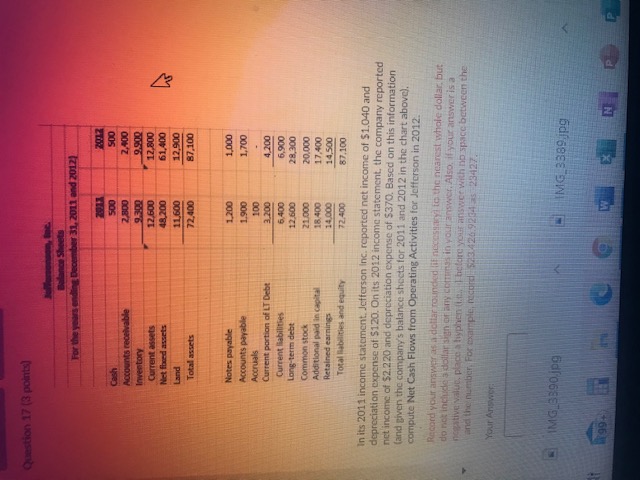

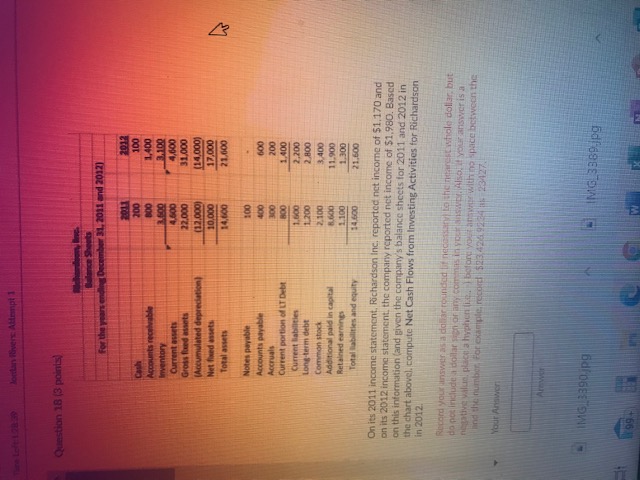

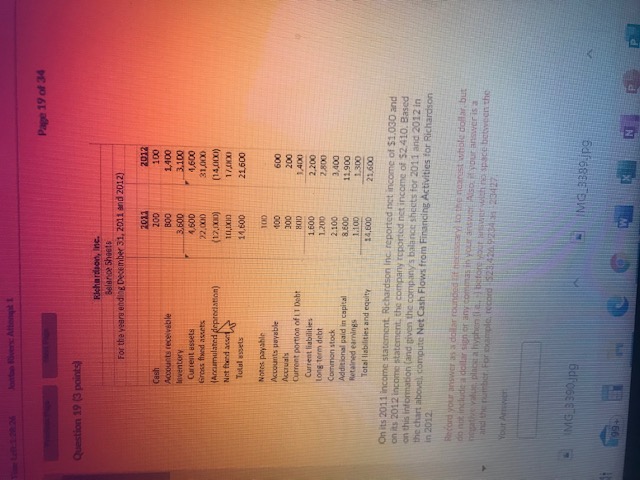

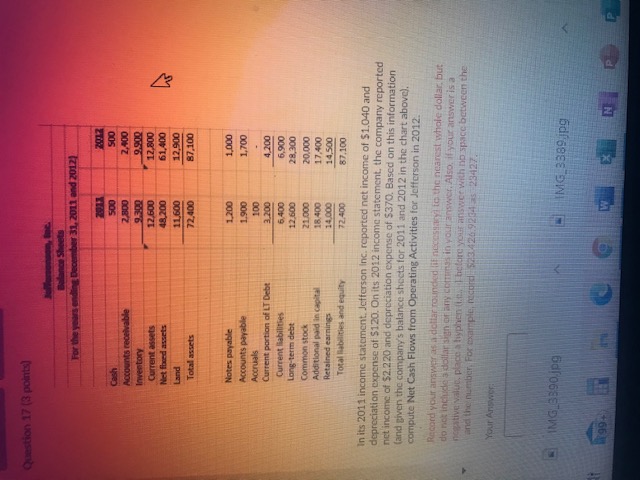

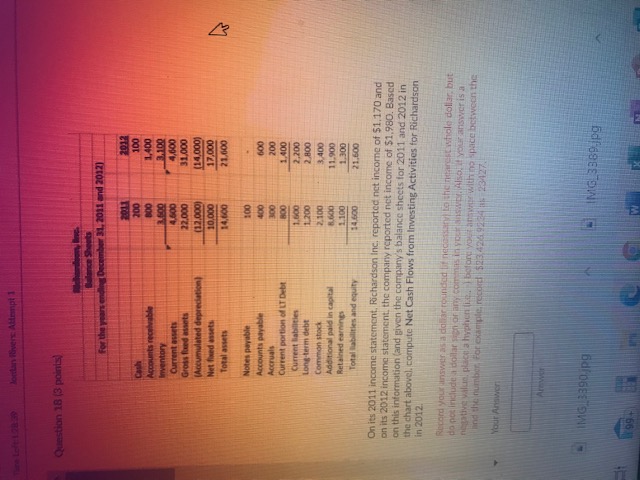

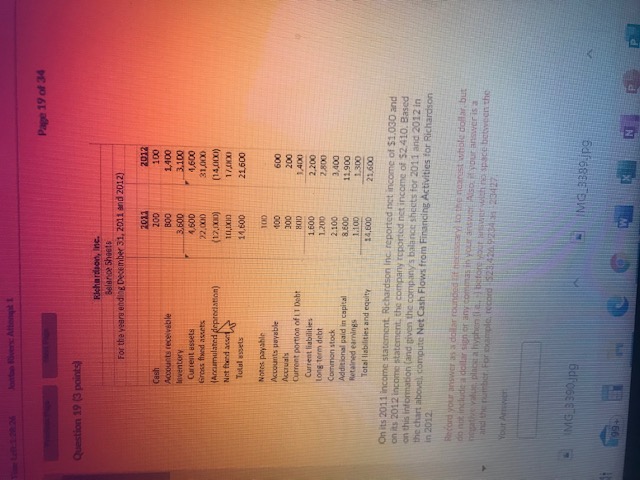

Question 17 (3 points) one Balance Sheets For the years ending December 31, 2011 and 2012) Cash Accounts receivable Inventory Current assets Net feed assets Land Total assets 500 2 800 9.300 12,600 48,200 11.600 72.400 2012 SOO 2.400 9.900 12.800 61,400 12,900 87,100 Notes payable 1.200 1,000 Accounts payable 1.900 1,700 Accruals 100 Current portion of LT Debt 3.200 4.200 Current liabilities 6.400 6.900 Long-term debt 12.600 28,300 Common stock 21.000 20.000 Additional paid in capital 18.400 17.400 Retained earning 14.000 14,500 Total abilities and equity 72.400 87.100 In its 2011 income statement. Jefferson Inc. reported net income of $1.040 and depreciation expense of $120. On its 2012 income statement, the company reported net income of $2.2 20 and depreciation expense of $370. Based on this information (and given the company's balance sheets for 2011 and 2012 in the chart above). compute Net Cash Flows from Operating Activities for Jefferson in 2012. Record your answer as a dollar rounded into the nearest whole dollar, but do not includes dollar sign or any comes in your answer. Also, if your answer is a native value place atyphen I heard your answer with no space between the and the number. For example, record 2.3.426.928423427 Your Arower IMG_3590.jpg IMG_3389.jpg 199+ Question 18 (3 points) De Balance Sheets for the years and December 31, 2011 and 2012) Cash Accounts receivable Inventory Current assets Gross feeds (Accumulated depreciation Net fixed assets Total assets 2011 200 BOO 3600 4.600 22.000 (12.000) 10.000 14.000 2012 100 1.400 3.100 4,600 31,000 (14,000) 17.000 21.000 w Notes payable 100 Accounts payable 400 600 Accruals 300 200 Current portion of LT Debt 800 1.400 Current liabilities 1.600 2.200 Long-term debt 1.200 2,800 Common stock 2.100 3.400 Additional in capital 8.600 11.900 Retained earnings 2.100 1.300 Total abilities and equity 14.600 21.600 Onits 2011 income statement, Richardson Inc, reported net income of $1.170 and on its 2012 income statement, the company reported not income of $1.980. Based on this information and given the company's balance sheets for 2011 and 2012 in the chart abovel.compute Net Cash Flows from Investing Activities for Richardson in 2012 Record your inswer as a dal rounded if necessary the nearest whole dollar but do not include a dolls or any comes in you. Also it your answer is a negative value place a hyphen before you with a space between the ind the number for example, record $2342692423427 Your Answer IMG_3390.jpg IMG_3389.JPG 99 Joten Allegati Page 19 of 34 Question 19 (3 points Richardson, Inc. Belanda Shoes For the year ending December 31, 2011 and 2012) Cash Accounts receivable Inventory Current assets Gros fundaskets Acumulated depreciation) Netheda Tutalets 2011 200 300 3.600 4.600 22.000 (17,1%) 10X 11,600 2012 100 1,400 3.100 4,600 31,000 (14,0001) 1740 21,600 Noite payable 100 Accounts payable 100 600 Accruals 300 200 Current portion of Debt H00 1,400 Current liabilities 1.600 2.200 Long term debt 1.200 2.800 Common stock 2.100 3,400 Additional paid in capital 8.50D 11,900 Retained earnings 1.100 1.300 Total liabilities and equity 14.000 21,600 On its 2011 income statement. Richardson Inc. reported net income of $1.030 and on its 2012 income statement the company reported net income of $2.410. Based on this information and given the company's balance sheets for 2011 and 2012 in the chart abovel compute Net Cash Flows from Financing Activities for Richardson in 2012 Hecord your answers adolar rounded it sary to the nearest whole darbus do not include a delar sign or any coas your ans Also your answer is a Vocalyphen before watch no space between the and the bet For comple, record 523.4209234 23427 Yout IMG_3390pg MG.1389.jpg 199