Question

Question 17 (6 marks) On 21 June 20x1, the Large Mart store in Armidale purchased a new company car for its customer service department (called

Question 17 (6 marks)

On 21 June 20x1, the Large Mart store in Armidale purchased a new company car for its customer service department (called the "Nerd Herd"). The car costs $60,000 and was purchased from Coffs Harbour Car Sales. When purchasing the car, Large Mart took out a 1 year comprehensive insurance policy with NRMA insurance for a cost of $2,000. The invoice for the car allows Large Mart to deduct 5% of the cost of the car if the invoice is paid within 10 days.

On 23 July 20x1, Large Mart paid the invoice from the Coffs Harbour Car Sales (after deducting 5% discount) as well as the invoice for the insurance of the car.

Required:

a) Determine if the amount paid for the comprehensive insurance of the car and the discount received from Coffs Harbour Car Sales influence the total cost of the car in Large Marts accounting system AND explain your decision. (3 marks)

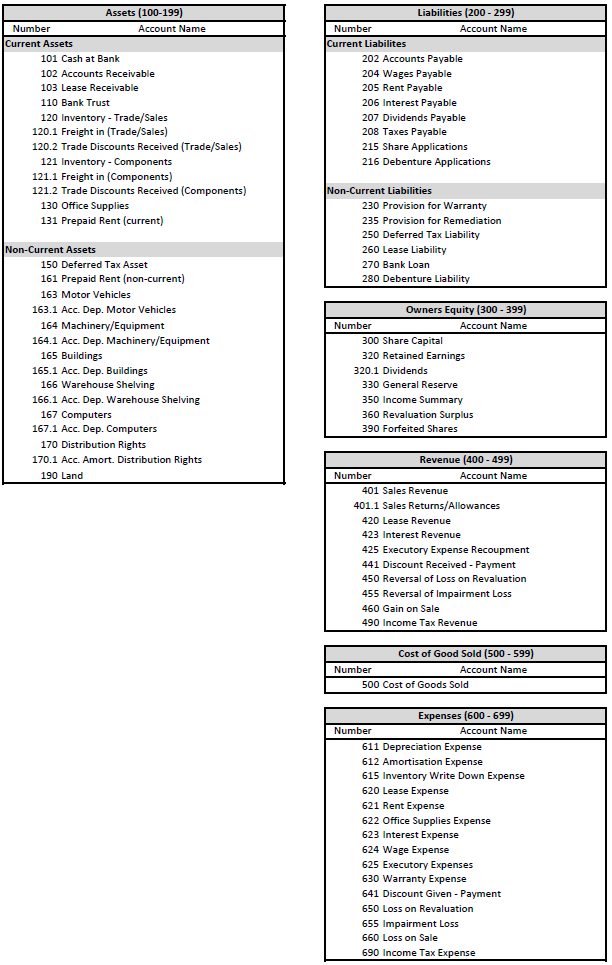

b) Provide all journal entries that are necessary in the books of Large Mart to account for the purchase of the car, and the payment of the invoice from Coffs Harbour Car Sales. (3 marks)

Question 18 (6 marks)

On 1 July 20x1, Large Mart purchases a new building (and the associated land) in Sydney. Large Mart paid $600,000 for the land and $800,000 for the building.

Large Mart will use the building for 25 years. After this time the building will have a residual value of $50,000. All Large Mart buildings are depreciated using the declining-balance method, and the yearly depreciation percentage for this building will be 8%.

On 30 June 20x3, Large Mart decides to revalue the building to its fair value of $750,000.

Required:

a) Calculate the yearly amount of depreciation for the new building for the year ended 30 June 20x3 AND outline the required calculations. (2 marks)

b) Provide all journal entries that are necessary to record the revaluation of the building on 30 June 20x3 AND outline the required calculations. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started