the amount you invest and the yield, which depends on the rate of return. For example, if you invest $100, and the proportional rate of return is X, the yield is $100X, and you end up with $100+$100X. You have $100 to invest Suppose you invest $100 in the firstinvestment What is the expected dollar amount you will end up with? (Whatis the expected value of your portfolio Integer Question 18 6 pts Portfolio problem - 8 Continued. Whatis the standard deviation of the dollar amount you will end up with? Integer Question 19 Portfolio problem - 9 Continued. What is the probability you will end up with less than $807 3 decimals Question 20 Portfolio problem - 10 Alternatively suppose you invest $100 in the second investment What is the probability you will end up with less than $80? 3 decimals