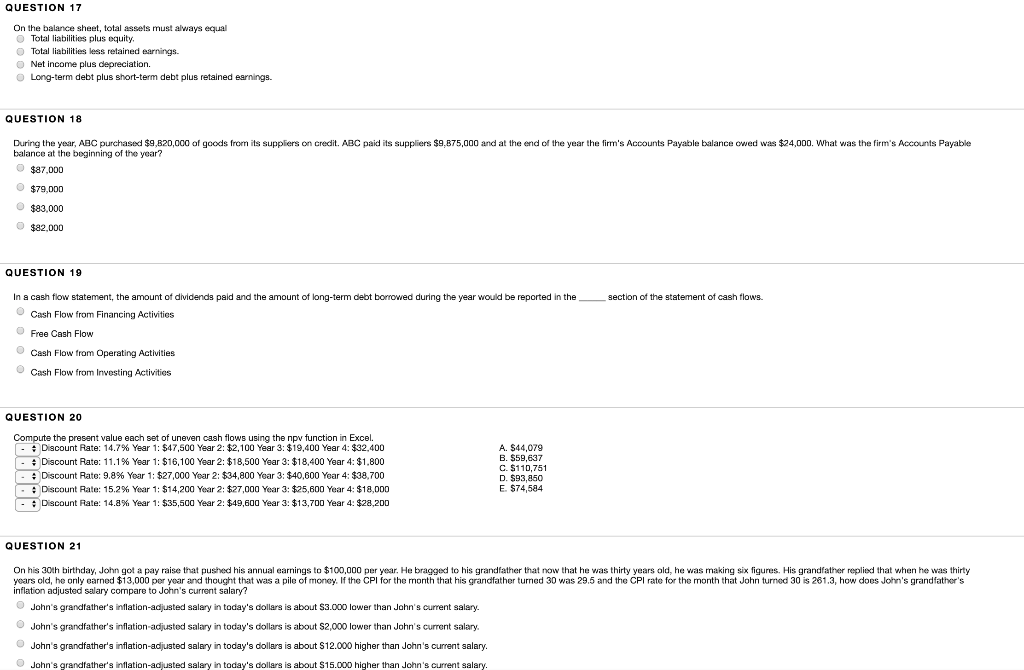

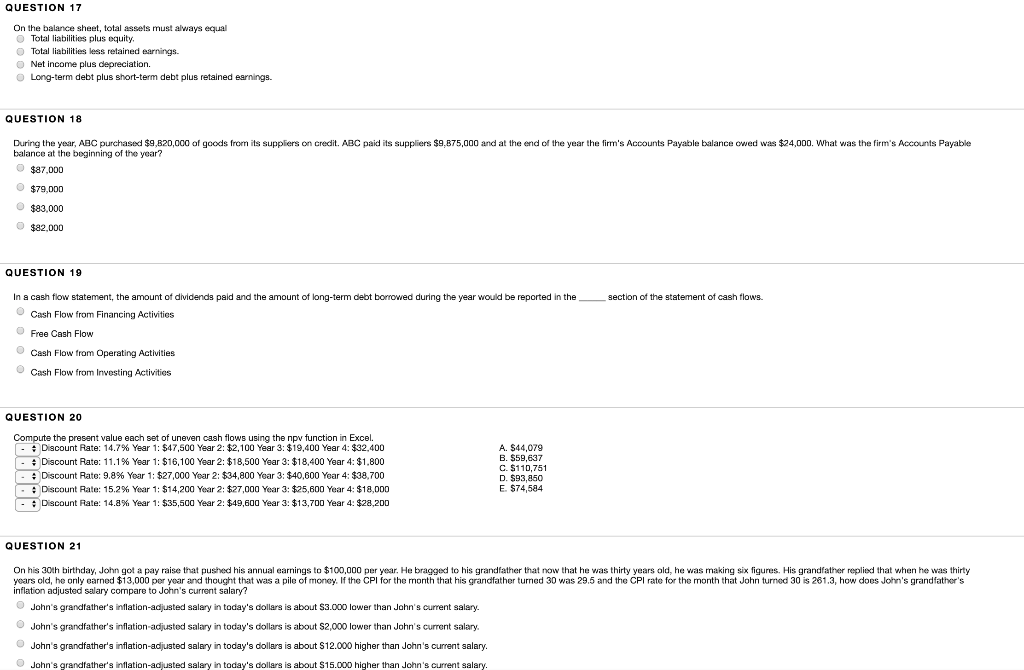

QUESTION 17 On the balance sheet, total assets must always equal Total liabilities plus equity Total liabilities less retained earnings. Net income plus depreciation. O Long-term debt plus short-term debt plus retained earnings QUESTION 18 During the year, ABC purchased $9,820,000 of goods from its suppliers on credit. ABC paid its suppliers $9,875,000 and at the end of the year the firm's Accounts Payable balance owed was $24,000. What was the firm's Accounts Payable balance at the beginning of the year? $87.000 O $79,000 O$83,000 O $82,000 QUESTION 19 In a cash flow statement, the amount of dividends paid and the amount of long-term debt borrowed during the year would be reported in the section of the statement of cash flows. Cash Flow from Financing Activities OFree Cash Flow Cash Flow from Operating Activities Cash Flow from Investing Activities QUESTION 20 Compute the present value each set of uneven cash flows using the npv function in Excel Discount Rate: 14.7 % Year 1 : $47,500 Year 2: $2,100 Year 3: $19,400 Year 4: $32,400 Discount Rate: 11.1 % Year 1: $16,100 Year 2:$18,500 Year 3: $18,400 Year 4: $1,800 Discount Rate: 9.8 % Year 1 : $27,000 Year 2: $34,800 Year 3: $40,600 Year 4: $38,700 Discount Rate: 15.2 % Year 1 : $14,200 Year 2: $27,000 Year 3: $25,800 Year 4: $18,000 A. $44,079 B. $59,637 C. $11D,751 D. $93,850 E. $74,584 Discount Rate: 14.8 % Year 1: $35,500 Year 2: $49,600 Year 3: $13,700 Year 4: $28,200 QUESTION 21 On his 30th birthday, John got a pay raise that pushed his annual earnings to $100,000 per year. He bragged to his grandfather that now that he was thirty years old, he was making six figures. His grandfather replied that when he was thirty years old, he only earned $13,000 per year and thought that was a pile of money. If the CPI for the month that his grandfather turned 30 was 29.5 and the CPI rate for the month that John turned 30 is 261.3, how does John's grandfathor's inflation adjusted salary compare to John's current salary? John's grandfather's inflation-adjusted salary in today's dollars is about S3.000 lower than John's current salary. John's grandfather's inflation-adjusted salary in today's dollars is about S2,000 lower than John's current salary. John's grandfather's inflation-adjusted salary in today's dollars is about S12.000 higher than John's current salary. John's grandfather's inflation-adjusted salary in today's dollars is about $15.000 higher than John's current salary