Question

Question 16-20 On December 31, Year 1 and Year 2, Smith Company had the following defined benefit pension plan balances Fair value of plan assets

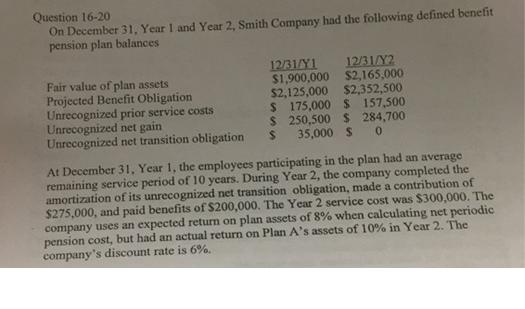

Question 16-20 On December 31, Year 1 and Year 2, Smith Company had the following defined benefit pension plan balances Fair value of plan assets Projected Benefit Obligation Unrecognized prior service costs Unrecognized net gain Unrecognized net transition obligation 12/31/Y112/3/Y2 $1,900,000 $2,165,000 $2,125,000 $2,352,500 S 175,000 157,500 S 250,500 284,700 35,000 0 At December 31, Year 1, the employees participating in the plan had an average remaining service period of 10 years. During Year 2, the company completed the amortization of its unrecognized net transition obligation, made a contribution of $275,000, and paid benefits of $200,000. The Year 2 service cost was $300,000. The company uses an expected return on plan assets of 8% when calculating net periodic pension cost, but had an actual return on Plan A's assets of 10% in Year 2, The company's discount rate is 6%.

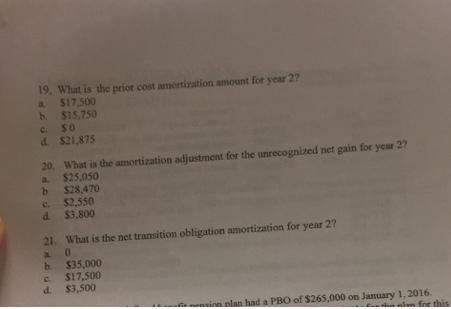

19. What is the prior cost amortization amount for year 2? a. $17,500 b. $ $15,750 c. $0 d. $21,875

20. What is the amortization adjustments for the unrecognized net gain for year 2? a. $25,050 b. $28,470 c. $2,550 d. $3,800

21. What is the net transition obligation amortization for year 2' a. $0 b. $35,000 c. $17,500 d. $.3,500"

Questions 19 to 21 needed

Question 16-20 On December 31, Year 1 and Year 2, Smith Company had the following defined benefit pension plan balances Fair value of plan assets Projected Benefit Obligation Unrecognized prior service costs Unrecognized net gain Unrecognized net transition obligation $2,165,000 DBUYI12/31/Y2 $1,900,000 $2,125,000 $2,352,500 $ 175,000 $ 157,500 250,500 $ 284,700 35,000 S $ 0 $ At December 31, Year 1, the employees participating in the plan had an average remaining service period of 10 years. During Year 2, the company completed the amortization of its unrecognized net transition obligation, made a contribution of $275,000, and paid benefits of $200,000. The Year 2 service cost was $300,000. The company uses an expected return on plan assets of 8% when calculating net periodic pension cost, but had an actual return on Plan A's assets of 10% in Year 2. The company's discount rate is 6%.

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Solution Note All are individual questions Although four parts h...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started