Answered step by step

Verified Expert Solution

Question

1 Approved Answer

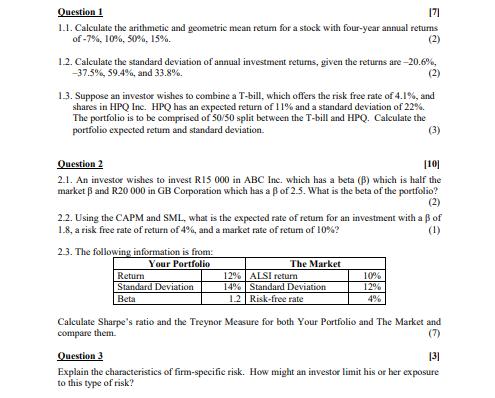

Question [17] 1.1. Calculate the arithmetic and geometric mean retum for a stock with four-year annual returns of -7%, 10%, 50%, 15%. (2) 1.2.

Question [17] 1.1. Calculate the arithmetic and geometric mean retum for a stock with four-year annual returns of -7%, 10%, 50%, 15%. (2) 1.2. Calculate the standard deviation of annual investment returns, given the returns are -20.6%, -37.5%, 59.4%, and 33.8%. (2) 1.3. Suppose an investor wishes to combine a T-bill, which offers the risk free rate of 4.1%, and shares in HPQ Inc. HPQ has an expected return of 11% and a standard deviation of 22%. The portfolio is to be comprised of 50/50 split between the T-bill and HPQ. Calculate the portfolio expected retum and standard deviation. Question 2 (3) [10] 2.1. An investor wishes to invest R15 000 in ABC Inc. which has a beta (B) which is half the market and R20 000 in GB Corporation which has a of 2.5. What is the beta of the portfolio? (2) 2.2. Using the CAPM and SML, what is the expected rate of retum for an investment with a of 1.8, a risk free rate of return of 4%, and a market rate of return of 10%? 2.3. The following information is from: (1) Your Portfolio Return Standard Deviation Beta The Market 12% ALSI return 10% 14% Standard Deviation 12% 1.2 Risk-free rate 4% Calculate Sharpe's ratio and the Treynor Measure for both Your Portfolio and The Market and compare them. Question 3 (7) [3] Explain the characteristics of firm-specific risk. How might an investor limit his or her exposure to this type of risk?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started