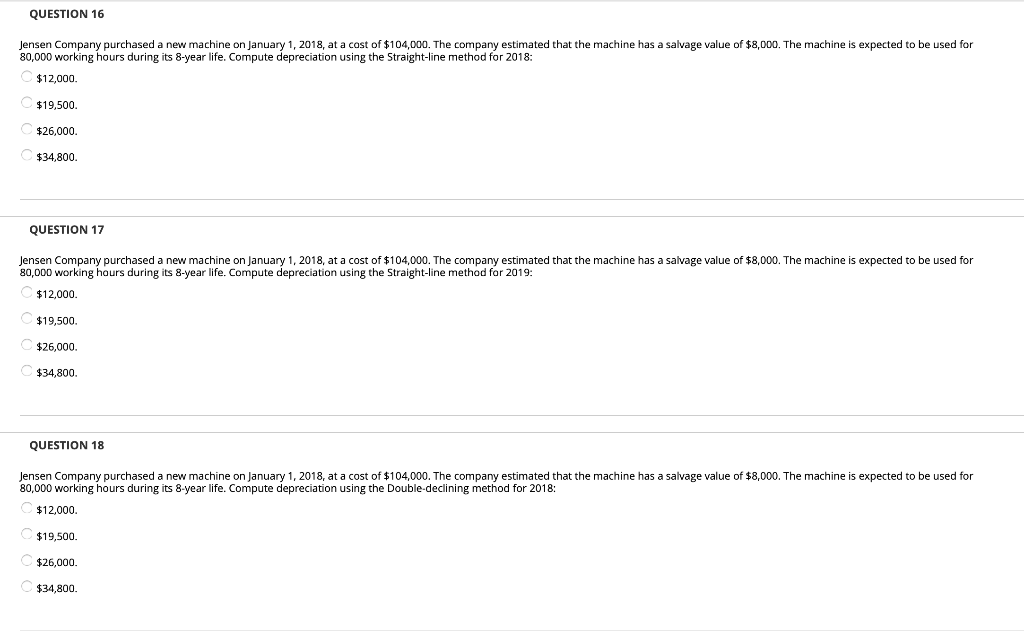

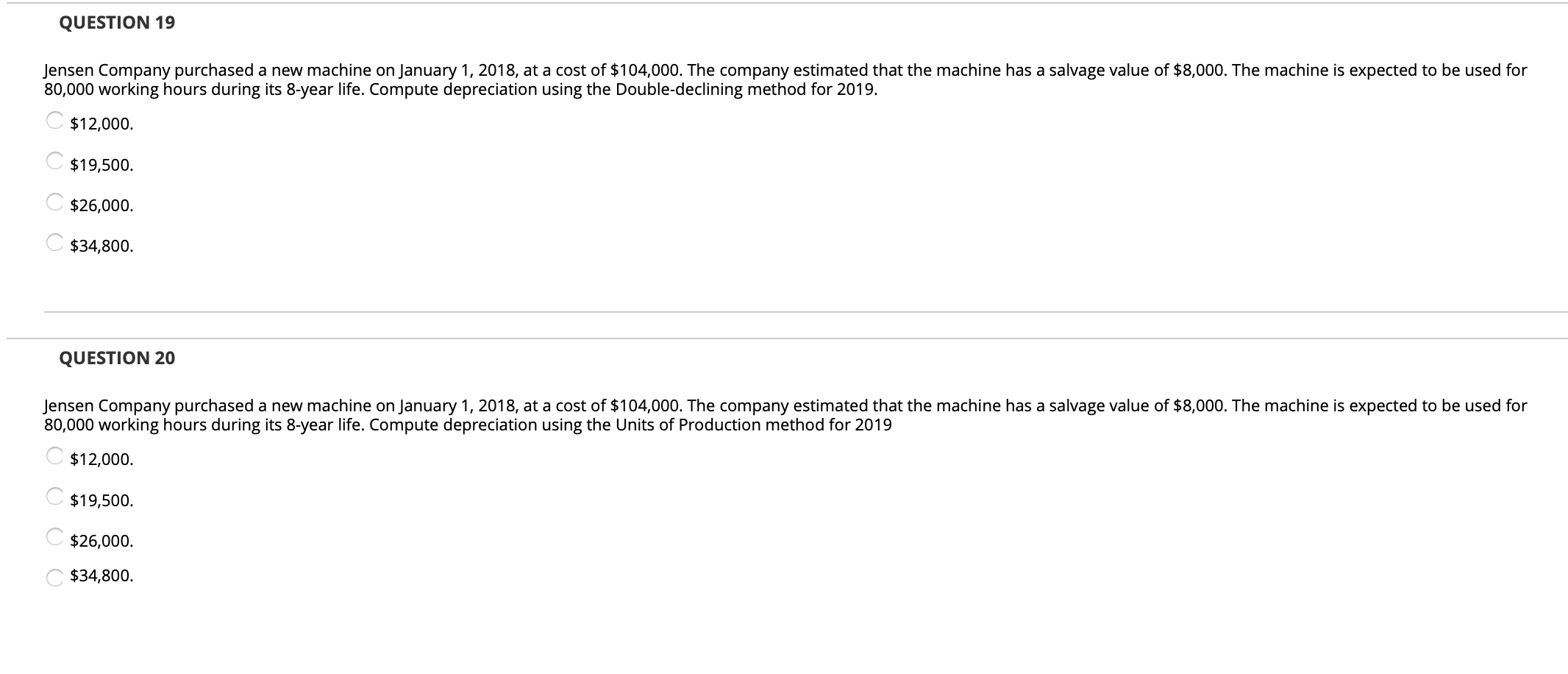

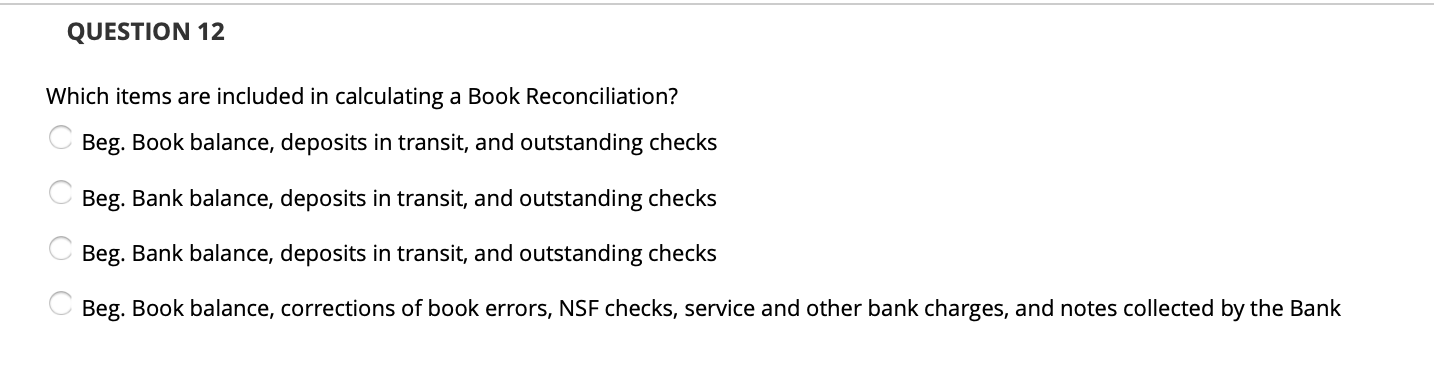

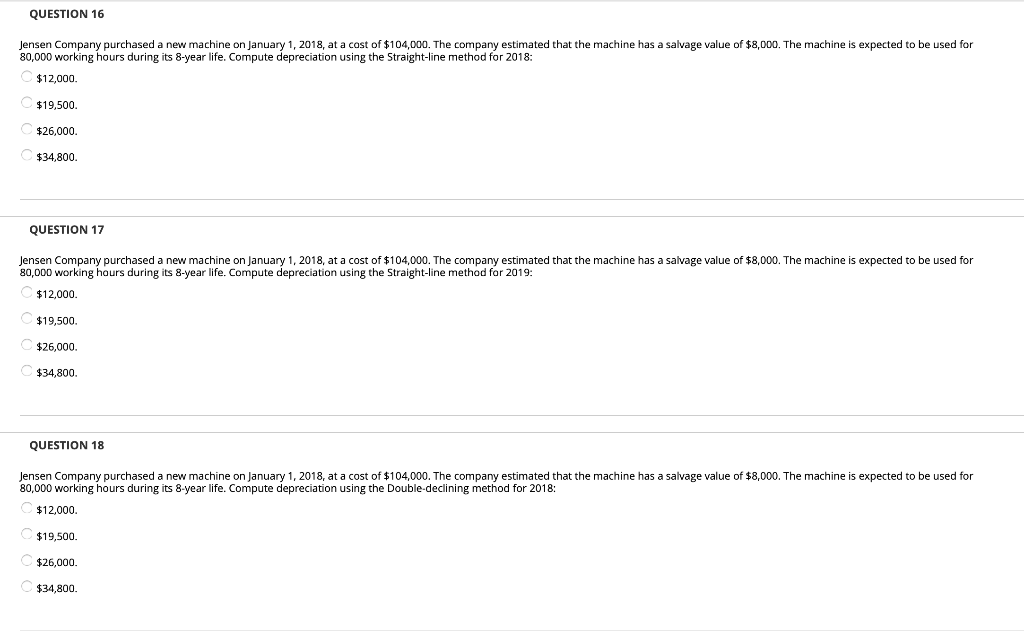

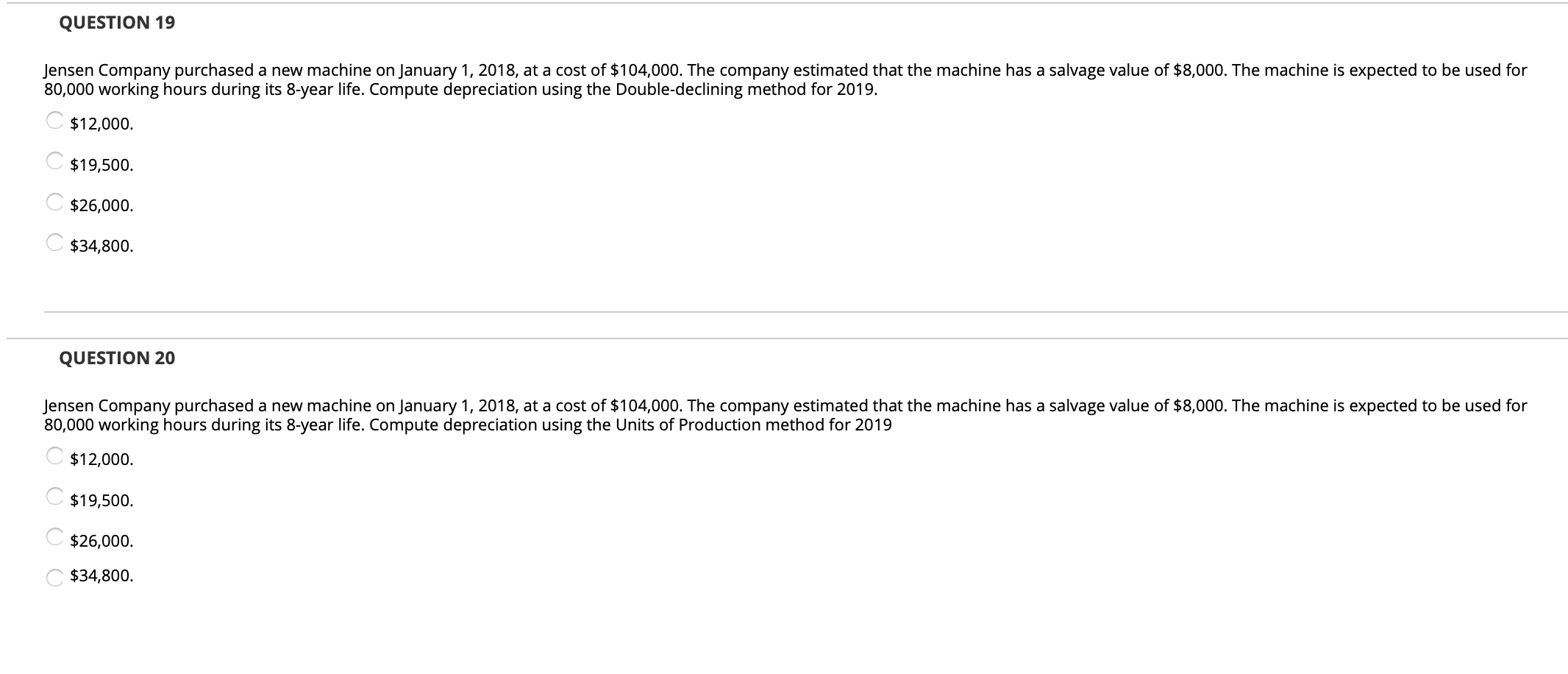

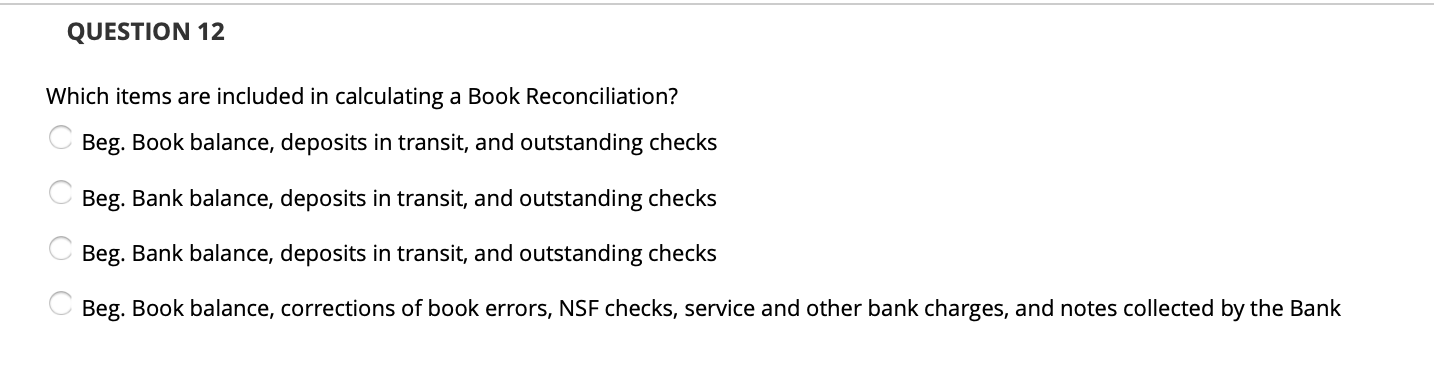

QUESTION 16 Jensen Company purchased a new machine on January 1, 2018, at a cost of $104,000. The company estimated that the machine has a salvage value of $8,000. The machine is expected to be used for 80,000 working hours during its 8-year life. Compute depreciation using the Straight-line method for 2018: $12,000 $19.500 $26,000 $34,800 QUESTION 17 expected to be used for Jensen Company purchased a new machine on January 1, 2018, at a cost of $104,000. The company estimated that the machine has a salvage value of $8,000. The machine i 80,000 working hours during its 8-year life. Compute depreciation using the Straight-line method for 2019: $12,000 $19,500. $26,000 $34,800. QUESTION 18 Jensen Company purchased a new machine on January 1, 2018, at a cost of $104,000. The company estimated that the machine has a salvage value of $8,000. The machine is expected to be used for 80,000 working hours during its 8-year life. Compute depreciation using the Double-declining method for 2018: $12,000. $19,500 $26,000 $34,800. QUESTION 19 Jensen Company purchased a new machine on January 1, 2018, at a cost of $104,000. The company estimated that the machine has a salvage value of $8,000. The machine is expected to be used for 80,000 working hours during its 8-year life. Compute depreciation using the Double-declining method for 2019. $12,000. $19,500. $26,000. $34,800. QUESTION 20 Jensen Company purchased a new machine on January 1, 2018, at a cost of $104,000. The company estimated that the machine has a salvage value of $8,000. The machine is expected to be used for 80,000 working hours during its 8-year life. Compute depreciation using the Units of Production method for 2019 $12,000. $19,500. C$26,000. $34,800. QUESTION 12 Which items are included in calculating a Book Reconciliation? Beg. Book balance, deposits in transit, and outstanding checks Beg. Bank balance, deposits in transit, and outstanding checks Beg. Bank balance, deposits in transit, and outstanding checks Beg. Book balance, corrections of book errors, NSF checks, service and other bank charges, and notes collected by the Bank QUESTION 13 Facts: D. J. Hunter's checkbook lists the following: Date Check No. Item Check Deposit Balance 622 $ 30 $ 110 6/1 4 9 13 14 18 26 28 30 623 624 625 626 627 Art Cafe Dividends received General Tire Co. QuickMobil Cash Woodway Baptist Church Bent Tree Apartments Paycheck 35 68 SS 85 285 $ 525 495 605 570 502 447 362 77 1,287 1,210 The June bank statement shows: Balance Add: Deposits Debit checks: $525 110 No. 622 623 Amount $30 35 86 624 625 55 (206) Other charges: NSF check Service charge ..... Balance $20 10 (30) $399 This is the correct amount for check number 624. Hunter's Adjusted Bank Balance as of June 30 is: $1287 $1239 $1305 $1609 QUESTION 14 Facts: D. J. Hunter's checkbook lists the following: Date Check No. Item Check Deposit Balance 622 $ 30 $ 110 6/1 4 9 13 14 18 26 28 30 623 624 625 626 627 Art Cafe Dividends received General Tire Co. QuickMobil Cash Woodway Baptist Church Bent Tree Apartments Paycheck 35 68 55 85 285 $ 525 495 605 570 502 447 362 77 1,287 1,210 The June bank statement shows: Balance Add: Deposits Debit checks: $525 110 No. 622 623 624 625 Amount $30 35 86 55 (206) Other charges: NSF check Service charge Balance $20 10 (30) $399 This is the correct amount for check number 624. Hunter's Adjusted Bank Balance as of June 30 is: $399 $869 $1239 C$1287 QUESTION 34 Tomlinson Packaging Corporation began business in 2018 by issuing 30,000 shares of $5 par common stock for $8 per share and 5,000 shares of 6%, $10 par preferred stock for par. At year end, the common stock had a market value of $10. On its December 31, 2019 balance sheet, Tomlinson Packaging would report C Common Stock of $300,000. C Common Stock of $150,000. Common Stock of $240,000. C Paid-in Capital of $200,000. QUESTION 35 Holden Packaging Corporation began business in 2018 by issuing 80,000 shares of $5 par common stock for $8 per share and 20,000 shares of 6%, $10 par preferred stock for par. At year end, the common stock had a market value of $10. On its December 31, 2019 balance sheet, Holden Packaging would report Common Stock of $800,000. Common Stock of $400,000. Common Stock of $640,000. C Paid-In Capital of $600,000. QUESTION 39 Retro Company is authorized to issue 10,000 shares of 8%, $100 par value preferred stock and 500,000 shares of no-par common stock with a stated value of $1 per share. If Retro issues 5,000 shares of common stock to pay its recent attorney's bill of $25,000 for legal services on a land access dispute, which of the following would be the best journal entry for Retro to record? C Legal Expense 5,000 Common Stock 5,000 Legal Expense 25,000 Common Stock 25,000 O Legal Expense 25,000 Common Stock Paid-in Capital in Excess of Stated Value - Common 5,000 20,000 Legal Expense 25,000 Common Stock Paid-in Capital in Excess of Par value - Common 5,000 20,000 QUESTION 60 Identify the effect the declaration of a stock dividend has on the par value per share and book value per share. Par Value per Share Book Value per Share Increase Decrease Par Value per Share No effect Book Value per Share Increase Par Value per Share Decrease Book Value per Share Decrease Par Value per Share No effect Book Value per Share Decrease