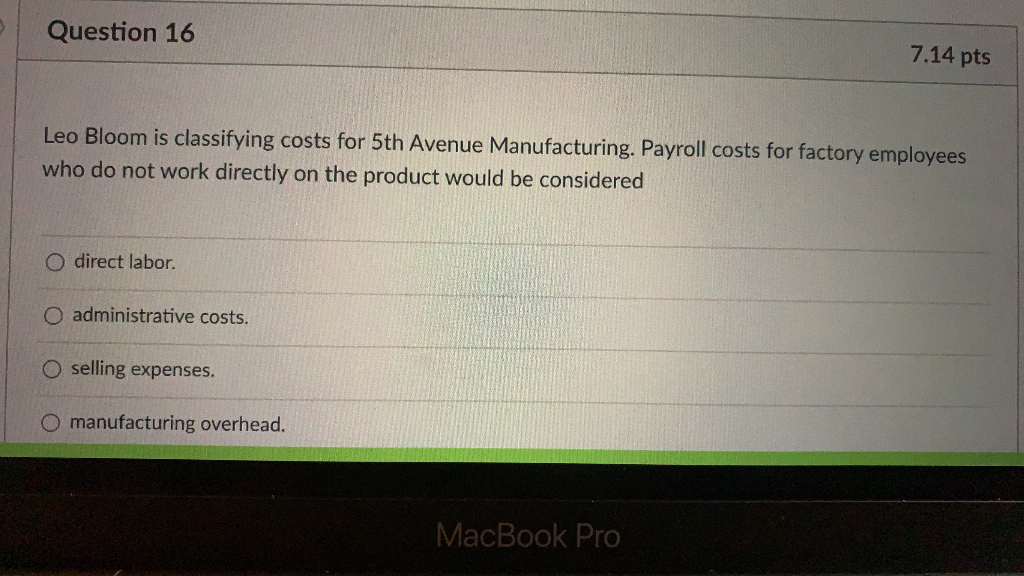

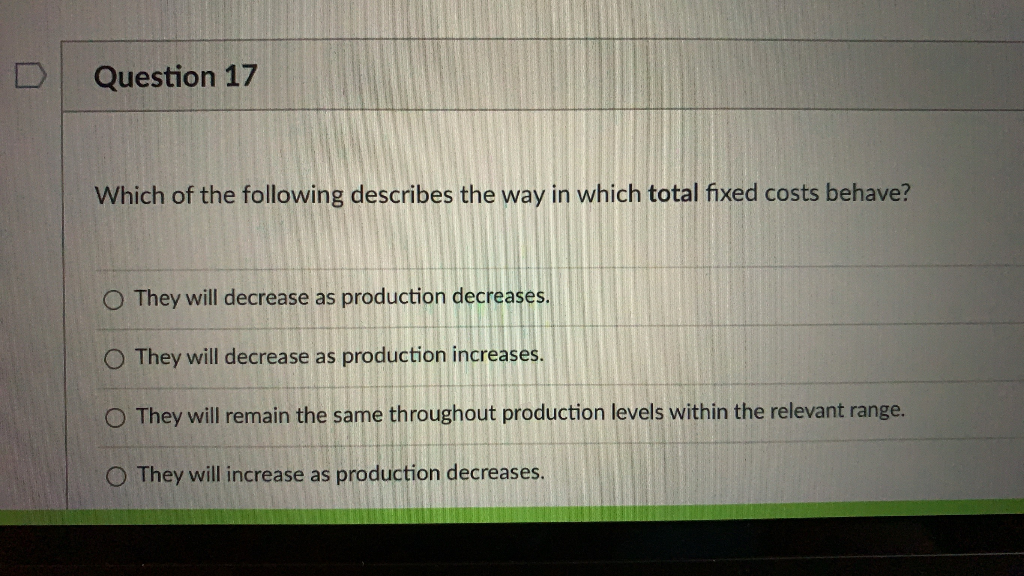

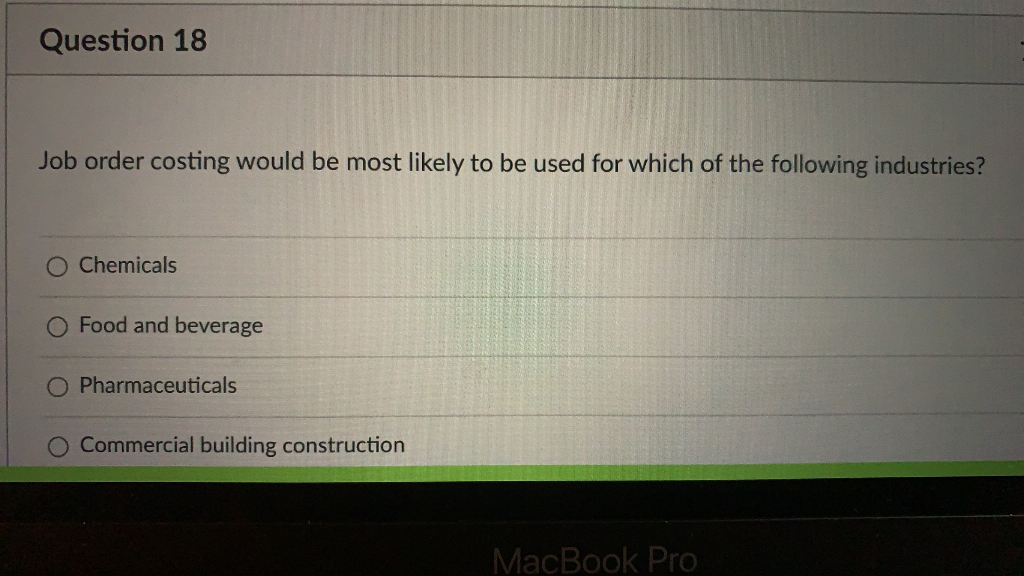

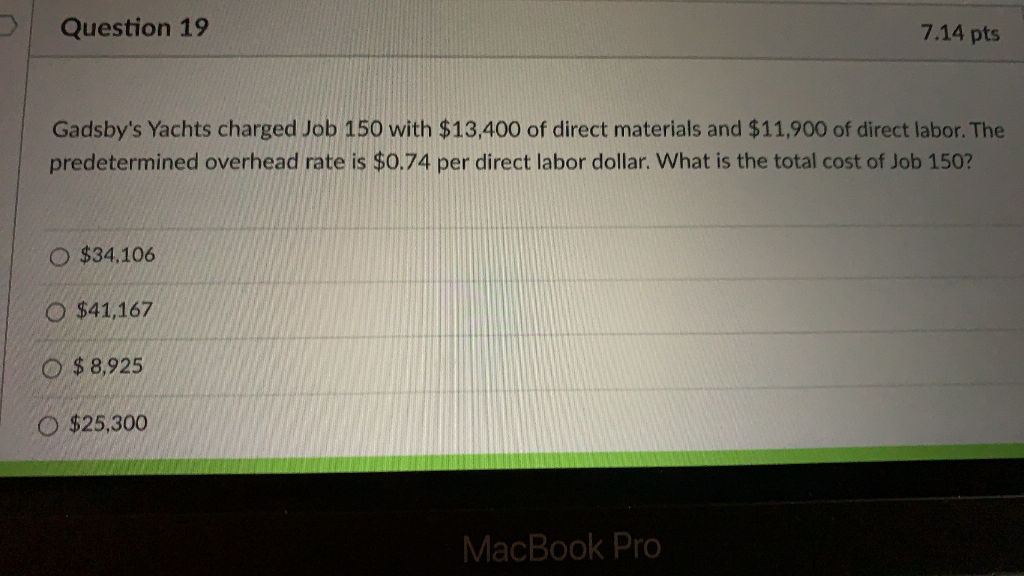

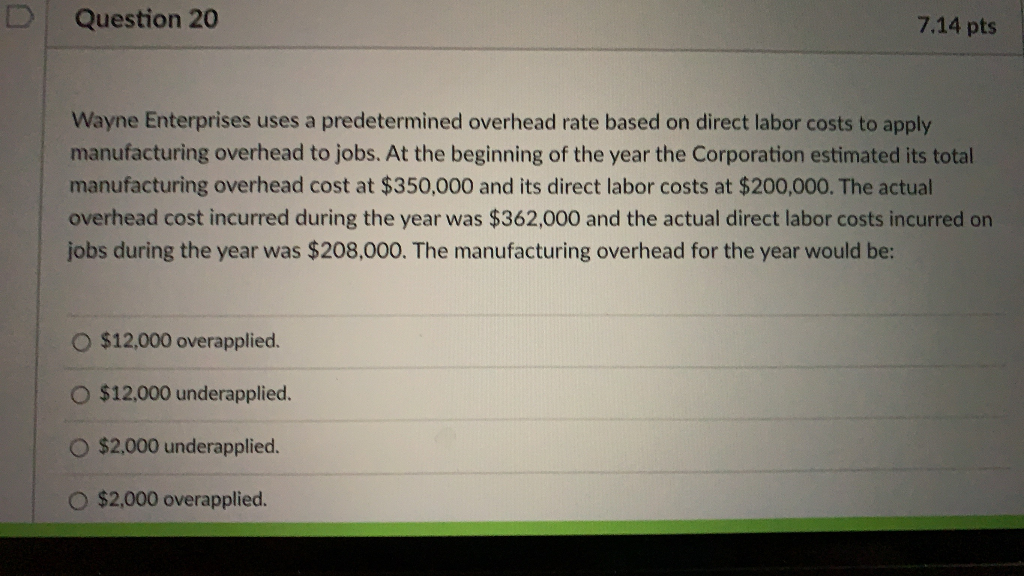

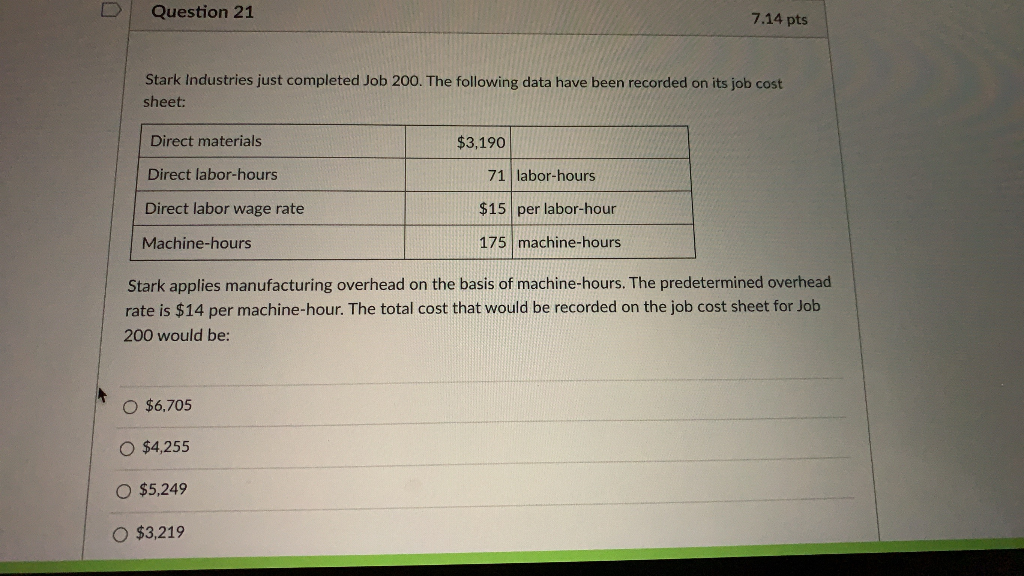

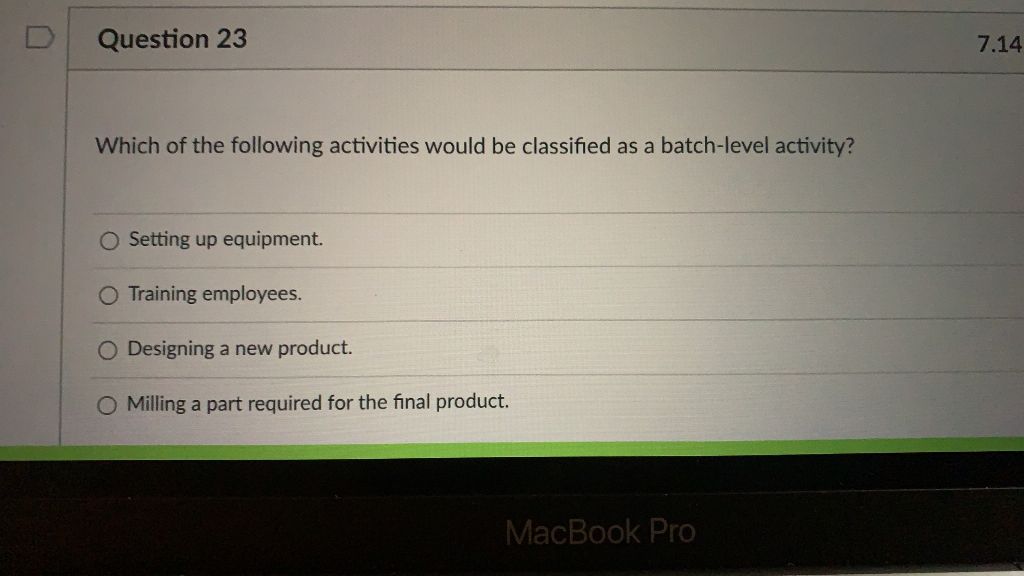

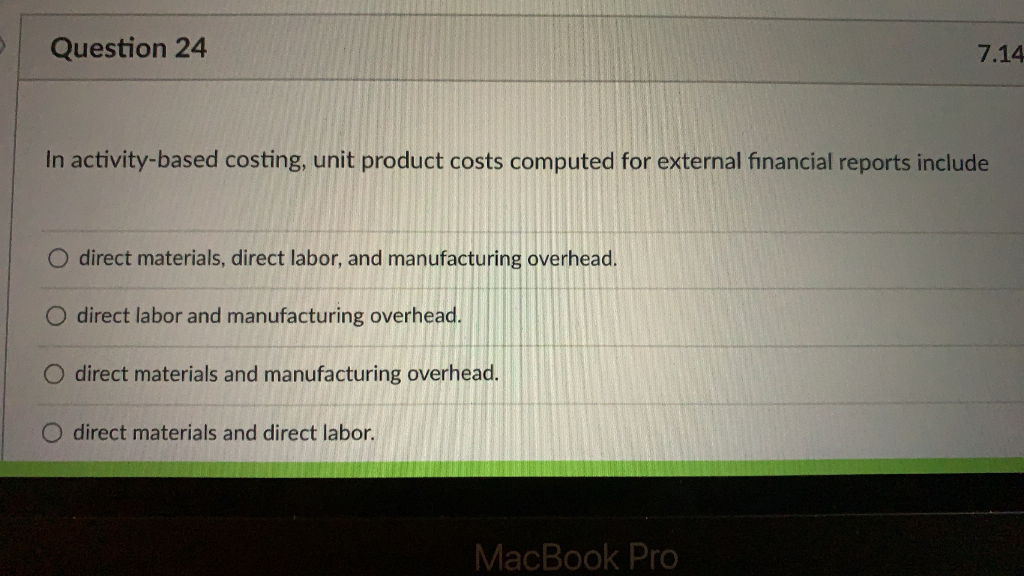

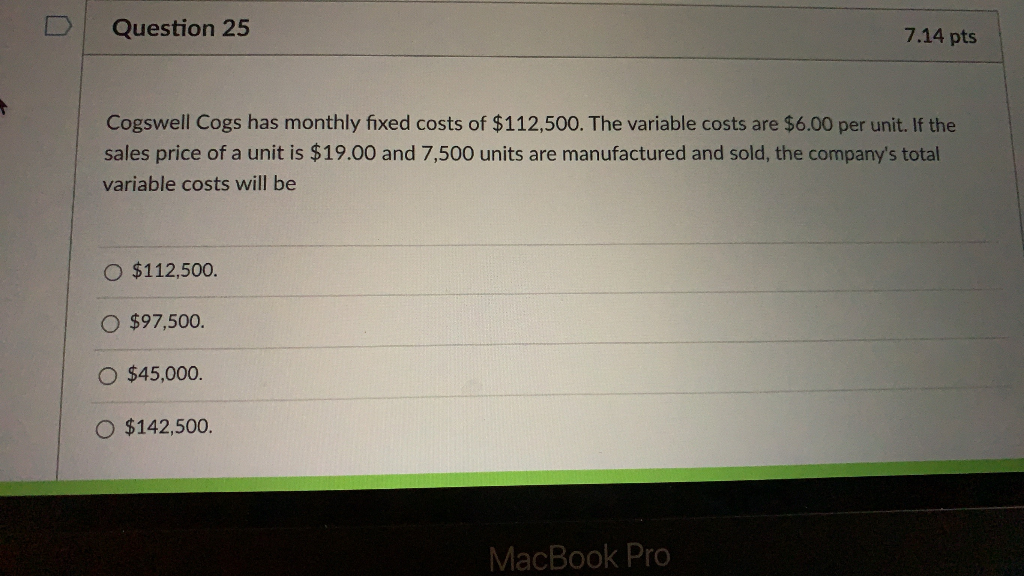

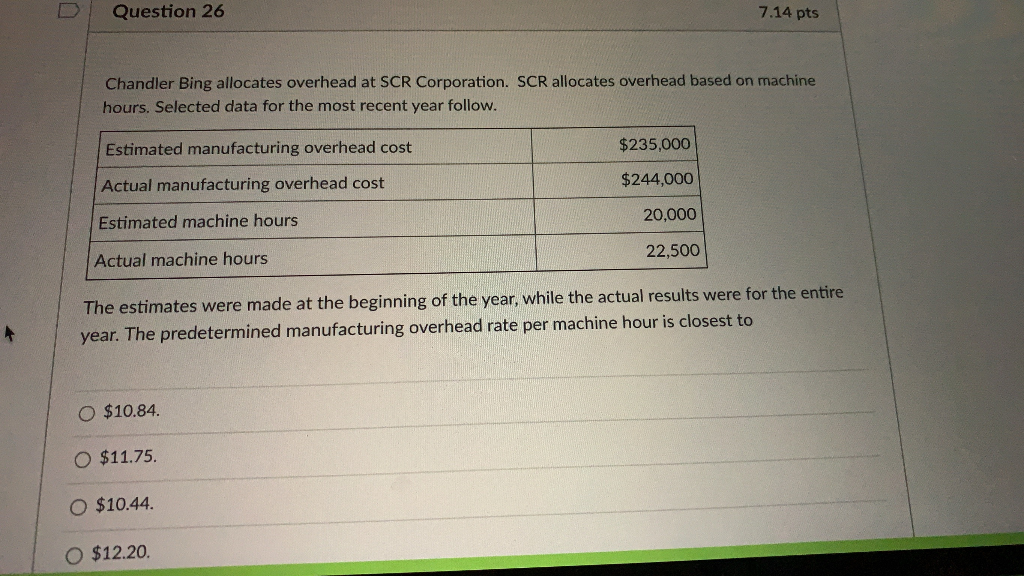

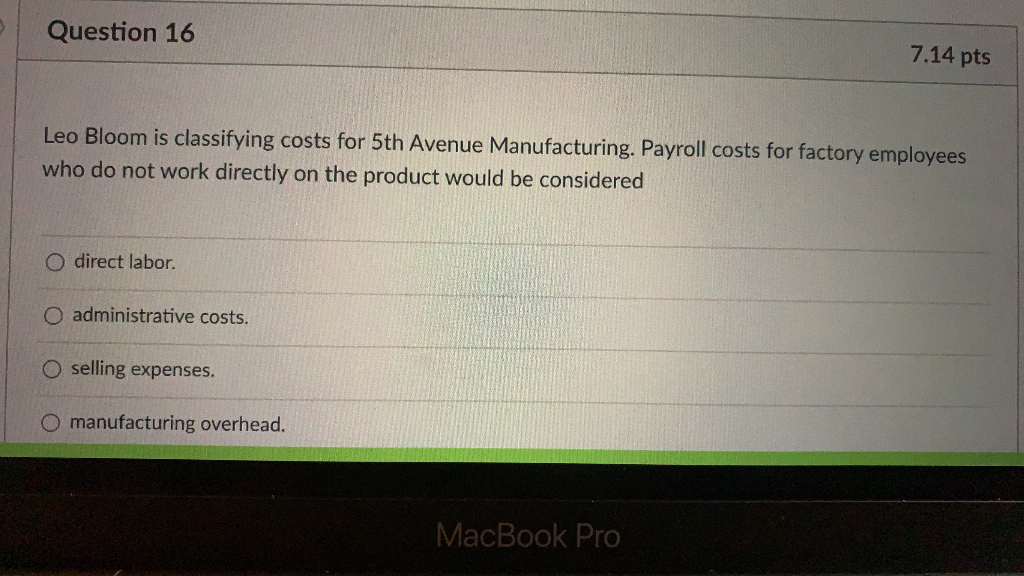

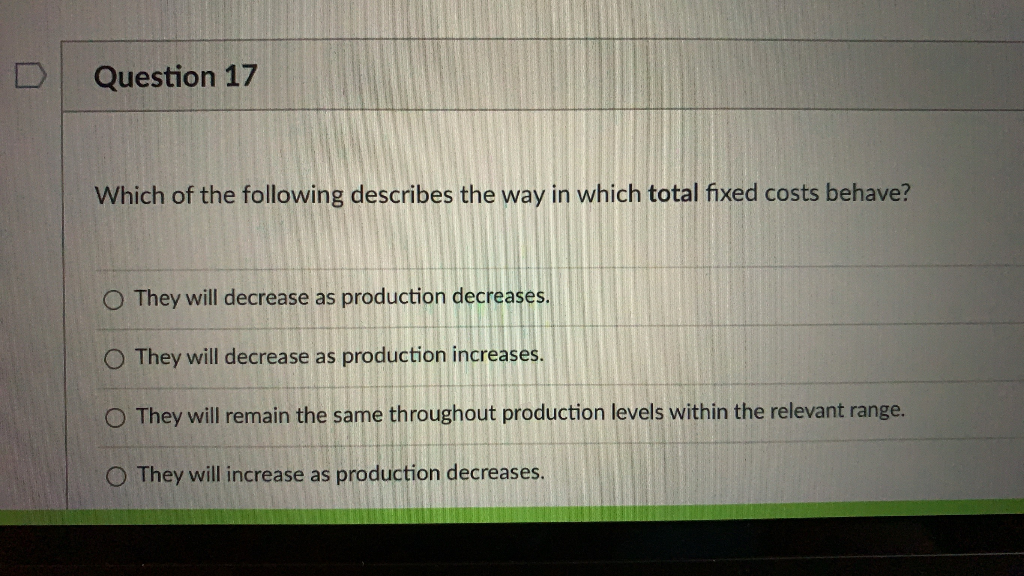

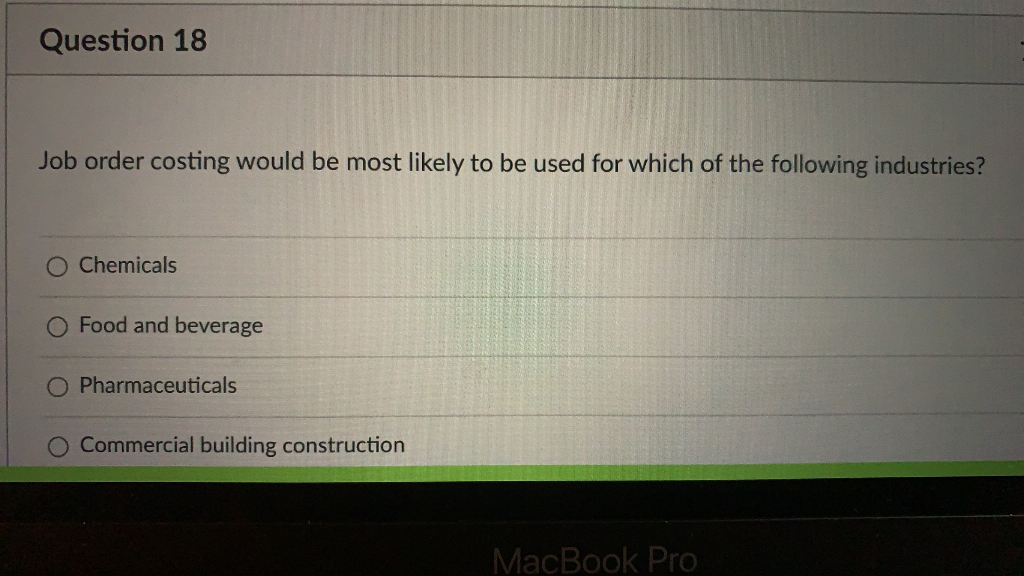

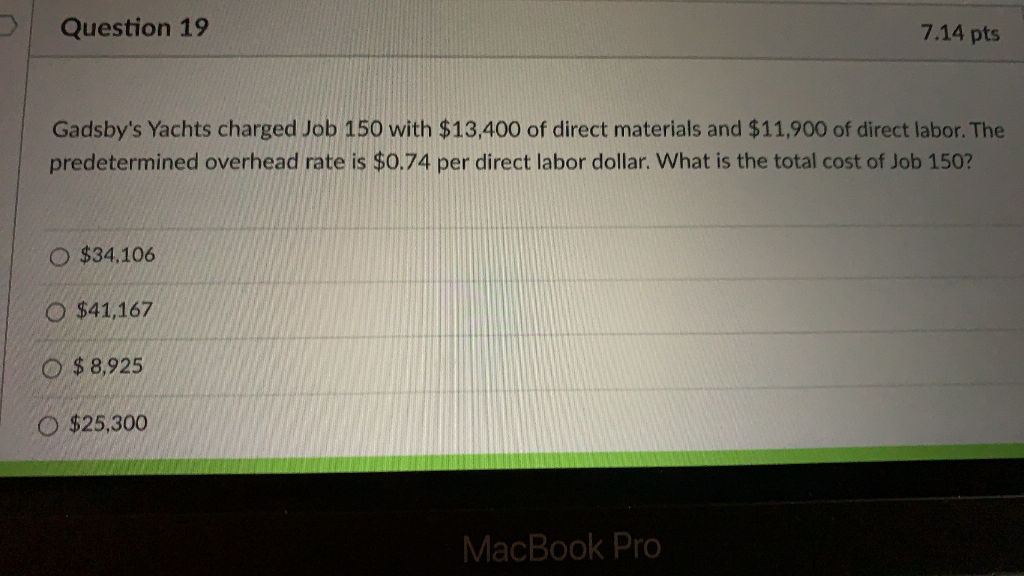

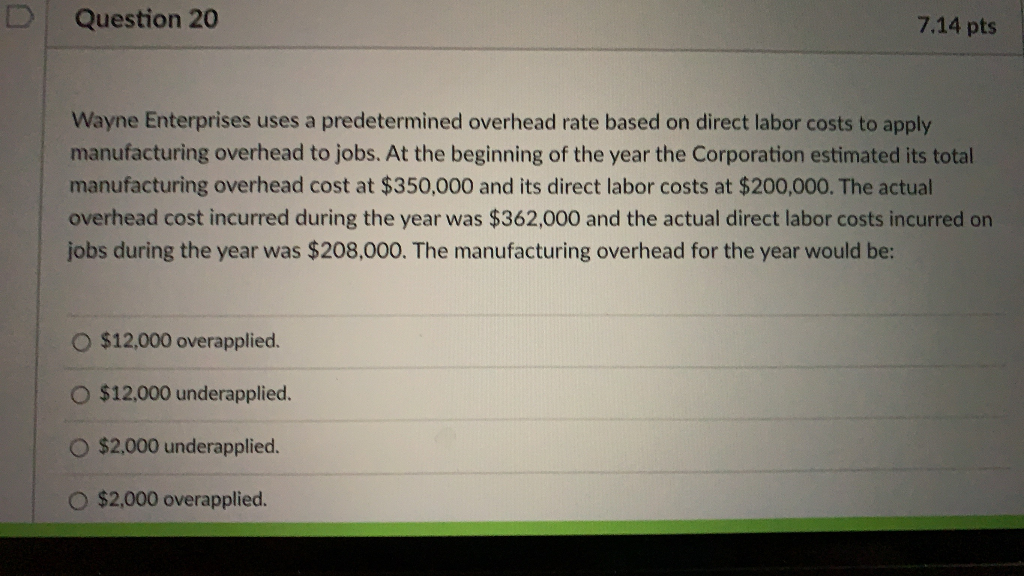

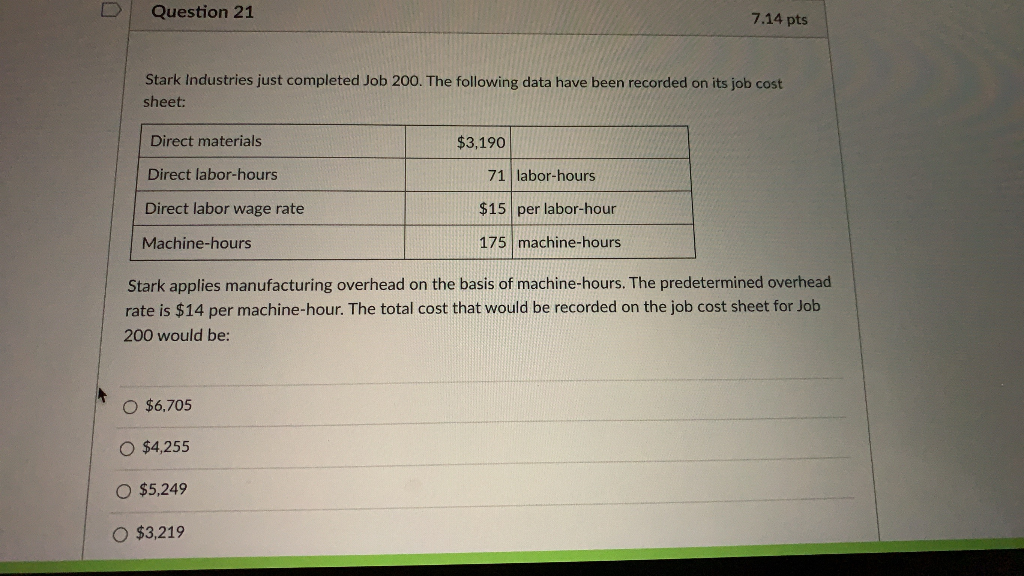

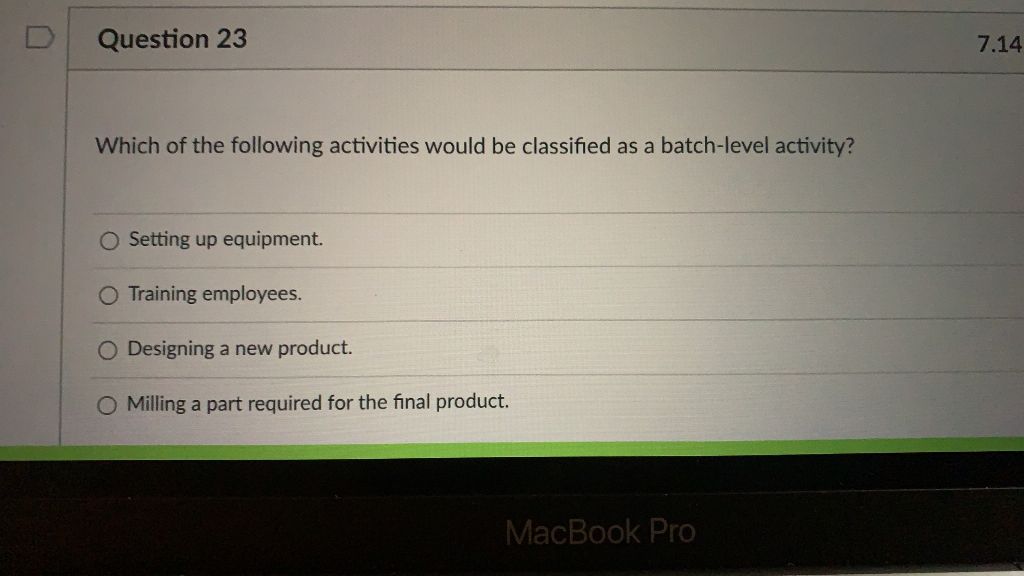

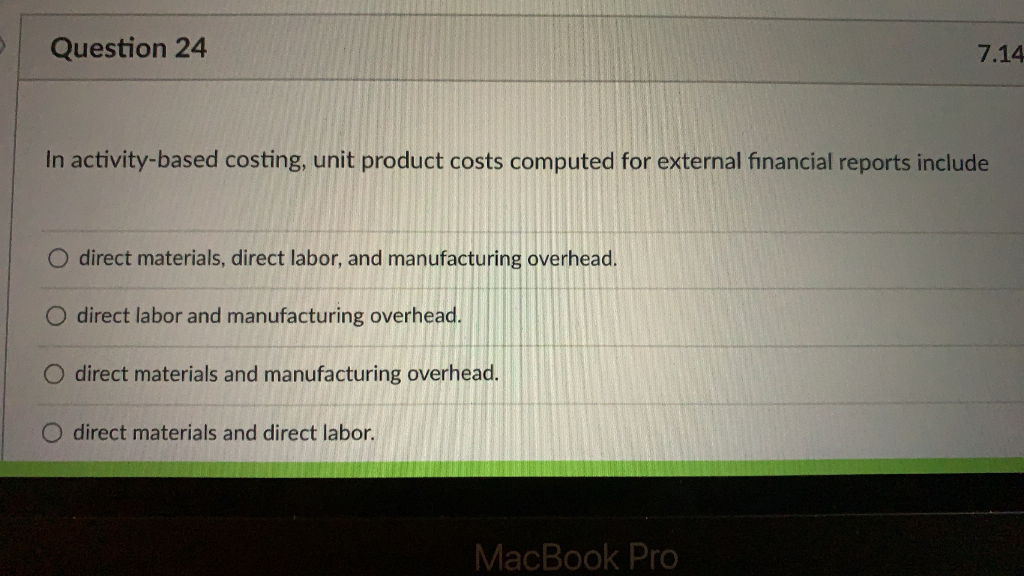

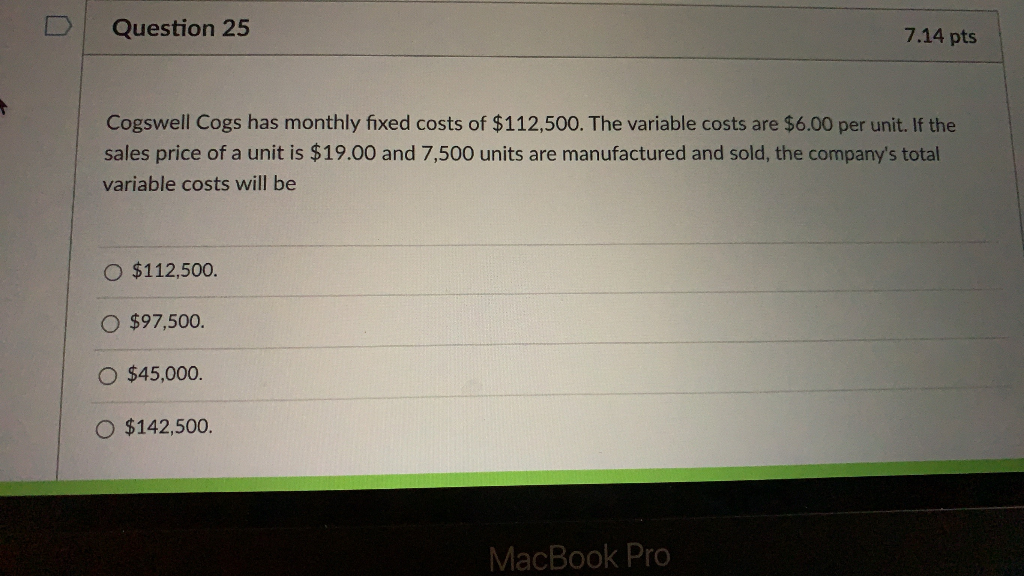

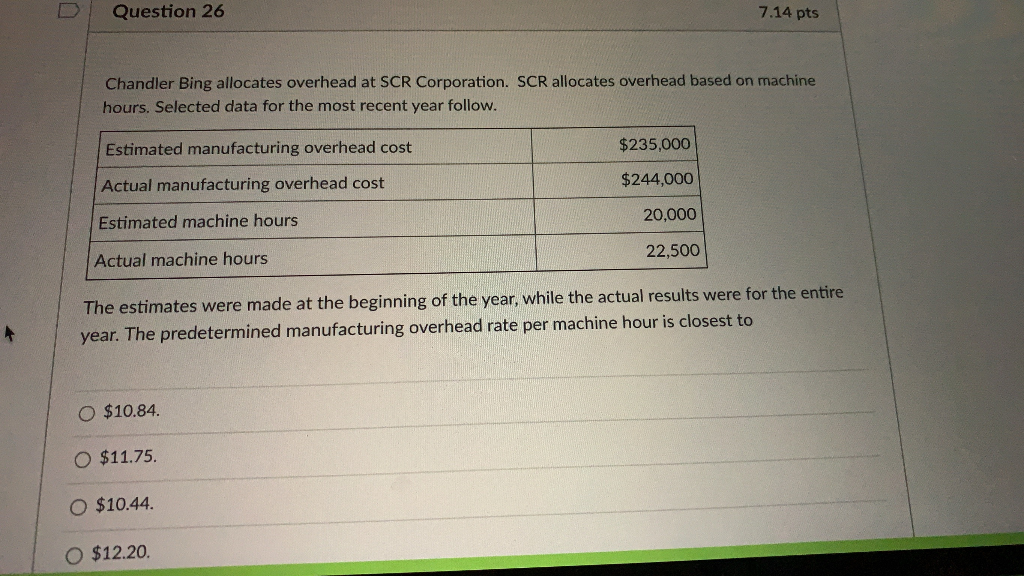

Question 16 7.14 pts Leo Bloom is classifying costs for 5th Avenue Manufacturing. Payroll costs for factory employees who do not work directly on the product would be considered O direct labor. O administrative costs. selling expenses. O manufacturing overhead. MacBook Pro D Question 17 Which of the following describes the way in which total fixed costs behave? O They will decrease as production decreases. O They will decrease as production increases. O They will remain the same throughout production levels within the relevant range. They will increase as production decreases. Question 18 Job order costing would be most likely to be used for which of the following industries? O Chemicals O Food and beverage Pharmaceuticals Commercial building construction MacBook Pro Question 19 7.14 pts Gadsby's Yachts charged Job 150 with $13,400 of direct materials and $11.900 of direct labor. The predetermined overhead rate is $0.74 per direct labor dollar. What is the total cost of Job 150? $34.106 O $41,167 O $ 8,925 O $25,300 MacBook Pro Question 20 7.14 pts Wayne Enterprises uses a predetermined overhead rate based on direct labor costs to apply manufacturing overhead to jobs. At the beginning of the year the Corporation estimated its total manufacturing overhead cost at $350,000 and its direct labor costs at $200,000. The actual overhead cost incurred during the year was $362,000 and the actual direct labor costs incurred on jobs during the year was $208,000. The manufacturing overhead for the year would be: O $12.000 overapplied. O $12,000 underapplied. $2,000 underapplied. O $2,000 overapplied. D Question 21 7.14 pts Stark Industries just completed Job 200. The following data have been recorded on its job cost sheet: Direct materials $3,190 Direct labor-hours 71 labor-hours Direct labor wage rate $15 per labor-hour Machine-hours 175 machine-hours Stark applies manufacturing overhead on the basis of machine-hours. The predetermined overhead rate is $14 per machine-hour. The total cost that would be recorded on the job cost sheet for Job 200 would be: O $6.705 $4,255 O $5,249 $3,219 Question 23 7.14 Which of the following activities would be classified as a batch-level activity? Setting up equipment. O Training employees. O Designing a new product. O Milling a part required for the final product. MacBook Pro Question 24 7.14 In activity-based costing, unit product costs computed for external financial reports include O direct materials, direct labor, and manufacturing overhead. O direct labor and manufacturing overhead. O direct materials and manufacturing overhead. direct materials and direct labor. MacBook Pro Question 25 7.14 pts Cogswell Cogs has monthly fixed costs of $112,500. The variable costs are $6.00 per unit. If the sales price of a unit is $19.00 and 7,500 units are manufactured and sold, the company's total variable costs will be $112,500. $97,500. $45,000. O $142,500. MacBook Pro Question 26 7.14 pts Chandler Bing allocates overhead at SCR Corporation. SCR allocates overhead based on machine hours. Selected data for the most recent year follow. Estimated manufacturing overhead cost $235,000 Actual manufacturing overhead cost $244,000 Estimated machine hours 20,000 22,500 Actual machine hours The estimates were made at the beginning of the year, while the actual results were for the entire year. The predetermined manufacturing overhead rate per machine hour is closest to O $10.84. O $11.75. O $10.44. $12.20