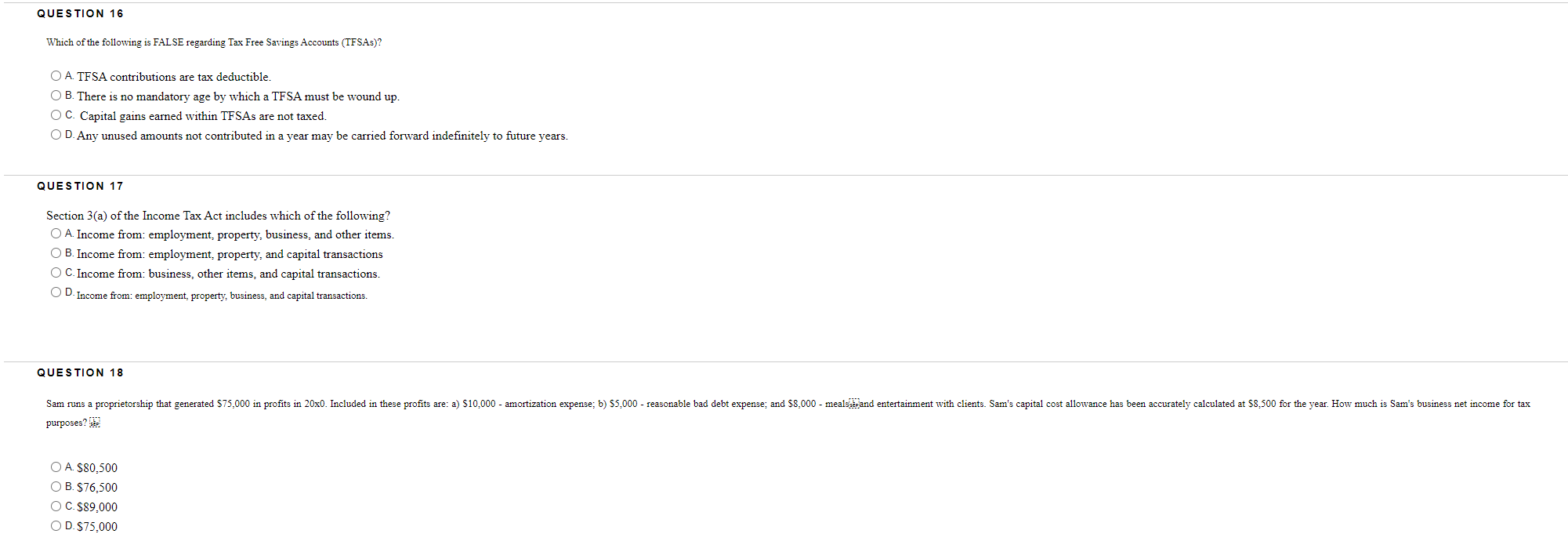

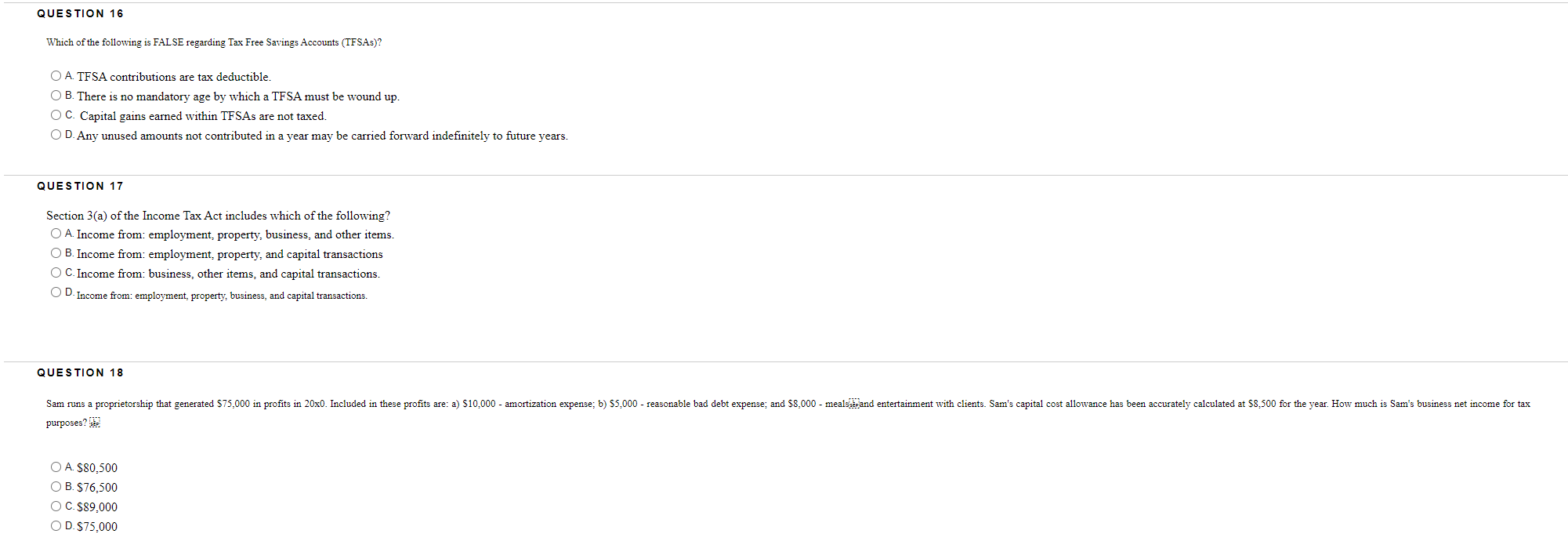

QUESTION 16 Which of the following is FALSE regarding Tax Free Savings Accounts (TFSAs)? O A. TFSA contributions are tax deductible. OB. There is no mandatory age by which a TFSA must be wound up. O C. Capital gains earned within TFSAs are not taxed. O D. Any unused amounts not contributed in a year may be carried forward indefinitely to future years. QUESTION 17 Section 3(a) of the Income Tax Act includes which of the following? O A. Income from: employment, property, business, and other items. O B. Income from: employment, property, and capital transactions OC. Income from: business, other items, and capital transactions. D.Income from: employment, property, business, and capital transactions. QUESTION 18 Sam runs a proprietorship that generated $75,000 in profits in 20x0. Included in these profits are: a) $10,000 - amortization expense; b) 55,000 - reasonable bad debt expense; and $8,000 - meals and entertainment with clients. Sam's capital cost allowance has been accurately calculated at $8,500 for the year. How much is Sam's business net income for tax purposes? O A $80.500 OB. $76,500 O C. $89.000 OD. $75,000 QUESTION 16 Which of the following is FALSE regarding Tax Free Savings Accounts (TFSAs)? O A. TFSA contributions are tax deductible. OB. There is no mandatory age by which a TFSA must be wound up. O C. Capital gains earned within TFSAs are not taxed. O D. Any unused amounts not contributed in a year may be carried forward indefinitely to future years. QUESTION 17 Section 3(a) of the Income Tax Act includes which of the following? O A. Income from: employment, property, business, and other items. O B. Income from: employment, property, and capital transactions OC. Income from: business, other items, and capital transactions. D.Income from: employment, property, business, and capital transactions. QUESTION 18 Sam runs a proprietorship that generated $75,000 in profits in 20x0. Included in these profits are: a) $10,000 - amortization expense; b) 55,000 - reasonable bad debt expense; and $8,000 - meals and entertainment with clients. Sam's capital cost allowance has been accurately calculated at $8,500 for the year. How much is Sam's business net income for tax purposes? O A $80.500 OB. $76,500 O C. $89.000 OD. $75,000