Question #17

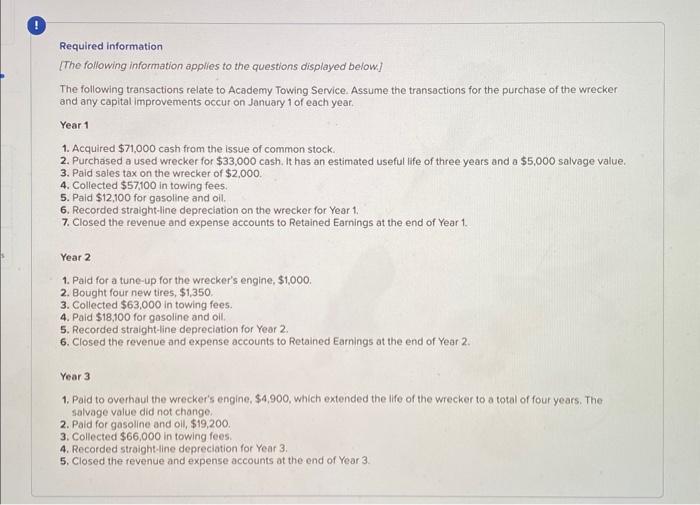

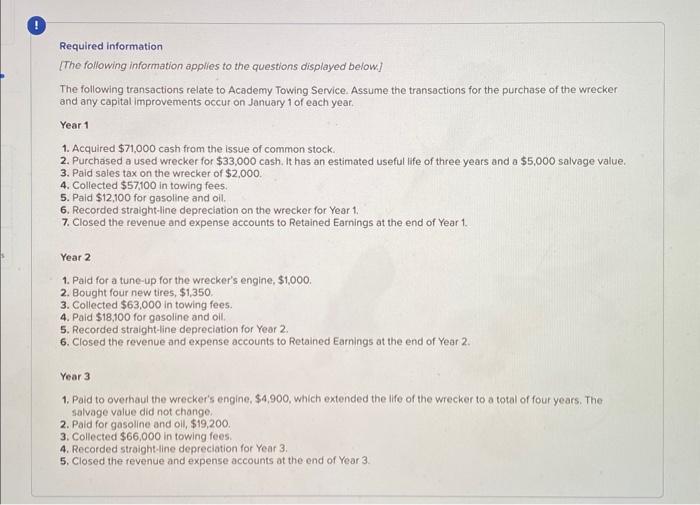

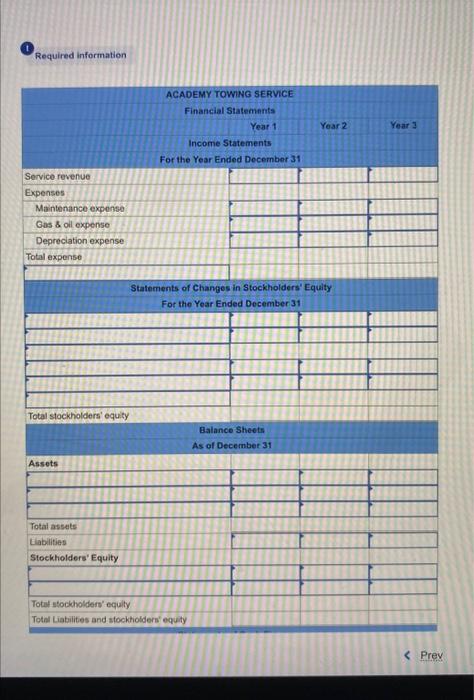

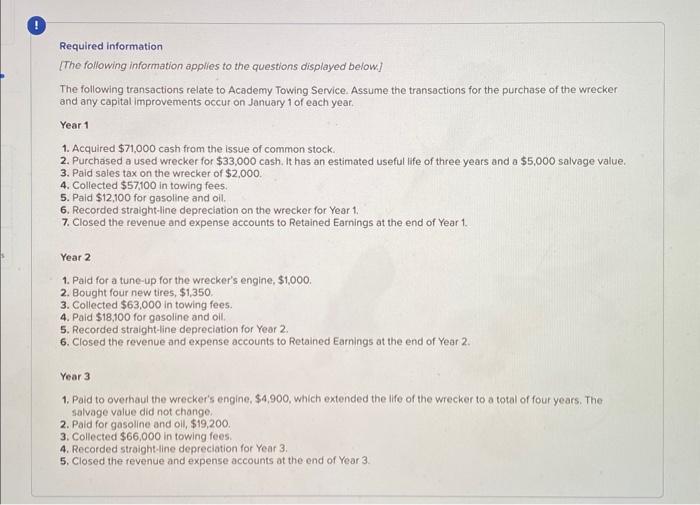

Required information [The following information applies to the questions displayed below] The following transactions relate to Academy Towing Service. Assume the transactions for the purchase of the wrecker and any capital improvements occur on January 1 of each year. Year 1 1. Acquired $71,000 cash from the issue of common stock 2. Purchased a used wrecker for $33,000 cash. It has an estimated useful life of three years and a $5,000 salvage value. 3. Paid saies tax on the wrecker of $2,000. 4. Collected $57,100 in towing fees. 5. Paid $12,100 for gasoline and oil. 6. Recorded straight-line depreciation on the wrecker for Year 1. 7. Closed the revenue and expense accounts to Retained Earnings at the end of Year 1. Year 2 1. Paid for a tune-up for the wrecker's engine, $1,000. 2. Bought four new tires, $1,350. 3. Collected $63,000 in towing fees. 4. Paid $18,100 for gasoline and oll. 5. Recorded straight-line depreciation for Year 2. 6. Closed the revenue and expense accounts to Retained Earnings at the end of Year 2. Year 3 1. Paid to overhaul the wrecker's engine, $4,900, which extended the life of the wrecker to a total of four years. The salvage value did not change. 2. Paid for gasoline and oll, $19,200. 3. Collected $66,000 in towing fees. 4. Recorded stralght-iline depreciation for Year 3. 5. Closed the fevenue and expense accounts at the end of Year 3. (1) Required information 17 (1) Required information Stockholders' Equity Total stockholders' equity Total Liabilities and stockholders' equity Statements of Cash Flows: For the Year Ended December 31 Net cash flow from financing activities Ending cash balance Required information [The following information applies to the questions displayed below] The following transactions relate to Academy Towing Service. Assume the transactions for the purchase of the wrecker and any capital improvements occur on January 1 of each year. Year 1 1. Acquired $71,000 cash from the issue of common stock 2. Purchased a used wrecker for $33,000 cash. It has an estimated useful life of three years and a $5,000 salvage value. 3. Paid saies tax on the wrecker of $2,000. 4. Collected $57,100 in towing fees. 5. Paid $12,100 for gasoline and oil. 6. Recorded straight-line depreciation on the wrecker for Year 1. 7. Closed the revenue and expense accounts to Retained Earnings at the end of Year 1. Year 2 1. Paid for a tune-up for the wrecker's engine, $1,000. 2. Bought four new tires, $1,350. 3. Collected $63,000 in towing fees. 4. Paid $18,100 for gasoline and oll. 5. Recorded straight-line depreciation for Year 2. 6. Closed the revenue and expense accounts to Retained Earnings at the end of Year 2. Year 3 1. Paid to overhaul the wrecker's engine, $4,900, which extended the life of the wrecker to a total of four years. The salvage value did not change. 2. Paid for gasoline and oll, $19,200. 3. Collected $66,000 in towing fees. 4. Recorded stralght-iline depreciation for Year 3. 5. Closed the fevenue and expense accounts at the end of Year 3. (1) Required information 17 (1) Required information Stockholders' Equity Total stockholders' equity Total Liabilities and stockholders' equity Statements of Cash Flows: For the Year Ended December 31 Net cash flow from financing activities Ending cash balance