Answered step by step

Verified Expert Solution

Question

1 Approved Answer

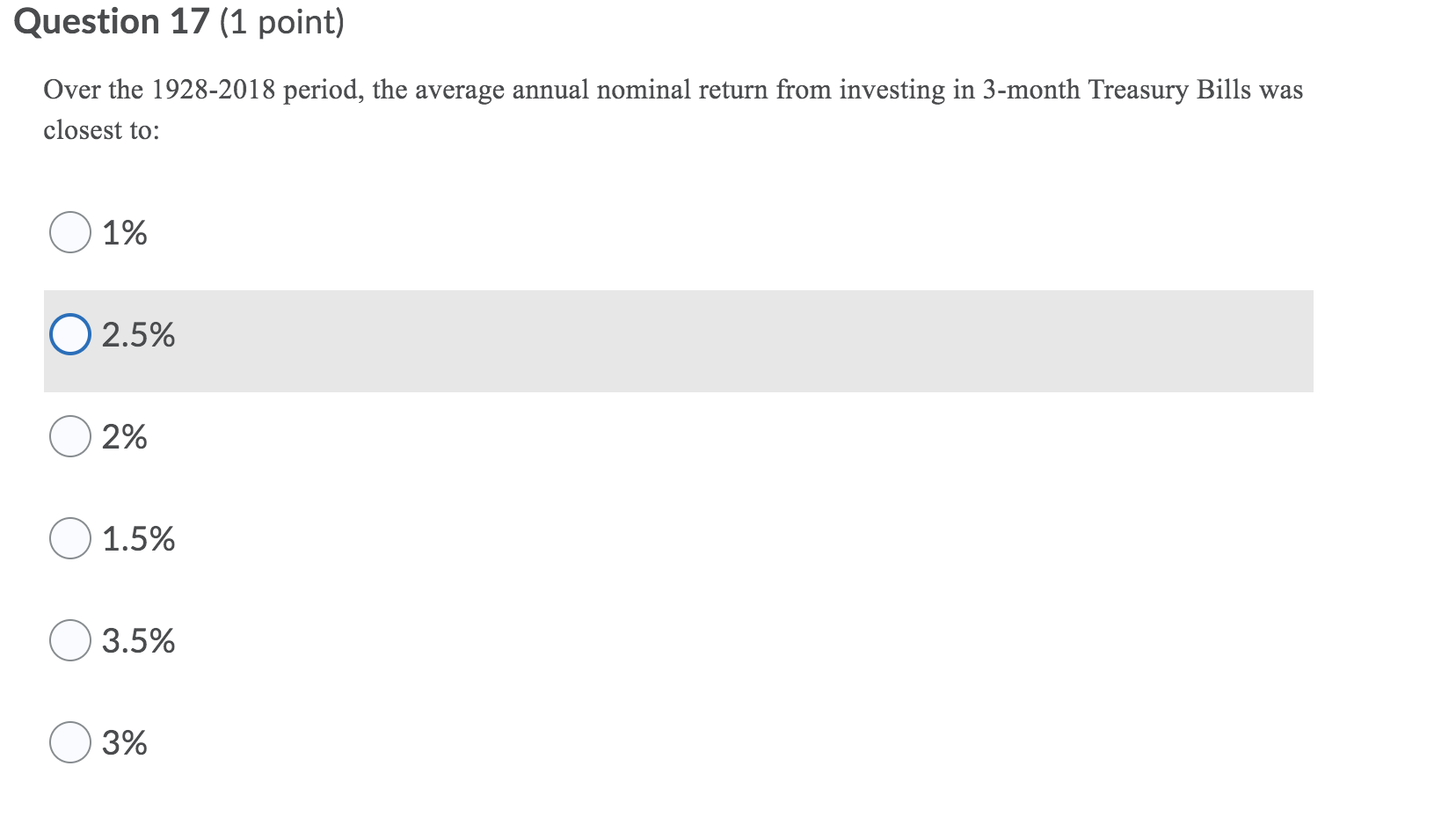

Question 17 (1 point) Over the 1928-2018 period, the average annual nominal return from investing in 3-month Treasury Bills was closest to: 1% O 2.5%

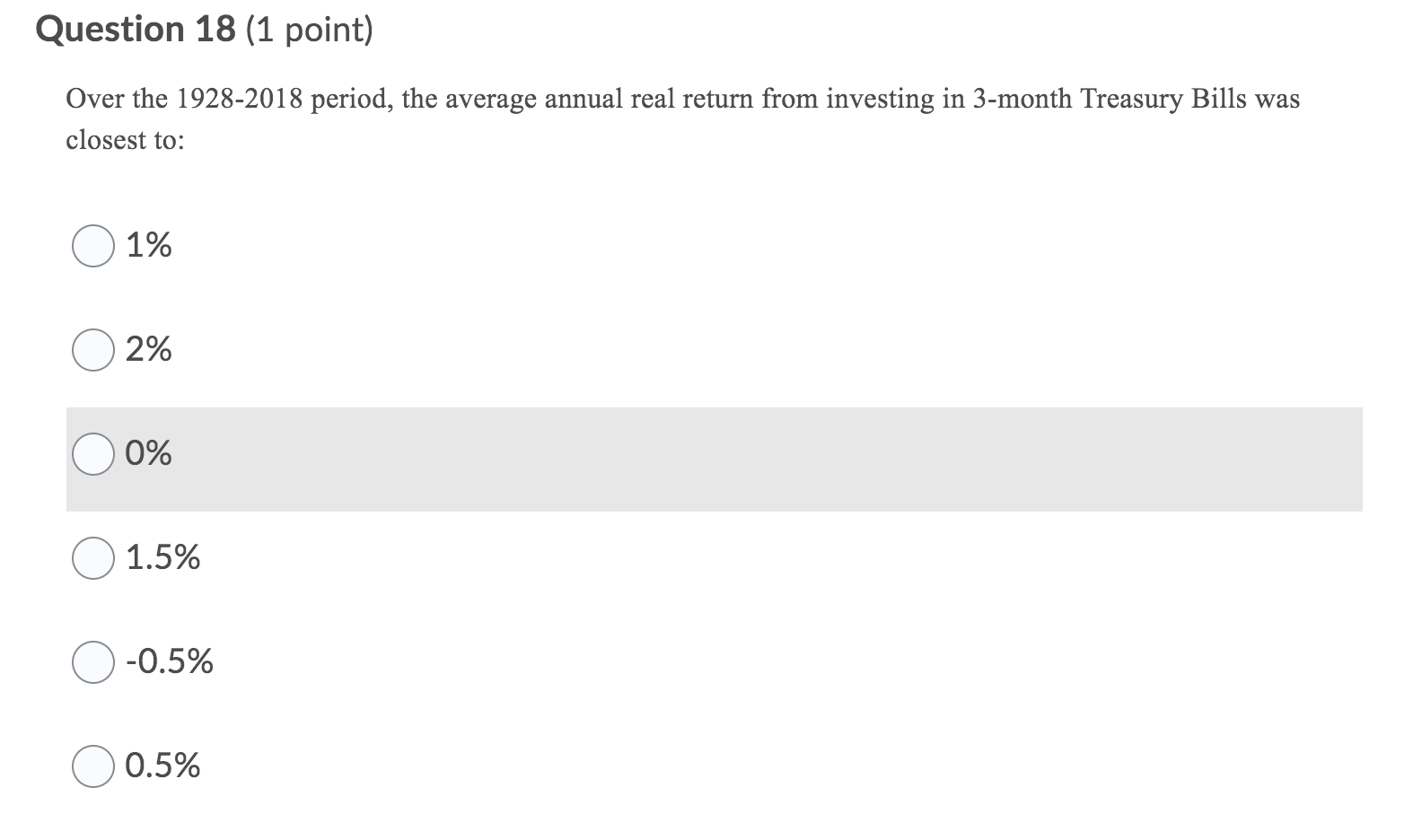

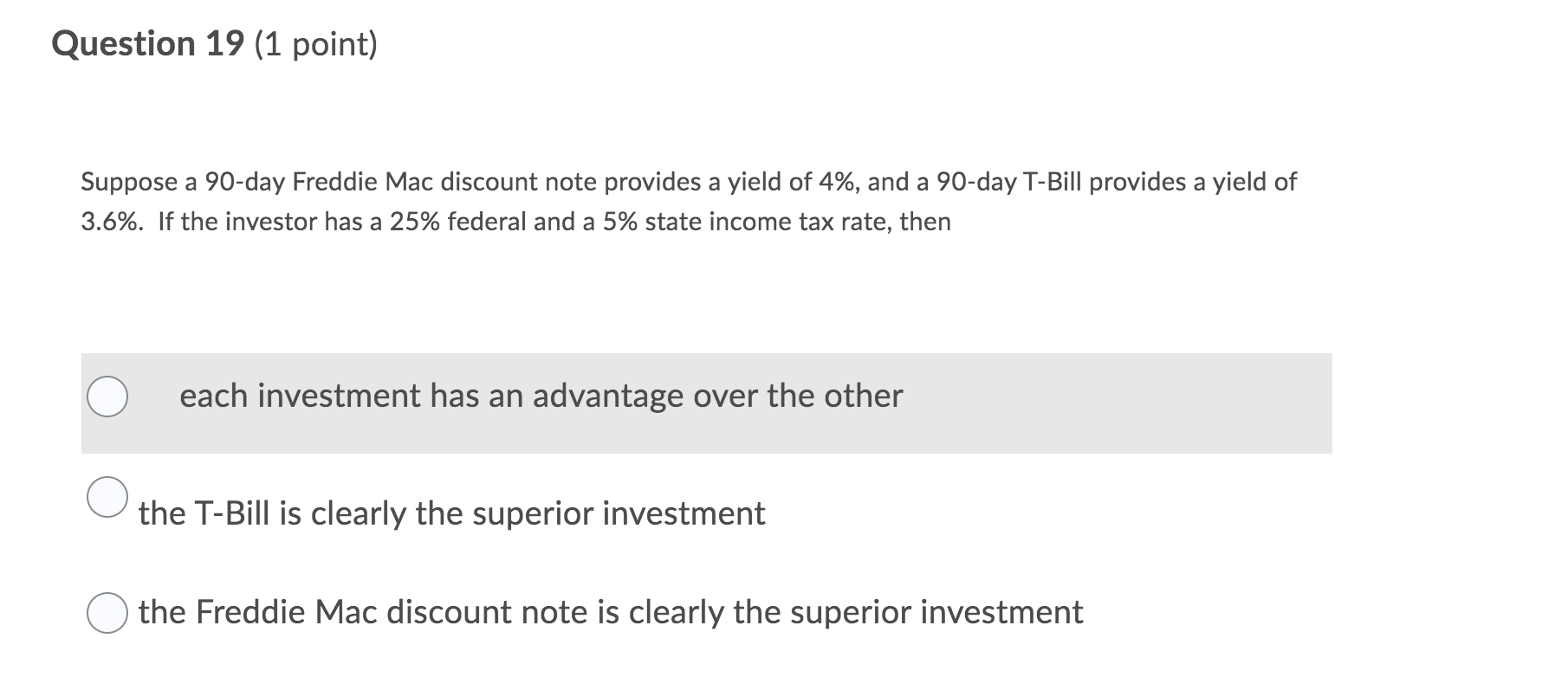

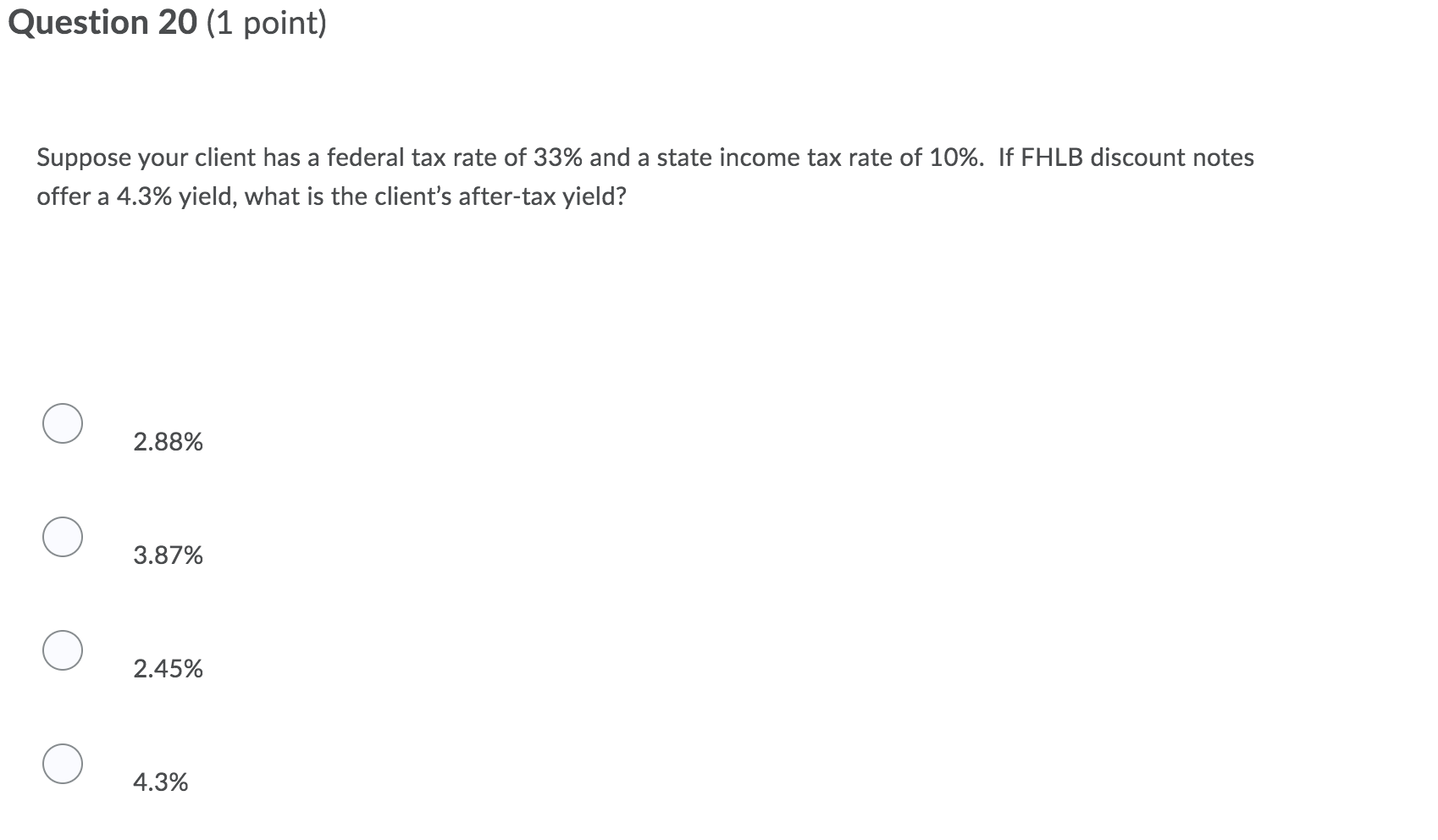

Question 17 (1 point) Over the 1928-2018 period, the average annual nominal return from investing in 3-month Treasury Bills was closest to: 1% O 2.5% 2% 1.5% 3.5% 3% Question 18 (1 point) Over the 1928-2018 period, the average annual real return from investing in 3-month Treasury Bills was closest to: 1% 2% 0% 1.5% -0.5% 0.5% Question 19 (1 point) Suppose a 90-day Freddie Mac discount note provides a yield of 4%, and a 90-day T-Bill provides a yield of 3.6%. If the investor has a 25% federal and a 5% state income tax rate, then each investment has an advantage over the other the T-Bill is clearly the superior investment the Freddie Mac discount note is clearly the superior investment Question 20 (1 point) Suppose your client has a federal tax rate of 33% and a state income tax rate of 10%. If FHLB discount notes offer a 4.3% yield, what is the client's after-tax yield? 2.88% 3.87% 2.45% 4.3%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started