Question #16 please show work PAR r S Capital Budgeting Whichever project you choose, if any. you require a return of 13 percent on your

Question #16 please show work

Question #16 please show work

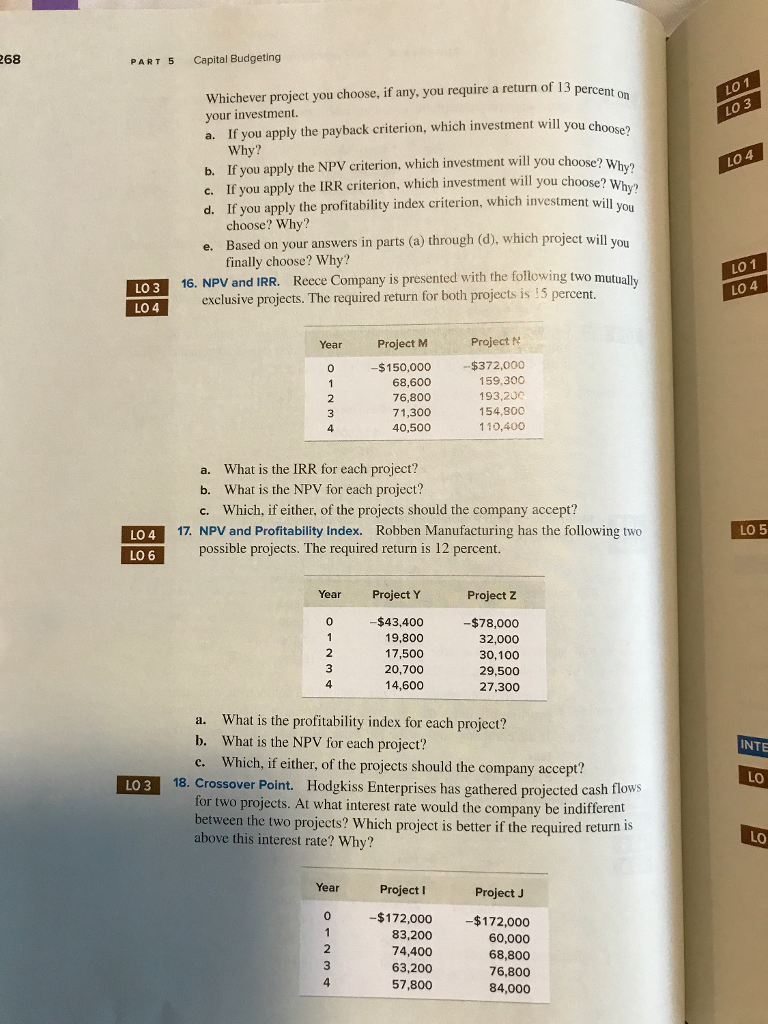

PAR r S Capital Budgeting Whichever project you choose, if any. you require a return of 13 percent on your investment. a. If you apply the payback criterion, which investment will you Why? b. If you apply the NPV criterion, which investment will you choose? Why? c. If you apply the IRR criterion. which investment will you choose? Why d. If you apply the profitability index criterion, which investment will you choose? Why? e. Based on your answers in parts (a) through (d). which project will you finally choose? Why? 16. NPV and IRR. Reece Company is presented with the foncwing two mutually exclusive pmjects. required leturn for lyoth projects is percent. Year Project M -5150.000 68.600 76.800 71.300 40.500 a. What is the IRR [or each project? b. What is the NPV for each project? Project N -$372.coc 1 10,400 c. Which, if either. of the projects should the company accept? 17. NPV and Profitability Index. Roblkn Manufacturing has the following two possible projects. The required return is 12 percent. Year project Y 3 -$43,400 19,800 17.500 20.700 14,600 Project Z 478.000 32,000 30.100 29.500 27.300 a. What is the profitability index for each project? b. What is the NPV for each project? c. Which, if either, of the projects should the company accept? 18 Cmssover Point. Hodgkiss Enterprises has gathered projected cash flows for two projects. At what interest rate would the company be indifferent between the two projects? Which pmject is better if the required return is above this interest rate? Why? o 2 3 4 Pr*ct -$172000 83.200 74,400 63.200 57,800 Project J $172000 60,000 68,800 76.800 84,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started